Archer Aviation Soars: 8.5% Upside Predicted as Canaccord Reiterates Buy After Patent Deal

Archer Aviation just secured a major patent deal—and Wall Street is taking notice.

The Bullish Signal

Canaccord Genuity doubled down on their Buy rating, pointing to the strategic patent acquisition as a game-changer. They're forecasting an 8.5% price surge—not bad for a single catalyst.

Why This Matters

Patents in the eVTOL space are like gold dust. They protect innovation, block competitors, and create moats around future revenue streams. This deal positions Archer to dominate urban air mobility before the market even takes off.

The Street's Take

While analysts cheer, remember this is the same crowd that once thought WeWork was revolutionary. Still, when a firm like Canaccord reiterates Buy with specific upside targets, it's worth paying attention.

Archer's patent play could be the catalyst that separates the flyers from the failures in the coming air mobility revolution. Time will tell if this surge has legs—or wings.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Following this latest win, Canaccord Genuity’s four-star analyst Austin Moeller reiterated a Buy rating on Archer with a $13 price target, which implies an 8.5% upside. He believes the acquisition gives Archer access to valuable eVTOL technologies that could strengthen its future aircraft lineup.

Meanwhile, ACHR shares ROSE an impressive 5.68% on Monday, closing at $11.98.

New Technology and Industry Implications

The Lilium patents cover several key areas such as advanced battery design, high-voltage systems, propellers, flight controls, and ducted fans. According to Moeller, Archer’s decision to buy these assets suggests confidence in Lilium’s earlier work, particularly its silicon-dominant anode battery technology.

That battery design was validated by the U.S. Department of Energy’s Idaho National Laboratory in 2023, showing up to 50% higher energy density and five times more power than earlier cells. Moeller said Archer may adapt the technology for the next generation of its Midnight eVTOL aircraft. With that, the aircraft could gain better range and carry more weight, while also addressing flight reserve limits required under visual flight rules.

Potential Catalysts Ahead

Moeller advised investors to watch for updates on Archer’s future Midnight battery systems in upcoming earnings calls. He also pointed to Archer’s joint work with defense contractor Anduril on a hybrid-VTOL drone project for the Department of War. In addition, he noted that the U.S. Army plans to launch a new Collaborative Combat Aircraft program that could feature rotorcraft drones, offering another potential growth path for the company.

Overall, Moeller’s reiterated rating signals steady confidence in Archer’s strategy as the company strengthens its patent portfolio and positions itself for future opportunities in both commercial and defense aviation markets.

Is Archer Aviation Stock a Good Buy?

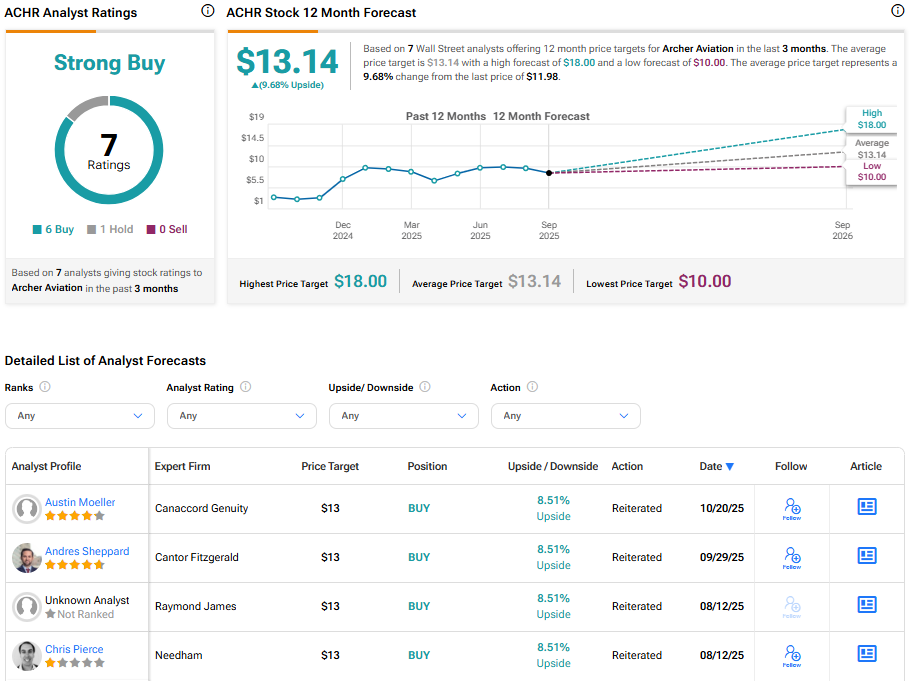

On Wall Street, analysts remain optimistic about the company’s prospects. Based on seven recent ratings, Archer Aviation boasts a “Strong Buy” consensus with an average 12-month price target of $13.14. This implies a 9.68% upside from the current price.