Wedbush Slashes CarMax (KMX) Target by 35% After ’Weak’ Performance - Here’s Why Traders Should Care

Wall Street's patience wears thin as CarMax hits a speed bump.

Analysts at Wedbush just downgraded KMX stock following what they called 'weak' quarterly results—slashing their price target by a staggering 35%.

The Numbers Don't Lie

That 35% cut speaks volumes about fading confidence in the used-car giant's near-term prospects. When institutions move this aggressively, retail investors should take notice.

Market Realities Bite

High interest rates and squeezed consumer budgets are finally catching up with big-ticket retailers. CarMax's struggle mirrors broader economic pressures that even crypto investors watch closely—when traditional markets stumble, digital assets often benefit from capital rotation.

Finance's Favorite Pastime: Kicking Companies When They're Down

Because nothing says 'analysis' like waiting for results to turn south before adjusting targets. Wedbush's timing proves yet again that Wall Street analysts are better historians than fortune tellers.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

KMX stock dropped 20% on Friday after Q2 earnings and revenue missed estimates. The shares have also declined 44% year-to-date.

Wedbush Turns Cautious on CarMax

Devitt noted that CarMax missed expectations on “all key metrics,” including revenue, retail sales, and diluted EPS. He also highlighted disappointing results in used-car unit growth, average selling price, and retail gross profit, all of which fell short of estimates.

As a result, Devitt said that the weak Q2 performance is raising investor concerns about the company’s ability to maintain market leadership and drive growth. He added that the overall outlook for CarMax has turned cautious, with the company now losing market share faster than its main competitor.

Devitt’s new price target of $54 implies an upside of 18.42% from the current level.

Wedbush Isn’t the Only One Downgrading KMX Stock

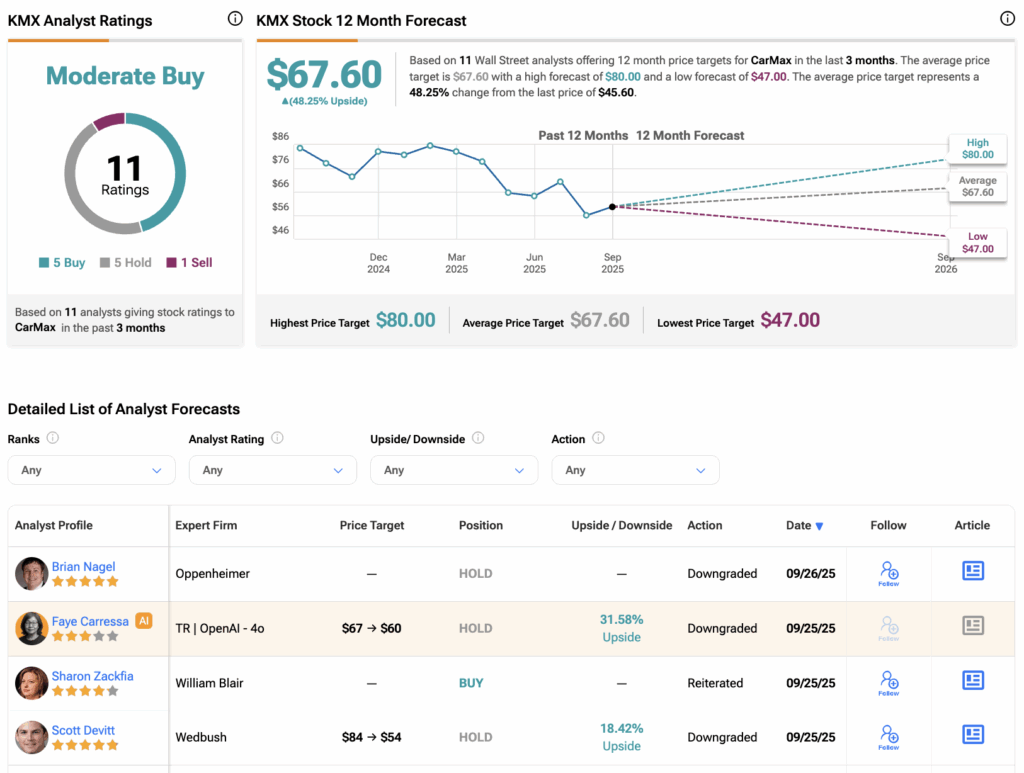

Following the results, Oppenheimer’s top-rated analyst Brian Nagel also downgraded his rating to Hold.

Nagel expressed concern that the company may need a longer-term strategic adjustment to strengthen its Core offerings and improve marketing, especially as demand may weaken. He further noted that some of the recent sales and profit weakness might be short-term and self-inflicted, but these challenges still pose significant hurdles for the company.

Nagel added that he doesn’t expect CarMax shares to rise until there are clear signs of a lasting recovery.

Is CarMax a Good Stock to Buy?

Turning to Wall Street, the analysts’ consensus rating for CarMax stock is Moderate Buy, based on five Buys, five Holds, and one Sell assigned over the past three months. Meanwhile, KMX stock price target of $67.60 implies a potential 48.25% upside for the shares.