Millionaire Trader Predicts XRP’s Next Move Will Be Fast and Aggressive

XRP poised for explosive breakout according to successful trader

MARKET INSIGHTS

A seven-figure portfolio manager reveals XRP's chart pattern suggests imminent vertical movement. The digital asset appears coiled for what technical analysts call a 'parabolic advance'—where prices accelerate rapidly within compressed timeframes.

TIMING THE SURGE

Historical data shows XRP typically consolidates for extended periods before making dramatic upward moves. This trader's track record of calling previous rallies adds credibility to the prediction, though past performance never guarantees future results—something Wall Street veterans conveniently forget during bull markets.

VOLUME CONFIRMATION

Recent trading activity shows institutional accumulation patterns emerging. The smart money appears positioning before retail investors catch wind of the potential move. Typical Wall Street playbook—get in early, pump the narrative, then dump on the latecomers.

Will this prediction prove accurate or become another cautionary tale in crypto's volatile landscape? The charts will reveal all soon enough.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

That’s not to say that there haven’t been some bumps and bruises along the way, many of which were connected to global geopolitics and trade uncertainties. Indeed, TSM’s share price rolled downhill during the winter months, as the markets worried about the growing tensions between the U.S. and China.

The spring and summer seasons have been much kinder to TSM investors, as the continued hyperscaler buying spree has provided TSM with no shortage of tailwinds (and revenues).

As a case in point, the company demonstrated a stellar quarter with its last earnings release. Q2 2025 revenues of $30.07 billion in U.S. dollars represented a 44.4% year-over-year increase, while its gross margin was 58.6%.

The company’s share price has been a reflection of this bullish picture, and it has practically doubled in value since hitting a post-Liberation Day trough in early April.

After this bull run, however, has it become too late to hop on board the TSM bandwagon? Top investor Stefon Walters doesn’t think so.

“There’s one key reason the rally may continue: the expected spending on artificial intelligence (AI) infrastructure in the coming years,” predicts the 5-star investor, who is among the top 2% of stock pros covered by TipRanks.

The company is making a killing on its AI chips, notes Walters, with 60% of its Q2 revenues coming from its high-performance computing segment. The investor further details that “nearly all” of the AI chips that have been used to build out data center infrastructure come from TSM.

In other words, continued hyperscaler spending bodes quite well for the TSM. On that note, Walters points out that Nvidia is expecting between $3 to $4 trillion in infrastructure spending through the end of the current decade.

“As the undisputed leader in chip manufacturing — which is critical to training AI models — TSMC can expect a good amount of this to trickle down into its business in some FORM or fashion,” adds Walters. (To watch Stefon Walters track record, click here)

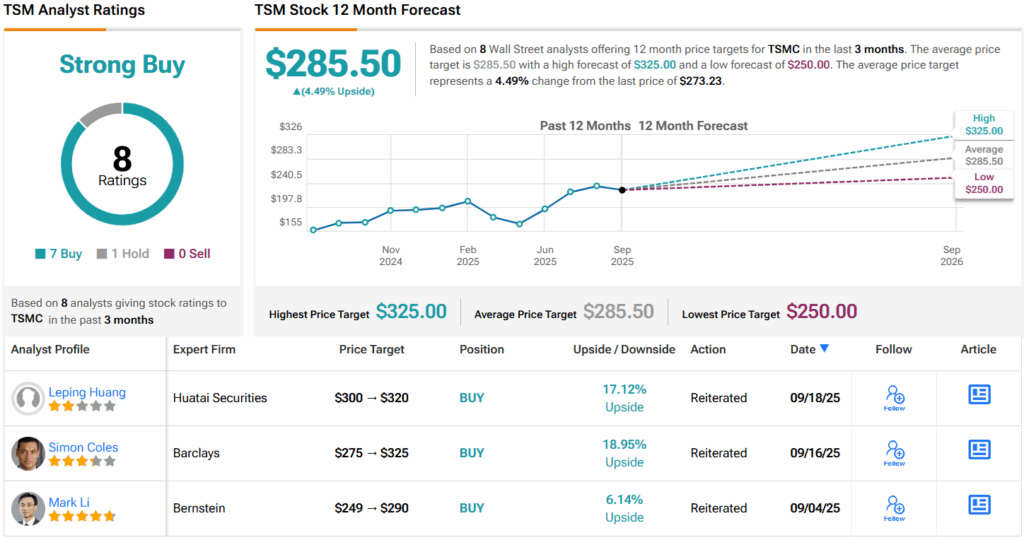

For its part, Wall Street seems pretty gung ho about TSM. With 7 Buys and 1 Hold, TSM coasts to a Strong Buy consensus rating. Its 12-month average price target of $285.50 has an upside of ~5%. (See)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.