Tether’s Billion-Dollar Bitcoin Bet: 8,888 BTC Purchase Brings Massive Crypto Accumulation

Tether just dropped $1 billion on Bitcoin—grabbing exactly 8,888 coins in a single massive move. The stablecoin giant's latest acquisition pushes their total Bitcoin holdings to staggering new heights.

The Accumulation Game

While traditional finance plays with bonds and treasury notes, Tether keeps stacking digital gold. Their latest purchase isn't just another trade—it's a strategic power move in the crypto reserves race.

Market Impact

This billion-dollar buy signals institutional confidence remains unshaken despite regulatory noise. Tether's growing Bitcoin treasury demonstrates where smart money sees long-term value—while traditional investors chase fractional percentage gains in legacy markets.

Because nothing says financial innovation like watching billion-dollar companies hoard digital assets while banks still can't figure out wire transfers on weekends.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Paychex reported revenue of $1.54 billion in Fiscal Q1 2026, compared to analysts’ estimate of $1.54 billion. This marked a 17% gain year-over-year compared to $1.32 billion. The company attributed this to “continued progress integrating Paycor and sustained demand for our comprehensive HCM solutions.” It also noted an increase in the number of clients served, as well as more revenue generated per client.

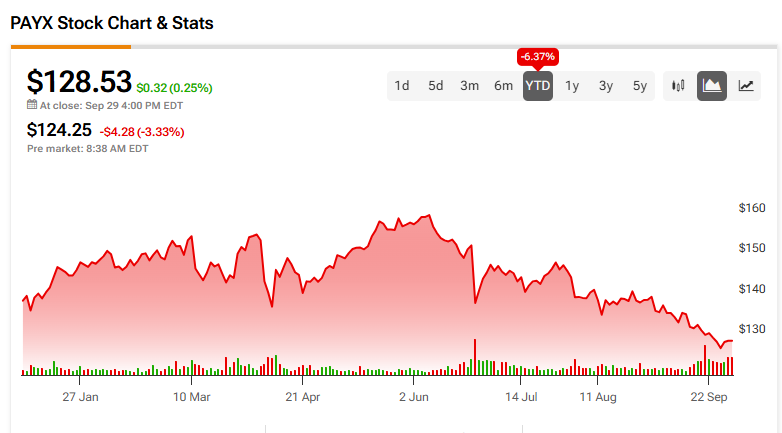

Paychex stock was down 3.33% in pre-market trading on Tuesday, following a 0.25% boost yesterday. The shares have fallen 6.37% year-to-date and 8.71% over the past 12 months.

Paychex Guidance

Paychex provided shareholders with updated guidance in its latest earnings report. The company now expects adjusted EPS growth to range from 9% to 11% in Fiscal 2026. The company didn’t alter any other part of its guidance, despite having reported a double-digit percentage increase in revenue. This means it still expects revenue growth for the year to range from 16.5% to 18.5%.

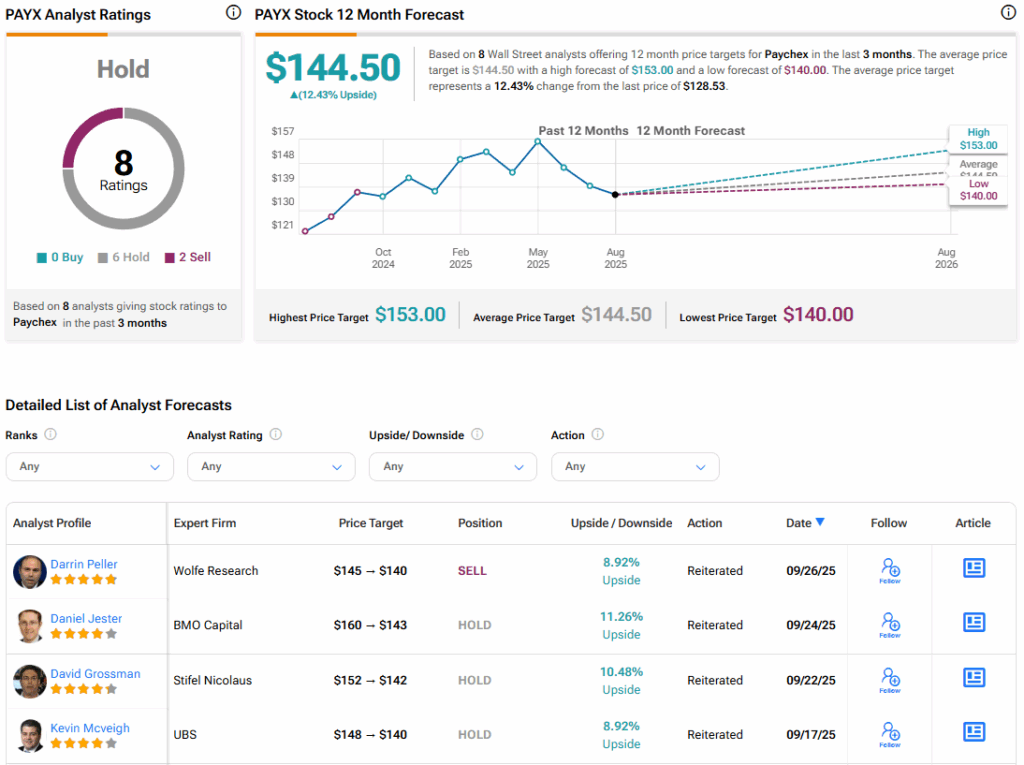

Is Paychex Stock a Buy, Sell, or Hold?

Turning to Wall Street, the analysts’ consensus rating for Paychex is Hold, based on six Hold and two Sell ratings over the past three months. With that comes an average PAYX stock price target of $144.50, representing a potential 12.43% upside for the shares. These ratings and price targets will likely change as analysts update their coverage after today’s earnings report.