BTIG Warns: Starbucks’ (SBUX) Turnaround Could Drag On Longer Than Expected

Wall Street's patience wears thin as another analyst sounds the alarm on Starbucks' recovery timeline.

BTIG throws cold water on SBUX rebound hopes

The investment firm delivers a sobering assessment—predicting the coffee giant's operational overhaul will stretch beyond optimistic projections. No quick fixes here, just the harsh reality of structural challenges meeting quarterly expectations.

When analyst forecasts clash with corporate optimism

Market watchers now face the classic dilemma: trust the turnaround story or heed the professional skeptics. Another reminder that in finance, 'long-term' often means 'until we find something better to pitch.'

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

BTIG made the comments as it reaffirmed a Buy rating and $105 price target on SBUX stock. The price target is 27% higher than where SBUX stock currently trades. “We remain Buy-rated with a $105 price target, but acknowledge the turnaround here is taking longer than we initially anticipated,” wrote BTIG in a note to clients.

The comments from the boutique investment bank come a day after Starbucks announced plans to close about 500 store locations in North America as part of its restructuring, alongside a reduction of 900 corporate employees.

Better Days Ahead

“We are encouraged by the longer-tail portfolio restructuring and further cost reductions, and we eagerly await a return to positive transaction counts in the U.S. as the ultimate catalyst,” wrote BTIG in its summary of Starbucks’ future prospects and likely stock performance.

According to BTIG, the store closures represent about 4.5% of the company’s North American retail locations. Starbucks is also cutting about 10% of its remaining non-retail staff. The company expects about $1 billion in charges related to the closures and restructuring. SBUX stock has fallen 7% in 2025.

Is SBUX Stock a Buy?

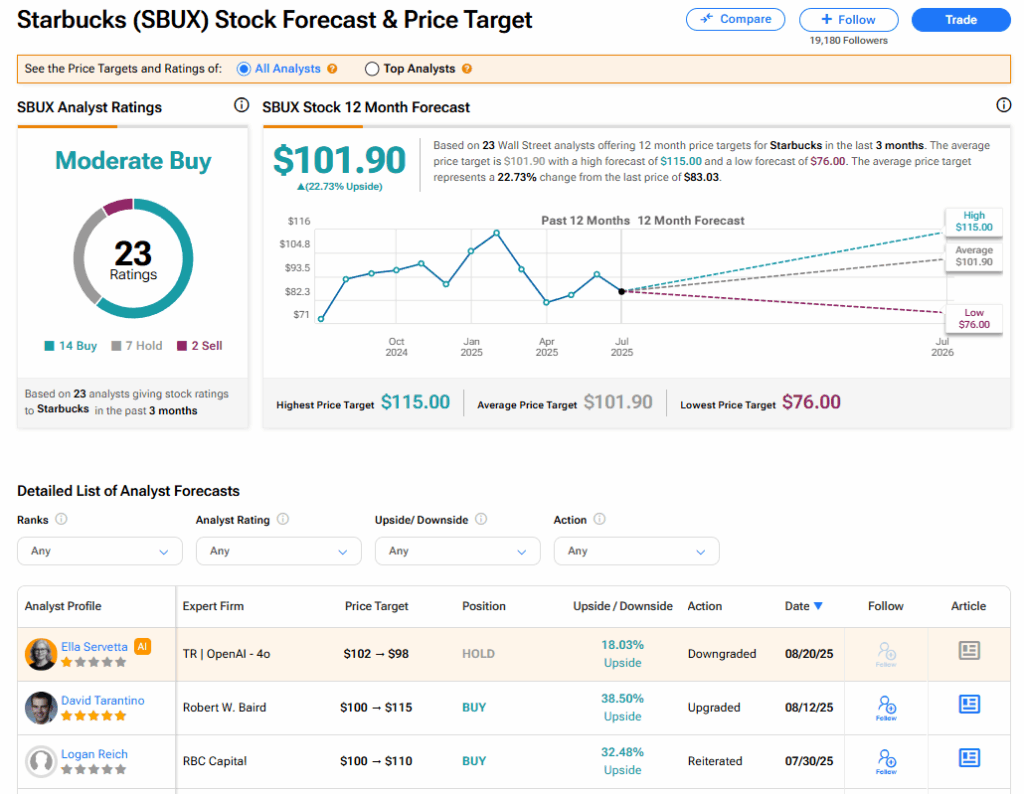

The stock of Starbucks has a consensus Moderate Buy rating among 23 Wall Street analysts. That rating is based on 14 Buy, seven Hold, and two Sell recommendations issued in the last three months. The average SBUX price target of $101.90 implies 22.73% upside from current levels.