VOO ETF Shatters Records: 2025’s Unstoppable Market Dominator

Vanguard's flagship ETF just rewrote the rulebook on passive investing.

The Numbers Don't Lie

While traditional fund managers scramble to justify their fees, VOO continues its relentless march toward market supremacy. The October 2025 surge proves retail and institutional investors alike are voting with their dollars—and they're choosing efficiency over expensive active management.

Why This Matters Now

In an era where financial advisors still push complicated portfolios, VOO's brutal simplicity keeps winning. It's almost like making money shouldn't require paying someone 2% annually for underperformance.

The trend is clear: either adapt to the ETF revolution or get left behind counting your diminishing management fees.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Fund Flows and Sentiment

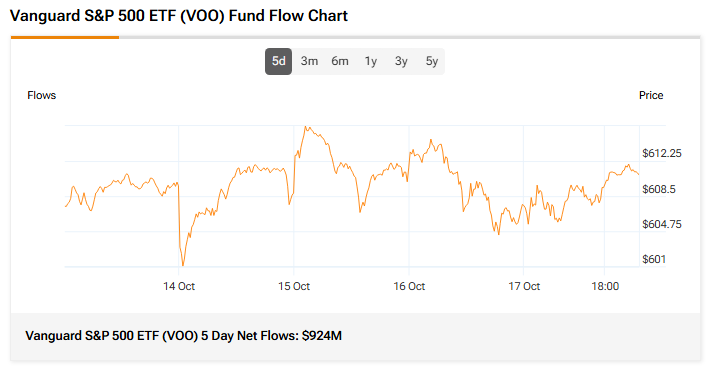

The VOO ETF, which tracks the S&P 500 (), continues to draw investor interest. According to TipRanks data, VOO recorded 5-day net flows of about $924 million, showing steady investor demand for large-cap U.S. exposure.

Today’s VOO ETF Performance

According to TipRanks’ unique ETF analyst consensus, determined based on a weighted average of analyst ratings on its holdings, VOO is a Moderate Buy. The Street’s average price target of $691.52 implies an upside of 13.22%.

Currently, VOO’s five holdings with the highest upside potential are GoDaddy (GDDY), Fiserv, Inc. (FI), News Corp. (NWSA), MGM Resorts (MGM), and Moderna (MRNA).

Meanwhile, its five holdings with the greatest downside potential are Garmin (GRMN), Paramount Skydance (PSKY), Intel (INTC), Super Micro Computer (SMCI), and Tesla (TSLA).

Revealingly, VOO ETF’s Smart Score is eight, implying that this ETF will likely outperform the market.

Does VOO Pay Dividends?

Yes, VOO pays dividends, offering investors a source of regular income. The ETF distributes these payments every quarter to shareholders. They come from the dividends paid by the companies in the S&P 500 (). Since company payouts change over time, the dividend amount from VOO also varies each quarter.

VOO’s yield as of today is 1.15%.