Sharplink’s $80M Ethereum Treasury Expansion: Now Holding 859,000 ETH in Strategic Crypto Move

Sharplink just dropped another $80 million into its Ethereum reserves—because apparently traditional treasury management is too mainstream.

The Big Bet

With this latest acquisition, Sharplink's Ethereum holdings skyrocket to 859,000 ETH total. That's not just dipping toes in crypto waters—that's building an ark while Wall Street still debates whether digital assets are legitimate.

Treasury Transformation

While traditional corporations park cash in low-yield bonds, Sharplink keeps converting fiat into programmable money. The move signals either extreme confidence in Ethereum's future or a brilliant hedge against monetary policy madness—take your pick.

Strategic Accumulation

This isn't random speculation. Building a position this substantial requires either insider-level conviction or a team that actually understands blockchain's disruptive potential. Most finance departments still can't explain smart contracts without consulting their grandchildren.

At this rate, Sharplink might soon need to hire a full-time mempool watcher instead of another accountant. Because when your treasury generates more yield than your core business, you're either doing something very right—or the entire financial system is broken beyond repair.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Fly-E Group is an electric vehicle (EV) company, specializing in the design, installation and sales of electric motorcycles, bikes and scooters. The company also engages in the provision of accessories and spare parts, as well as maintenance and repair services.

Fly-E Group’s claims about the safety and efficiency of its lithium battery and the related impact on the company’s EV sales are at the heart of the current complaint.

Fly-E’s Misleading Claims

According to the lawsuit, Fly-E Group and two of its senior officers (the Defendants) repeatedly made false and misleading public statements throughout the Class Period. In particular, they are accused of omitting truthful information about the safety of Fly-E’s lithium battery and the toll safety concerns took on the company’s E-vehicle sales revenue from SEC filings and related material.

At the beginning of the Class Period, the company noted in an annual report that its brand was well-known and trusted, especially among food delivery workers in New York City, who see their stores and services as dependable, helping build a loyal customer base.

Additionally, Fly-E stated that it was developing the Fly E-Bike app to help customers better manage and enjoy their riding experience, with features like smart control, GPS, battery management, and vehicle security.

Furthermore, Fly-E noted that it operates in an industry with strict laws and regulations related to environmental safety, product testing, and battery safety and disposal. These regulations create additional costs and potential delays in developing and manufacturing their products.

Finally, Fly-E’s CEO said in the same report that the company is focused on improving product safety, expanding to new locations, and investing in digital tools like the Go Fly app to enhance customer experience and business operations. The company believed these efforts WOULD help it grow steadily over the long term.

However, subsequent events (detailed below) revealed that the defendants had failed to inform investors that recent investigations found many Fly-E mopeds failed federal safety tests, and that the company used fake safety certifications, leading to fines, lawsuits, and the refusal by the New York Department of Motor Vehicles (DMV) to register some models.

Plaintiffs’ Arguments

The plaintiffs maintain that the defendants deceived investors by lying and withholding critical information about the company’s business and prospects during the Class Period. Importantly, the defendants failed to inform investors that the issues with Fly-E’s lithium batteries were causing a significant impact on the sales of its EVs.

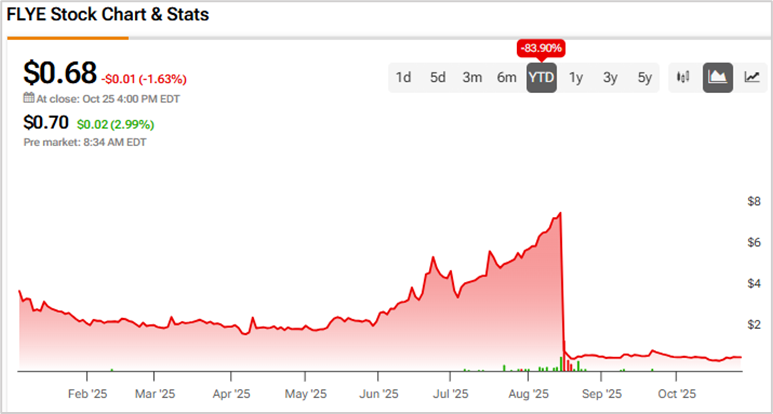

The information became clear on August 14, 2025, when Fly-E filed a FORM NT 10-Q, notifying of its inability to timely file Form 10-Q for the first quarter of fiscal year 2026 with the SEC. Fly-E disclosed a 32% drop in net revenue due mainly to selling fewer units. The decline was largely caused by recent lithium battery accidents involving their E-Bikes and E-Scooters, which made customers hesitant to buy and led to store closures. Following the news, FLYE stock collapsed 87.1% the next day.

To conclude, the defendants failed to inform investors about the ongoing investigation into the safety issues related to Fly-E’s lithium batteries and the related impact on sales. Due to these issues, FLYE stock has lost nearly 84% year-to-date.