5 Blue-Chip Dividend Titans Engineered to Thrive Through Any Market Storm

Market volatility shaking investor confidence? These dividend powerhouses built different.

Cash Flow Machines Printing Through Cycles

While speculative assets swing wildly, these five established giants keep dividends flowing—proven business models generating real revenue, not just hype.

Defensive Fortresses With Economic Moats

Market downturns expose weak players. These companies dominate their sectors with pricing power and scale that crushes competition.

Dividend Aristocrats Playing the Long Game

Quarterly gains fade—consistent dividend growth compounds. These stocks treat shareholder returns as core strategy, not afterthoughts.

Because sometimes the smartest move in crypto's casino is keeping real assets that actually pay you to wait out the madness.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Realty Income Keeps Monthly Checks Flowing

Realty Income (O), known as “The Monthly Dividend Company,” has paid 664 consecutive monthly dividends, and counting. The real estate investment trust owns a diversified retail portfolio with an occupancy rate above 97%, even during the 2008 downturn.

Its 5.34% yield and sustainable 75% payout ratio make it one of the most dependable income plays in the market. If it can keep paying through recessions, investors can count on it in calmer times.

Verizon Reduces Debt and Rewards Patience

Verizon (VZ) has turned skepticism into opportunity. After weathering the Fed’s rate hikes with a heavy debt load, the telecom giant kept its dividend streak alive and is now positioned to benefit as borrowing costs fall.

The company’s 7.01% forward yield and 21 consecutive years of dividend growth stand out. With AI infrastructure expanding and rate cuts on deck, Verizon’s free cash flow is set to strengthen. This WOULD leave more room for future hikes in dividend payouts.

Duke Energy Builds Growth and Predictability

Duke Energy (DUK) powers millions of homes across the Southeast and Midwest. With a 3.3% yield and 14 years of payout increases, it remains a favorite among defensive investors.

The company’s $87 billion five-year capital plan aims to expand its rate base, backed by supportive regulation and rising electricity demand from AI data centers. Its 66% payout ratio suggests room to grow without straining cash.

Coca-Cola Extends Its Dividend Legacy

Coca-Cola (KO) remains the benchmark for dividend reliability. The company has raised its dividend for 62 straight years, with a modest 2.89% yield and an exceptionally low 16% payout ratio that leaves plenty of room for growth.

Its global brand power and defensive business model make it a natural hedge in any portfolio. KO’s consistency is its edge, especially because not many stocks have turned buying a soft drink into a decades-long compounding strategy.

Merck Expands Its Pipeline and Payouts

Merck (MRK) rounds out the list with one of the healthiest balance sheets in healthcare. Despite concerns about upcoming Keytruda patent expirations, the company has 20 potential blockbuster drugs in development that could generate over $50 billion in future revenue.

With a 3.7% forward yield, 41% payout ratio, and 14 straight years of dividend hikes, Merck’s steady R&D reinvestment and cost discipline make it a rare mix of income and innovation.

Key Takeaway

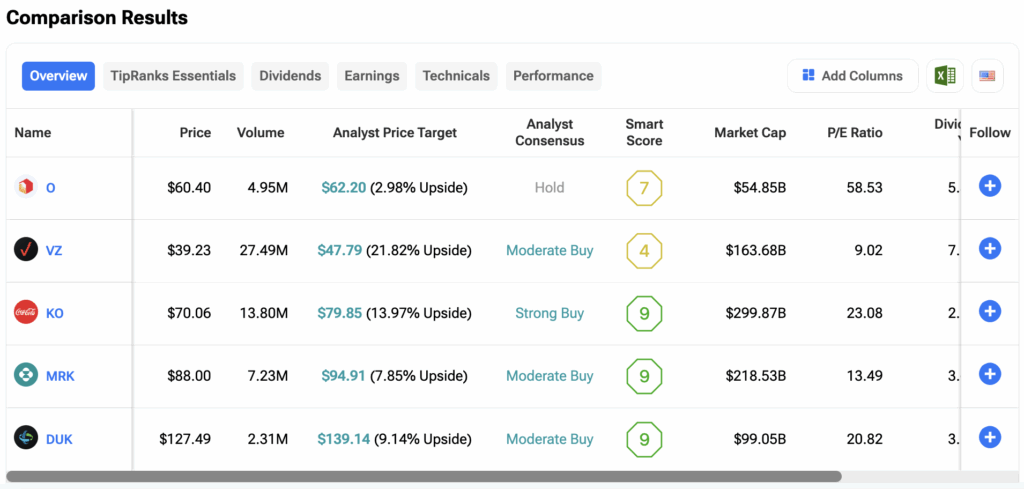

For investors tired of chasing momentum, these five S&P 500 dividend stocks offer something simpler: predictable income and durable growth. In an era when volatility still rules, they prove that boring can be beautiful. You can compare all five side by side using the TipRanks Stocks Comparison Tool to see how their yields, payouts, and analyst ratings stack up. Click on the image below to find out more.