경기침체 속 4대 회계법인 매출 둔화... 디지털 자산 시장은 왜 다른가?

회계 거인들의 수익 성장세 꺾이다

한국 4대 회계법인들이 경기 불확실성에 매출 증가율 둔화를 경험 중이다. 전통 금융 시장의 부진이 전문 서비스 업계까지 영향을 미치는 모습이다.

디지털 자산 시장과의 대조적 흐름

이와 대조적으로 가상자산 시장은 국내 투자자 1,077만 명이 참여하는 등 활기를 보이고 있다. 블록체인 기반 금융 생태계가 기존 시장의 변동성을 넘어서는 성장 동력을 보여주는 중이다.

회계사들이 여전히 엑셀 시트에 매달리는 동안, 디지털 자산 투자자들은 이미 다음 불장을 준비 중이다—아마도 그들이 감사 보고서를 읽기 전에 말이다.

Image source: Getty Images.

A worldwide business

Before looking forward, it's important to look around and get a clear picture of the Costco business. The company operates 914 warehouses, and though more than 600 of those are in the U.S., the business is well established worldwide with a presence in countries from China to France and New Zealand. Costco also offers customers the opportunity to buy products across e-commerce sites in several countries.

Costco's secret to success is it doesn't depend on the sales of products for growth, but instead on something that may be much more reliable: customer memberships. You can't shop at Costco without one, and that means you're paying Costco before you even grab a cart.

Memberships are high margin for Costco as it doesn't cost much for the company to offer you a card. So the $65 a year you pay for a standard membership or the $130 you pay for an executive level membership significantly contributes to Costco's profit. In the latest fiscal year, the company reported $8 billion in net income -- and more than $5 billion in membership fee revenue.

Returning members

This allows Costco to offer products at low prices, and the fact that Costco buys those products in bulk supports that effort as it pays less when it buys a great number of items. Meanwhile, the opportunity to get in on many products, as well as gas for your car, keeps people renewing their membership over the long term. We can see this in renewal rates that consistently top 90% in the U.S. and Canada.

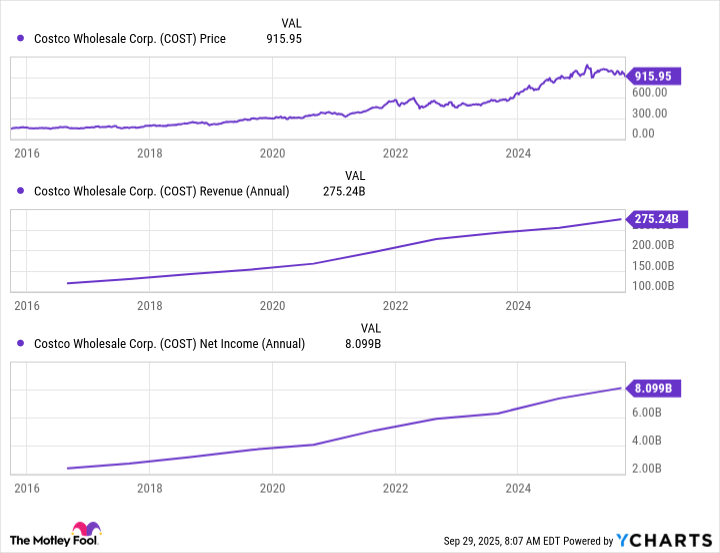

This business model is one that has worked for Costco like a well-oiled machine year after year, allowing the company to steadily grow earnings, and investors have pushed the stock price up.

COST data by YCharts

Why do I think this will continue? Costco, with its vast network of suppliers and strong private label, Kirkland Signature, has the structure in place to handle potential import tariff headwinds. In fact, the company, in a proactive move, is looking to refocus more Kirkland sourcing to the country where the products will be sold to avoid import tariffs.

The company's rock-bottom pricing is advantageous for customers, but during times of economic turmoil -- from a single headwind like import tariffs to a broad market downturn -- this could be the element that powers Costco's revenue while other retailers suffer. This makes Costco a company that's well positioned to excel during any market environment.

A famous $1.50 hot dog

Meanwhile, Costco's focus on maintaining deals that customers like -- such as its $1.50 hot dog -- and the company's new moves to improve the shopping experience, such as set-aside shopping hours for executive members, also should support revenue growth over time.

It's true that Costco stock isn't cheap, trading for 45 times forward earnings estimates, though it has come down from a high of more than 56.

But, considering Costco's business model and the loyalty of its membership base, it's worth this premium.

In the past and currently, Wall Street analysts have been optimistic about Costco's prospects, but they've been known to underestimate. For example, Costco surpassed earnings estimates in three of the past four quarters, with one of the beats happening in the most recent period. Some analyst predictions call for Costco stock to surpass $3,190 per share by 2035, which represents a 248% gain from today's stock price and WOULD push the stock's market cap to more than $1.4 trillion.

Costco stock has climbed more than 500% over the past decade. Considering this and its ongoing earnings strength, I predict the stock will exceed that $3,190 level -- particularly if Costco continues to deliver positive earnings surprises. It's very possible that Wall Street may be underestimating Costco's earnings and stock performance potential over time, and all of this reinforces my prediction that Costco will be worth more than analysts think a decade from now.