Qualcomm Stock (QCOM) Soars 15% Following Groundbreaking AI Chip Launch Announcement

Qualcomm just dropped a semiconductor bombshell that sent Wall Street scrambling—and their stock price rocketing.

The AI Hardware Revolution Hits Mobile

QCOM shares surged 15% in pre-market trading after the chipmaker unveiled its next-generation AI processors designed specifically for mobile devices. The announcement positions Qualcomm to challenge NVIDIA's dominance in the AI hardware space.

Market Reaction Speaks Volumes

Trading volume tripled the 30-day average as institutional investors piled in. The move represents Qualcomm's boldest play yet to capture the edge computing market—where AI processing happens directly on devices rather than in the cloud.

Analysts Divided But Bullish

While some skeptics question whether mobile AI can truly compete with data center-scale processing, the market's response suggests investors believe this could be Qualcomm's iPhone moment. Because nothing makes Wall Street happier than a good old-fashioned 'AI' label slapped on anything—even if half the analysts can't explain how the technology actually works.

The chip wars just got interesting—and Qualcomm just secured its seat at the grown-ups table.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Interestingly, the chips use Qualcomm’s Hexagon neural processing units (NPUs), which were first developed for its smartphone chips. According to Durga Malladi, head of Qualcomm’s data center and edge business, the company wanted to prove its capabilities in mobile devices before moving up to data centers. This expansion comes as global spending on AI data centers is expected to hit $6.7 trillion by 2030, mostly for systems built around AI chips. While Nvidia still dominates the market, other companies like AMD are gaining ground, and tech giants like Google (GOOGL) are building their own AI chips.

Moreover, Qualcomm’s new chips are designed to run AI models rather than train them, and the company says that its racks will be cheaper to run and use about 160 kilowatts, which is on par with Nvidia’s. Qualcomm will also sell its chips and parts separately for customers who want to build their own systems. In addition, while the company didn’t reveal prices or exact specs, it claimed that its chips are more energy-efficient and cost-effective, with support for up to 768GB of memory per card. This is more than what Nvidia or AMD currently offer.

Is QCOM Stock a Good Buy?

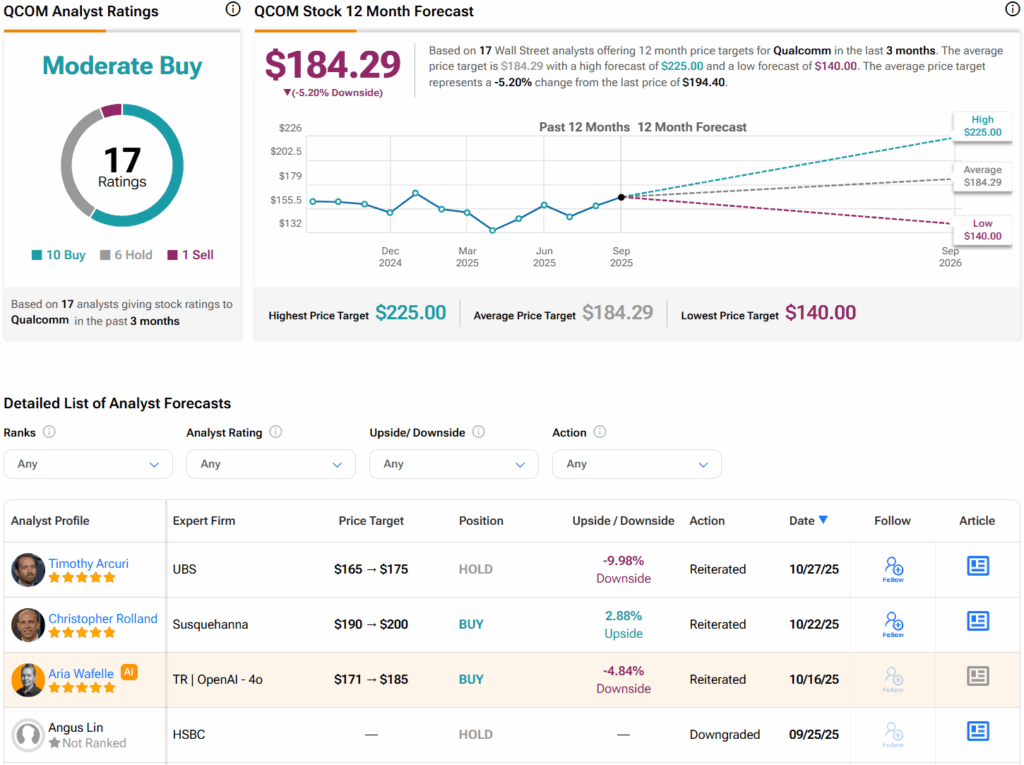

Turning to Wall Street, analysts have a Moderate Buy consensus rating on QCOM stock based on 10 Buys, six Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average QCOM price target of $184.29 per share implies 5.2% downside risk.