BREAKING: SHOP, AC, LULU Lead Canada’s Economic Rebound After Four-Month Slump

Canada's economy finally shakes off stagnation as major players drive unexpected growth surge.

The Turnaround Nobody Saw Coming

After four consecutive months of economic contraction, Canada's market pillars—Shopify, Air Canada, and Lululemon—are fueling a dramatic reversal. These homegrown giants are demonstrating remarkable resilience while traditional sectors struggle to find footing.

Digital Commerce Leads the Charge

Shopify's e-commerce infrastructure continues to outperform traditional retail models. Meanwhile, Air Canada's recovery trajectory surprises analysts who predicted prolonged travel sector weakness. Lululemon's global expansion proves Canadian brands can compete internationally despite domestic headwinds.

What This Means for Investors

The rebound suggests Canada's economy might finally be adapting to post-pandemic realities. Though let's be honest—four months of decline followed by one positive reading doesn't exactly scream 'economic miracle.' Traditional finance institutions will probably still find reasons to be cautious while missing the actual momentum.

Watch these stocks closely—they're not just indicators but active drivers of Canada's financial future.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Statistics Canada reports that gross domestic product (GDP) grew 0.2% in July of this year, the first increase in four months. However, preliminary estimates for August indicate that GDP for that month was unchanged.

Still, the fact that the Canadian economy grew in July comes as a relief and allays concerns among economists, politicians, and business leaders that the country was headed for a recession. News of the growth has well-known Canadian stocks such as Shopify (SHOP), Air Canada (TSE:AC), and Lululemon Athletica (LULU) rising.

Tariff Impacts

Since the spring, Canada’s economy has struggled under the weight of tariffs imposed by the neighboring U.S., which have impacted Canadian exports and the manufacturing sector. There has also been evidence that Canada’s labor market is cooling. To help boost the economy, the Bank of Canada lowered interest rates by 25-basis points on Sept. 17.

In terms of July’s performance, Statistics Canada said that the economic growth was driven by goods-producing industries, as well as mining, quarrying, and oil and gas extraction. Additionally, the manufacturing sector rebounded and grew 0.7% in July. Partially offsetting the gains was a 1% decline in the retail sector as Canadian consumers tighten their purse strings.

Is AC Stock a Buy?

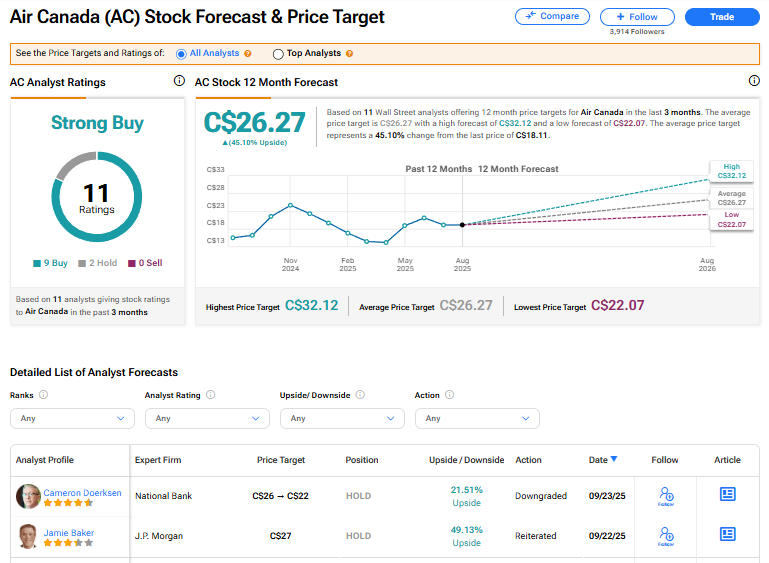

Air Canada’s stock has a consensus Strong Buy rating among 11 Wall Street analysts. That rating is based on nine Buy and two Hold recommendations issued in the last three months. The average AC price target of C$26.27 implies 45.10% upside from current levels.