Bitcoin Shatters $115K Barrier as Trump Reassures Markets - Crypto Rally Accelerates

Digital gold just got a presidential polish—and the markets are loving every glittering moment.

The Trump Effect: More Than Just Words

When former President Trump threw his weight behind cryptocurrency stability, Bitcoin didn't just climb—it exploded past the $115,000 psychological barrier. Market watchers saw immediate ripple effects across major exchanges as trading volumes spiked 40% within hours.

Institutional Money Floodgates Swing Open

Hedge funds and asset managers that had been sitting on the sidelines suddenly piled in—because nothing moves money faster than political certainty wrapped in bullish sentiment. The fear-of-missing-out meter hit maximum levels as traditional finance veterans scrambled to reposition portfolios.

The Technical Breakout Everyone Missed

Trading algorithms went haywire trying to keep up with the momentum. Resistance levels that had held for months vaporized in minutes, leaving technical analysts frantically redrawing their charts. The move created one of the cleanest breakout patterns in Bitcoin's volatile history.

Meanwhile, Wall Street bankers are probably still trying to explain to their clients why they recommended bonds instead—another brilliant reminder that traditional finance often misses the digital revolution happening right under its nose.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

TSMC is the world’s largest contract chipmaker. The company supplies advanced semiconductors to top tech giants, including Apple (AAPL), Nvidia (NVDA), and Advanced Micro Devices (AMD).

What to Expect from TSM Earnings?

TSMC recently released its monthly revenue data, showing that July–September sales exceeded expectations. In local currency terms, September revenue jumped 31.4% year-over-year but edged down 1.4% from August, indicating slight month-over-month softness.

Overall, Wall Street analysts expect TSMC to post Q3 earnings per share (EPS) of $2.63 per ADR, up more than 34% year-over-year. Meanwhile, revenue is projected to reach $32.07 billion, according to TSMC’s TipRanks Stock Forecasts Page, aligning with the company’s guidance range of $31.8 billion to $33.0 billion. The company also expects a gross profit margin between 55.5% and 57.5%, slightly lower than the 58.6% recorded in the previous quarter.

Meanwhile, TSM stock has fallen over 8% in the past five trading days, following Trump’s threat to impose 100% tariffs on China. While the news weighed on market sentiment, AI-related spending remains strong as a 100% tariff threat is likely just political talk, much like what happened in April.

Wall Street Stays Bullish on TSM Stock

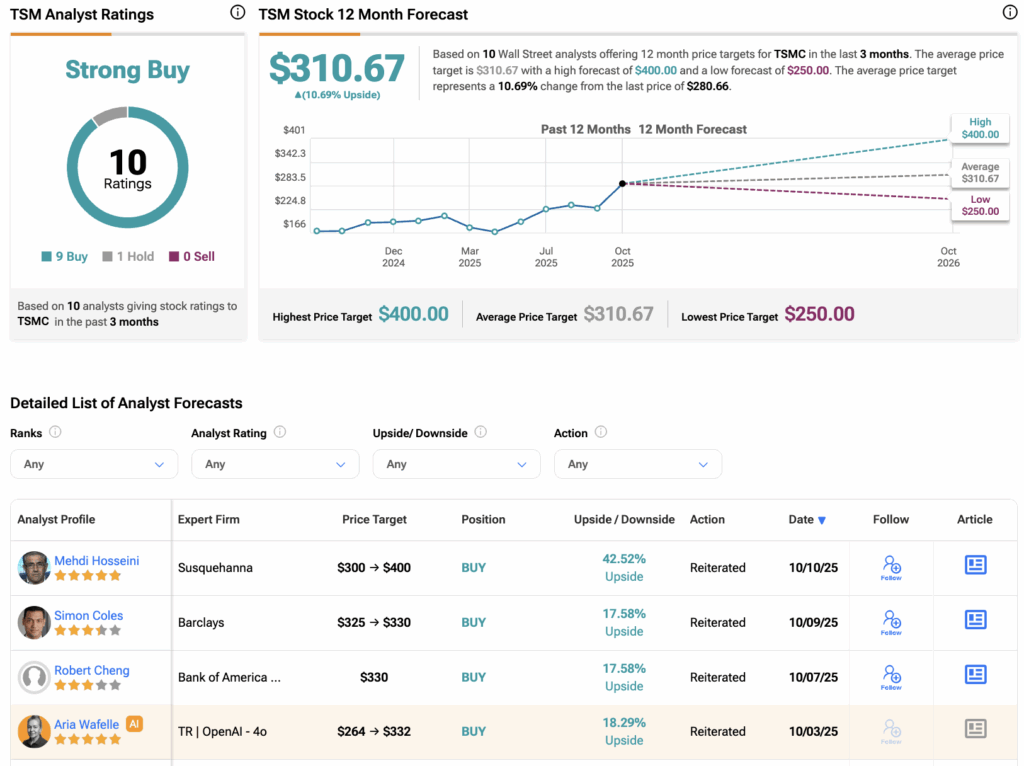

Last week, five-star-rated analyst Mehdi Hosseini of Susquehanna raised his price target on TSM stock from $300 to $400 while maintaining a Buy rating. He expects TSMC to deliver a “beat and raise” quarter, noting that Q4 FY25 and Q1 FY26 are tracking ahead of consensus and seasonal trends.

Similarly, Barclays analyst Simon Coles raised his price target on TSMC from $325 to $330 ahead of its Q3 earnings. Coles noted that recent developments have driven European semiconductor equipment stocks back toward their Q2 2024 highs. However, he added that further gains will likely depend on additional chip factory (fab) project announcements.

Is TSMC Stock a Good Buy?

According to TipRanks, TSM stock has a Strong Buy consensus rating based on nine Buys and one Hold assigned in the last three months. At $310.67 the TSMC average stock price target implies a 10.69% upside potential.