What Is One of the Best Artificial Intelligence (AI) Stocks to Buy Now?

AI stocks surge as machine learning reshapes entire industries—but which one delivers real value beyond the hype?

The Search for Substance

Forget the buzzwords and empty promises. We're cutting through the noise to find AI companies with actual revenue streams and sustainable business models. The market's flooded with pretenders claiming AI capabilities, but genuine innovation stands out.

Numbers Don't Lie

While everyone chases the next shiny object, smart investors focus on companies with proven AI integration and measurable results. The real winners aren't necessarily the loudest—they're the ones quietly building moats around their technology.

Beyond the Hype Cycle

True AI value emerges when technology solves actual business problems, not when it generates press releases. Look for companies where AI drives core operations rather than serving as marketing decoration.

Because let's face it—half the 'AI revolution' feels like consultants finding new ways to charge for spreadsheets.

Image source: Micron Technology.

Why Micron Technology stock is a buy

Micron is a Maker of computer memory and storage products. AI systems depend on these components to store and retrieve the data needed to execute tasks.

As a result, Micron's business is on fire. In its 2025 fiscal year, ended Aug. 28, revenue hit $37.4 billion, a significant jump from $25.1 billion in the prior year.

Not only is revenue rising, Micron is also doing an excellent job managing its expenses. Consequently, its fiscal 2025 diluted earnings per share (EPS) saw a jaw-dropping increase to $7.59, compared to $0.70 last year.

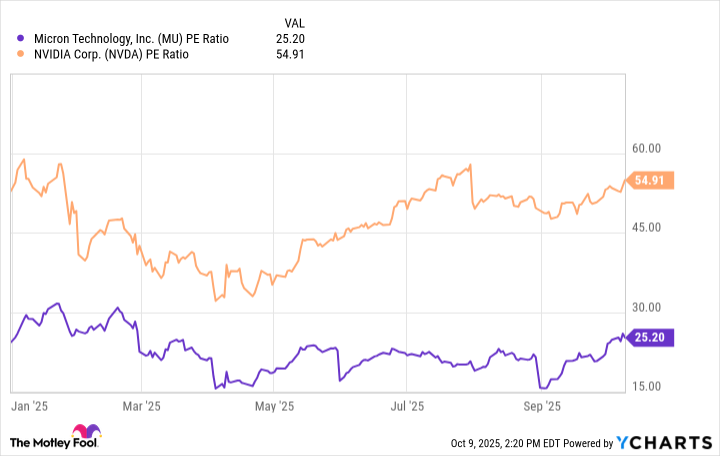

Micron's spectacular business performance led to a rise in its stock price. However, shares retain a reasonable valuation for an AI stock based on the price-to-earnings (P/E) ratio. Here's how Micron compares to Nvidia.

Data by YCharts.

The chart above shows Micron's P/E ratio is about half that of Nvidia's, indicating it's a better value. Also, while Micron's earnings multiple is rising, it's still below where it was at the start of the year.

Micron's strong business performance and appealing valuation make it a solid AI stock to buy.