GM Shatters EV Records in Q3 as Tax Credit Window Narrows

Detroit's automotive giant just dropped an electric bombshell.

Quarterly Blitz

General Motors electrified its Q3 performance with unprecedented EV delivery numbers—racing against the clock as federal incentives prepare to phase out. The timing couldn't be more charged.

Credit Countdown

With tax credits sliding toward expiration, GM's strategic push demonstrates how legacy automakers can pivot when regulatory tailwinds shift. Because nothing motivates like government money about to vanish.

Another case of corporate America perfectly timing its green transition—just as the financial incentives reach their peak. How convenient.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

It is worth mentioning that GM estimates its market share to be 17.2% so far in 2025, it’s highest since 2015. This comes as the company delivered 2.2 million vehicles in the first nine months of 2025, up 10% year-over-year.

Here’s a Breakdown of Q3 Sales

The automaker delivered 66,501 EVs during the quarter, more than double its EV volume in the same period last year. The spike came as buyers rushed to take advantage of the federal $7,500 EV tax credit, which expired on September 30 following a bill signed by President TRUMP in July.

The Chevrolet Equinox EV emerged as the best-selling non-Tesla (TSLA) EV in the U.S. during the quarter.

Brand-wise, Chevrolet saw an 8.3% increase in sales to 458,189 vehicles. Also, the GMC brand’s sales were up by 8.6%, putting it on track for its best year ever.

Moreover, sales for Cadillac saw the largest growth among GM’s brands, with a 25% increase. It was Cadillac’s strongest quarter since 2013. However, Buick was the only brand to see a decline, with sales down 14%.

GM’s Road Ahead

General Motors has entered Q4 with strong momentum. However, the expiration of the $7,500 federal EV tax credit is expected to slow EV sales in the fourth quarter of 2025.

In anticipation of the weak demand, GM has reduced production of its popular electric trucks and SUVs. This includes delaying a second shift at a Chevrolet assembly plant and temporarily halting production of some Cadillac EV models.

Despite EV and tariff challenges, the company’s Core business of internal combustion engine (ICE) vehicles remains robust. Also, interest rate cuts could offer some relief to consumers, thereby supporting GM’s sales.

Is GM a Good Stock to Buy Now?

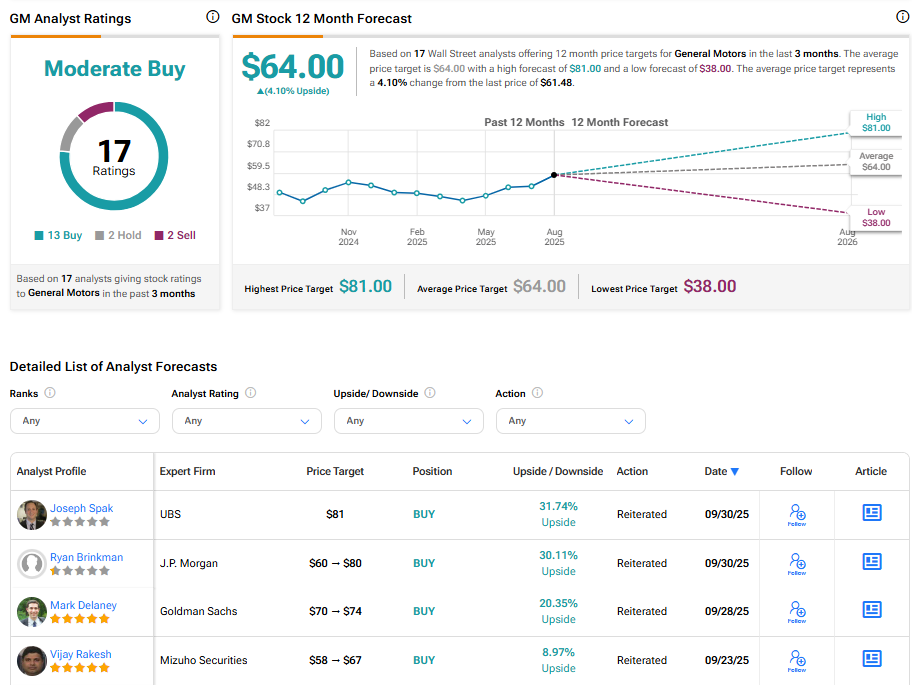

Overall, GM stock has a Moderate Buy consensus rating based on 13 Buy, two Hold, and two Sell recommendations. The average General Motors stock price target is $64, implying a 4.09% upside potential from current levels.