The Return of ICOs: Why the 2025 Token Boom Feels Both Familiar and Dangerous

Initial coin offerings are staging a dramatic comeback, flooding crypto markets with new tokens while raising familiar red flags.

The Ghost of Crypto Past

Remember 2017? The frenzy that saw billions pour into unproven projects before the spectacular collapse? Market patterns suggest we're witnessing a similar euphoria cycle, only this time with more sophisticated packaging and bigger promises.

Regulatory Roulette

Global watchdogs scramble to keep pace with the innovation explosion. Some jurisdictions embrace the token economy while others deploy heavy-handed restrictions, creating a regulatory patchwork that benefits the nimble and punishes the cautious.

Investor Psychology 2.0

The fear of missing out drives unprecedented retail participation despite clearer warning signs. Professional investors meanwhile deploy sophisticated tokenomics models that sometimes feel more like financial engineering than genuine innovation.

Survival of the Fittest

Amid the noise, legitimate projects building actual utility struggle for attention against flashy marketing and influencer hype. The market's short memory creates perfect conditions for history to repeat itself.

As the tokenization wave builds toward what some predict could surpass previous cycles, one can't help but wonder if we're watching innovation unfold or just the same old financial alchemy dressed in new digital clothes.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Expectations from Apple

Valued at nearly $4 trillion, Apple competes in one of the largest global markets for smartphones and wearables. The Street expects Apple to report an 8.5% year-over-year increase in adjusted earnings to $1.78 per share. Additionally, sales are estimated to rise 7.6% to $102.17 billion, up from $94.93 billion in the same period last year.

Import tariffs are likely to keep pressuring Apple’s margins. In Q4, Apple is expected to report gross margins of 46% to 47%, including a tariff impact of $1.1 billion. Meanwhile, Apple’s Services segment continues to show resilience, supported by a growing subscriber base across Apple TV+, Apple News+, Apple Card, and the Apple One bundle.

What Analysts Are Saying About Apple

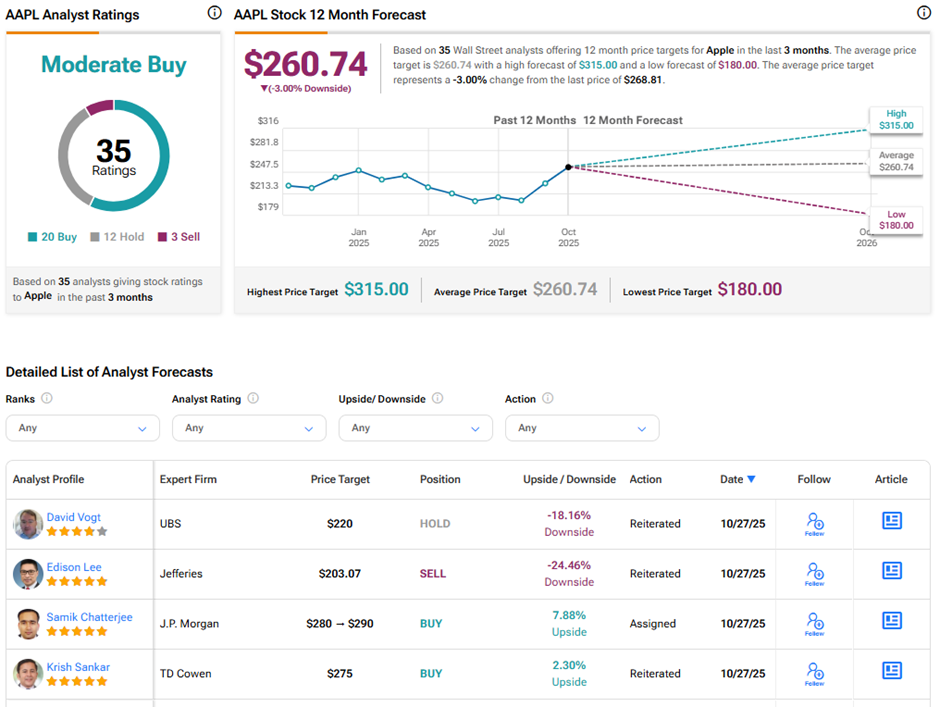

Wall Street remains divided on Apple’s long-term outlook. Ahead of the results, J. P. Morgan analyst Samik Chatterjee reiterated his “Buy” rating on AAPL stock and raised the price target from $280 to $290, implying 7.9% upside potential. He expects high-single-digit revenue growth in both Q4 and Apple’s Q1 outlook, reinforcing investors’ confidence in Apple’s positive product cycle.

UBS analyst David Vogt maintained his “Hold” rating and $220 price target, implying 18.2% downside potential. Vogt prefers to remain sidelined due to slowing demand for iPhones, especially in one of its largest markets China. The company is facing stiff competition from domestic players like Huawei and Xiaomi. Apple did resort to price discounting to boost its iPhone 16 sales, but it has still lagged behind Chinese peers in the mainland. Vogt also believes that Apple stock is currently trading NEAR all-time highs and may be overvalued compared to peers.

Jefferies analyst Edison Lee reiterated his “Sell” rating and kept his $203.07 price target intact, which implies 24.5% downside potential. Lee had recently downgraded the stock, citing concerns that the current stock price already prices in much of the Optimism from the iPhone 17 launch. He also worries that investors are setting unrealistically high expectations for future growth, particularly regarding the rumored iPhone 18 and Apple’s first foldable model, although it is not guaranteed.

Apple’s results are expected to remain strong, but opinions are divided. Optimists cite AI and product-driven growth, while skeptics warn that high expectations and valuations may cap gains.

Is Apple a Good Stock to Buy Right Now?

On TipRanks, AAPL stock has a Moderate Buy consensus rating based on 20 Buys, 12 Holds, and three Sell ratings. The average Apple price target of $260.74 implies 3% downside potential from current levels. Year-to-date, AAPL stock has gained 7.7%.