From Red to Green: Altcoin Turns $2.8M Loss into Profit Following Binance Listing!

What a difference an exchange makes. One altcoin just pulled off the ultimate crypto comeback story—flipping a brutal $2.8 million deficit into pure profit overnight. The catalyst? A single Binance listing announcement that sent traders scrambling.

The Power of Prime Real Estate

Getting listed on Binance isn't just getting a new trading pair—it's like moving from a side street to Times Square. Instant visibility, massive liquidity influx, and that sweet, sweet credibility bump. The price action was textbook: initial pump, profit-taking dip, then steady accumulation as the 'what did I miss?' crowd piled in.

Timing Is Everything

This wasn't blind luck. The project team strategically built momentum through community engagement and development updates right before the listing rumor mill started churning. When Binance made it official, the foundation was already laid for explosive movement.

Of course, Wall Street analysts would call this 'speculative frenzy' while quietly updating their own crypto portfolios. Because nothing says financial sophistication like chasing 100x returns on tokens named after cartoon animals.

Welcome to modern finance—where a single exchange listing can rewrite an entire project's financial trajectory in hours. The altcoin season continues, and Binance remains the kingmaker.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

What Moved the SCHD ETF?

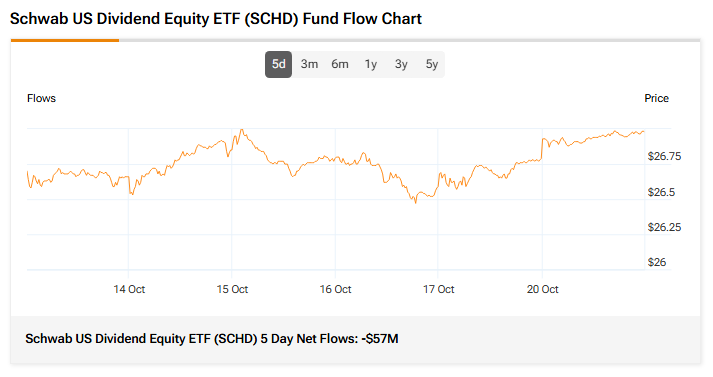

The SCHD ETF tracks the performance of high-dividend U.S. stocks from the Dow Jones U.S. Dividend 100 Index. According to TipRanks data, SCHD recorded 5-day net flows of about -$57 million, indicating that over the last five trading days, investors withdrew more money from the SCHD ETF than they added.

Today’s SCHD ETF Performance

According to TipRanks’ unique ETF analyst consensus, determined based on a weighted average of analyst ratings on its holdings, SCHD is a Moderate Buy. The Street’s average price target of $30.44 implies an upside of 12.80%.

Currently, SCHD’s five holdings with the highest upside potential are Ovintiv (OVV), Schlumberger (SLB), AMERISAFE, Inc. (AMSF), Robert Half (RHI), and Inter Parfums (IPAR).

Meanwhile, its five holdings with the greatest downside potential are Skyworks Solutions (SWKS), Archer Daniels Midland (ADM), Carter’s (CRI), Signet Jewelers (SIG), and Ford Motor (F).

Revealingly, SCHD ETF’s Smart Score is seven, implying that this ETF will likely perform in line with the market.