BlackRock CEO Larry Fink’s Crypto Bombshell: ’Digital Assets Are the Future, Not USD or Gold!’

Wall Street's most powerful voice just dropped a financial earthquake.

### The Traditional Finance Rebellion

Larry Fink's declaration cuts through decades of financial dogma—gold's glitter fades as digital assets surge. The man who oversees $10 trillion in assets just bypassed conventional wisdom entirely.

### Currency Revolution Accelerates

Central banks scramble while Bitcoin and Ethereum networks process transactions 24/7. No Fed meetings required, no gold vaults needed—just pure mathematical certainty.

### Institutional Tsunami Building

BlackRock's move signals what every hedge fund manager secretly knows but won't admit at country club dinners. The old guard's 'safe havens' look increasingly like sinking ships.

Fink's verdict lands like a blockchain confirmation—irreversible and transparent. While gold bugs polish their bars and dollar printers whir, the smart money's already coding the future. Because nothing says 'store of value' like an asset that doesn't require armed guards and can cross borders at light speed—take that, traditional finance dinosaurs.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Fund Flows and Sentiment

The SMH ETF tracks the performance of the MVIS US Listed Semiconductor 25 index. Recently, it has drawn considerable attention due to high-profile deals being conducted in the AI sector. The ETF is moving higher today boosted by the strong quarterly results of chipmaker Intel (INTC).

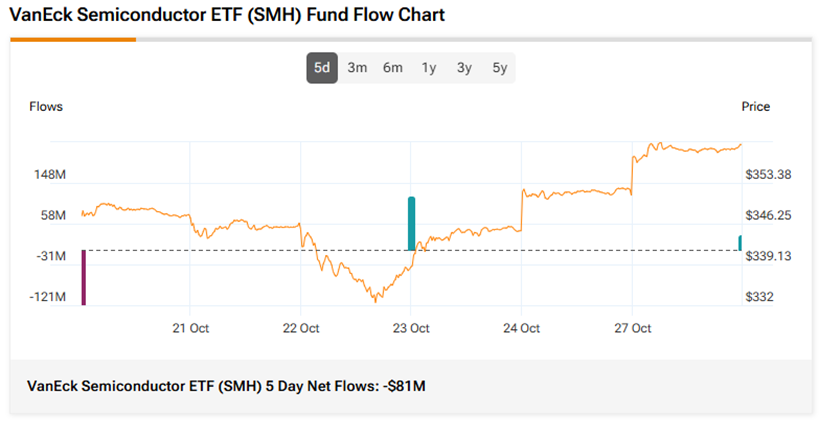

Over the past five days, the SMH ETF has witnessed net outflows of roughly $81.11 million, while over the past three months, it has reported net inflows of $2 billion.

Today’s SMH ETF Performance

According to TipRanks’ unique ETF analyst consensus, which is based on a weighted average of analyst ratings on its holdings, SMH is a Moderate Buy. The Street’s average price target of $379.00 implies an upside of 5.3%.

Currently, SMH’s five holdings with the highest upside potential are STMicroelectronics (STM), Universal Display (OLED), Synopsys (SNPS), Microchip Technologies (MCHP), and Nvidia (NVDA).

Its five holdings with the greatest downside potential are Intel, KLA Corporation (KLAC), Skyworks Solutions (SWKS), Monolithic Power (MPWR), and Applied Materials (AMAT).

Revealingly, SMH’s ETF Smart Score is Eight, implying that this ETF is likely to outperform the market.