Bitcoin Mirrors Gold’s Bullish Trajectory; Challenges Critical $117.5K Resistance Barrier

Digital gold follows precious metal's lead as bullish momentum builds

The Supply Wall Standoff

Bitcoin's relentless climb faces its ultimate test at the $117,500 threshold—a level that separates ambitious predictions from actual price discovery. The cryptocurrency's correlation with gold strengthens as institutional investors treat both assets as inflation hedges, though let's be honest, Wall Street still can't decide whether crypto belongs in the commodities section or the casino floor.

Technical indicators scream accumulation while skeptics watch from the sidelines. Market structure suggests this isn't just another pump—the fundamentals actually support the narrative for once. Mining difficulty adjustments and institutional inflows create perfect storm conditions.

Breaking through this resistance requires more than retail enthusiasm. It demands conviction from whales who've been quietly accumulating at these levels. The $117.5K barrier represents psychological warfare between early profit-takers and true believers.

Gold's glittering run provides cover for Bitcoin's assault on record territory. Traditional finance might hate the comparison, but the charts don't lie—both assets are rewriting their playbooks in real-time. Whether this resistance crumbles or holds will determine if we're witnessing a paradigm shift or just another crypto bubble waiting to pop.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

As a software company, Oracle provides its cloud infrastructure to companies across various industries, including in the education sector. Higher education institutions are one of the enterprise customers served by the company.

Lawmakers Probe ‘Algorithmic Collusion’

On Wednesday, the chairmen of the judiciary and antitrust committees of the two U.S. legislative chambers sent a letter to several organizations, requesting information on any tuition pricing algorithms they have developed for higher education institutions. They also enquired about how they use college applicants’ data on such technology. Oracle is one of these organizations, according to The New York Times.

Lawmakers raised concerns that American colleges might be engaging in “algorithmic collusion” by using enrollment management software (EMS) to increase profits and coordinate tuition fee pricing, financial aid, and admissions policies. These software might be using private algorithms to achieve this.

The letter noted that using a “common pricing formula or algorithm” or engaging in such practice through third-party companies violates the country’s antitrust laws.

“Companies selling EMS services to colleges and universities help schools extract more dollars from one last family each and every spring by taking part in what these companies call ‘financial aid leveraging,'” a letter addressed to David Coleman, CEO of non-profit organisation College Board, read in part.

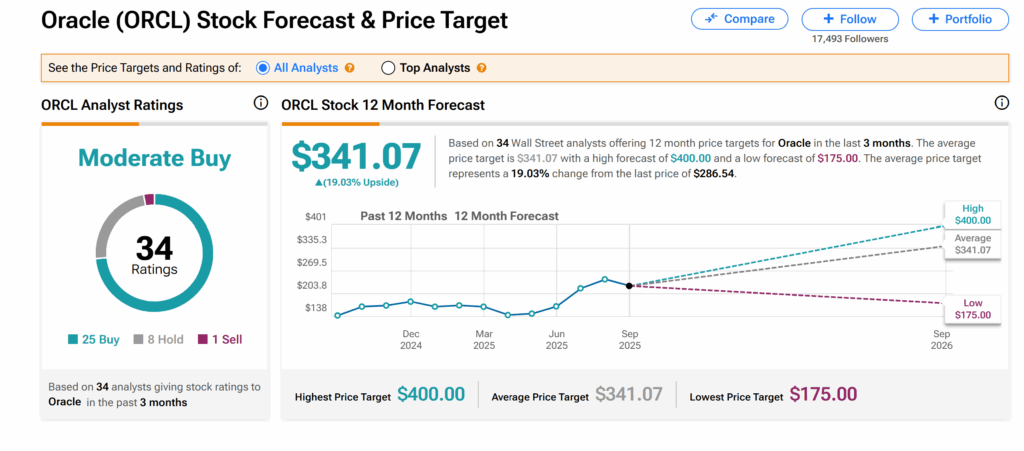

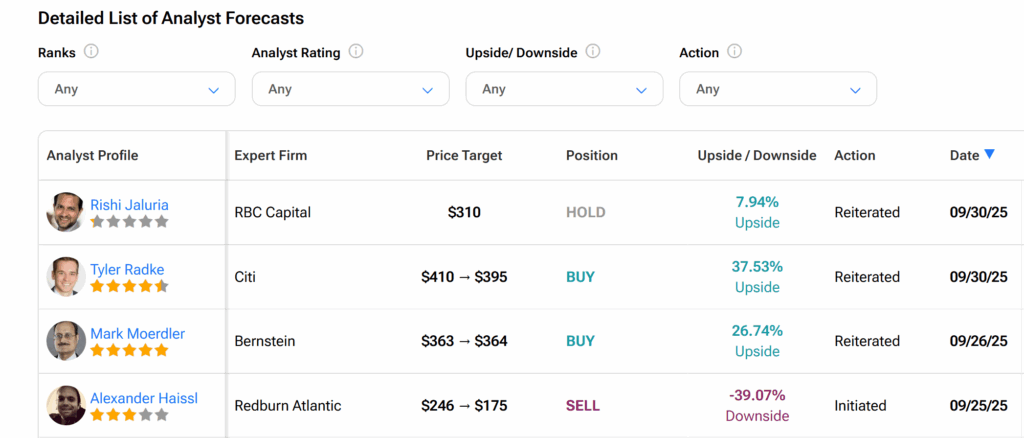

Is Oracle a Buy, Hold, or Sell?

Turning to Wall Street, Oracle’s shares currently have a Moderate Buy rating based on 25 Buys, eight Holds, and one Sell assigned by 34 Wall Street analysts over the past three months, as seen on TipRanks. Furthermore, the average ORCL price target of $341.07 indicates an 18.87% upside potential from the current level.