Tesla Stock Rises as Elon Musk Says ’Guess Not’ to Fears of Collapse

Tesla shares surge as Musk dismisses bankruptcy fears with characteristic nonchalance.

The Confidence Game

Elon Musk's two-word rebuttal sends Tesla stock climbing—proving once again that in modern markets, perception often outweighs fundamentals. The CEO's casual 'guess not' response to collapse concerns triggered immediate investor enthusiasm.

Market Mechanics

Traders snapped up shares following Musk's remarks, demonstrating the outsized influence of executive commentary on stock performance. The reaction highlights how sentiment can override traditional valuation metrics in today's hyper-connected trading environment.

Wall Street's selective memory strikes again—they'll panic over quarterly margins but take existential reassurance from a billionaire's tweet. Some things never change, even as the technology does.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The remark came as Tesla shares surged, showing strength despite the expiration of U.S. electric vehicle tax credits that many assumed WOULD drag demand lower. Musk’s post showcases his confidence that Tesla’s growth is not tied only to government incentives.

Tesla Stock Pushes Higher

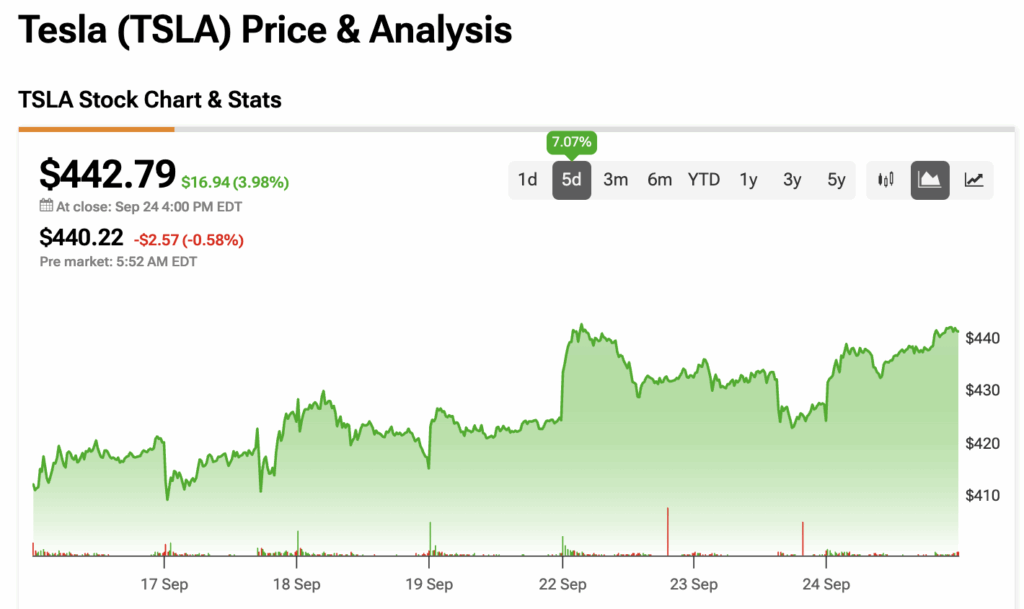

Tesla stock closed at $442.79 on September 24, up $16.94 (3.98%) for the day. Shares gained 7.07% over the past five sessions, hitting intraday highs above $447 before easing slightly in premarket trading to $440.22.

The rally highlights investors’ willingness to buy the dip even as broader auto sector concerns linger. For Musk, it is evidence that Tesla can stand on its own as demand drivers shift from subsidies to scale, technology, and brand strength.

Why the Market Reacted This Way

Economically, subsidies like tax credits reduce the effective price of a product, boosting short-term demand. When those credits expire, basic supply-and-demand logic suggests sales should weaken, which is why many traders expected Tesla stock to fall.

But Tesla’s gains show that other forces are at work. Brand loyalty, falling battery costs, and the company’s ability to scale production are offsetting the subsidy loss. Investors may also be betting that Tesla’s margins and new product cycles, from energy storage to robotics, will keep growth intact.

Investors Reassess Tesla’s Resilience

The MOVE gives Tesla shareholders a reason to breathe. A feared collapse never materialized, and the stock is proving durable without direct subsidy support. That could change how analysts model future cash flows, with less emphasis on government aid and more on Tesla’s underlying demand curve.

Still, volatility is never far away. Without credits, Tesla faces a purer competitive market. Investors will now judge the company more directly on cost efficiency, innovation speed, and global expansion.

Is Tesla a Buy, Sell, or Hold?

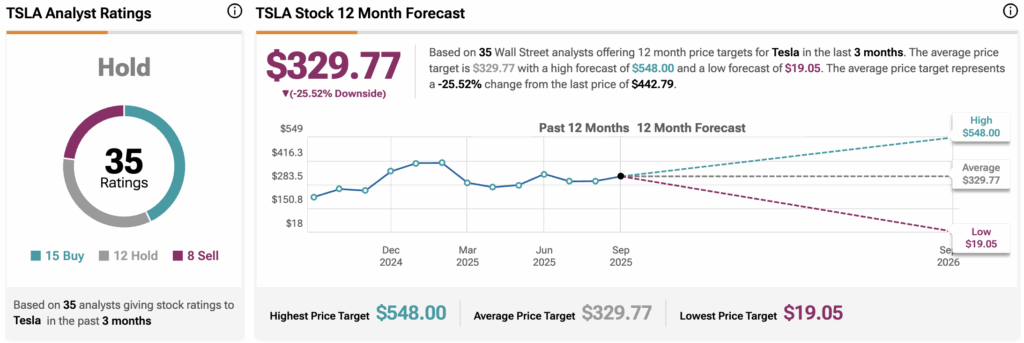

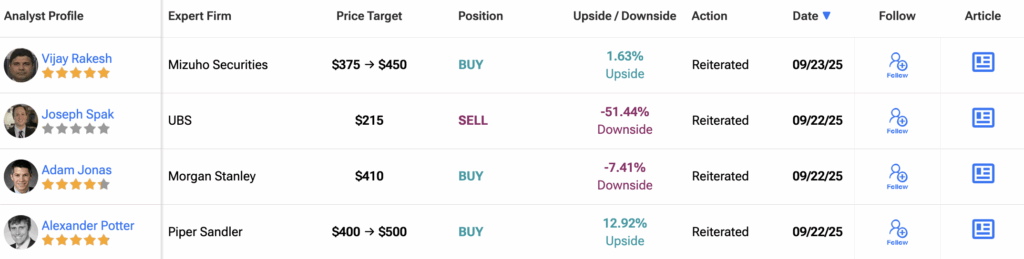

Turning to TipRanks, Tesla is still considered a Hold based on 35 ratings assigned by analysts in the last three months. The average price target for TSLA stock is $329.77, implying a 25.5% downside from the current price.