META Stock (META) Slips as Singapore Orders Crackdown on Facebook Impersonation Scams - Regulatory Storm Hits Social Media Giant

Singapore draws blood from Meta's stock price with sweeping anti-scam measures targeting Facebook's impersonation epidemic.

The Regulatory Hammer Falls

Singapore's financial watchdog unleashes unprecedented enforcement actions against Meta's flagship platform. The crackdown targets sophisticated impersonation scams that have drained millions from unsuspecting users through fake celebrity endorsements and business account takeovers.

Market Reaction and Fallout

Trading floors witness immediate sell pressure as investors digest the regulatory implications. The timing couldn't be worse—just as Meta attempts to rebuild advertiser confidence after previous privacy debacles. Another fine to add to the collection, as if their legal department needed more paperwork.

Platform Security Under Microscope

Facebook's verification systems face intense scrutiny following the enforcement action. Security analysts question whether the social media giant prioritizes user protection over engagement metrics. The age-old tech dilemma: safety versus growth—and we all know which one pays the quarterly bonuses.

Another day, another regulatory headache for Silicon Valley—but hey, at least the lawyers are getting rich.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The government said that it had given Meta, which owns Facebook, until the end of this month to introduce measures including facial recognition to help curb impersonation scams on Facebook.

Increased Number

The Ministry of Home Affairs said that Meta faces a fine of up to $776,639 if it fails to comply “without reasonable excuse”. It added that Meta could then suffer daily fines if it fails to meet the deadline.

The ministry is taking action because of an increase in instances of scammers exploiting Facebook for impersonation scams between June 2024 and June this year, using videos or images of government office holders in fake advertisements, accounts, profiles and business pages.

“While Meta has taken steps to address the risk of impersonation scams globally, including in Singapore, the home affairs ministry and the Singapore police force remain concerned by the prevalence of such scams in Singapore,” said the ministry.

It is the first such order issued under Singapore’s new Online Criminal Harms Act, since it came into force in February 2024.

Earlier this month, Singapore’s police ordered Meta to implement anti-scam measures against advertisements, accounts, profiles and business pages impersonating key government office holders on its Facebook platform. That order, however, did not come with a deadline attached.

META Responds

A Meta spokesperson said: “It’s against our policies to impersonate or run ads that deceptively use public figures to try to scam people, and we remove these when detected.”

Meta said that it had specialized systems to detect impersonating accounts and celeb-bait ads. It is working with law enforcement on “legal action against the criminals behind these scams.”

Social media scams are a key regulatory and reputational risk for Meta – see below:

Back in June, in the U.S. a group of 42 state attorneys general urged Meta to take stronger action against investment scams on Facebook, which falsely use images of Warren Buffett, Elon Musk, and Ark Invest’s Cathie Wood to trick users.

Meta is taking action against similar scams. In July it said it had removed about 10 million fake profiles in the first half of 2025. These accounts were pretending to be well-known content creators and were creating spammy content.

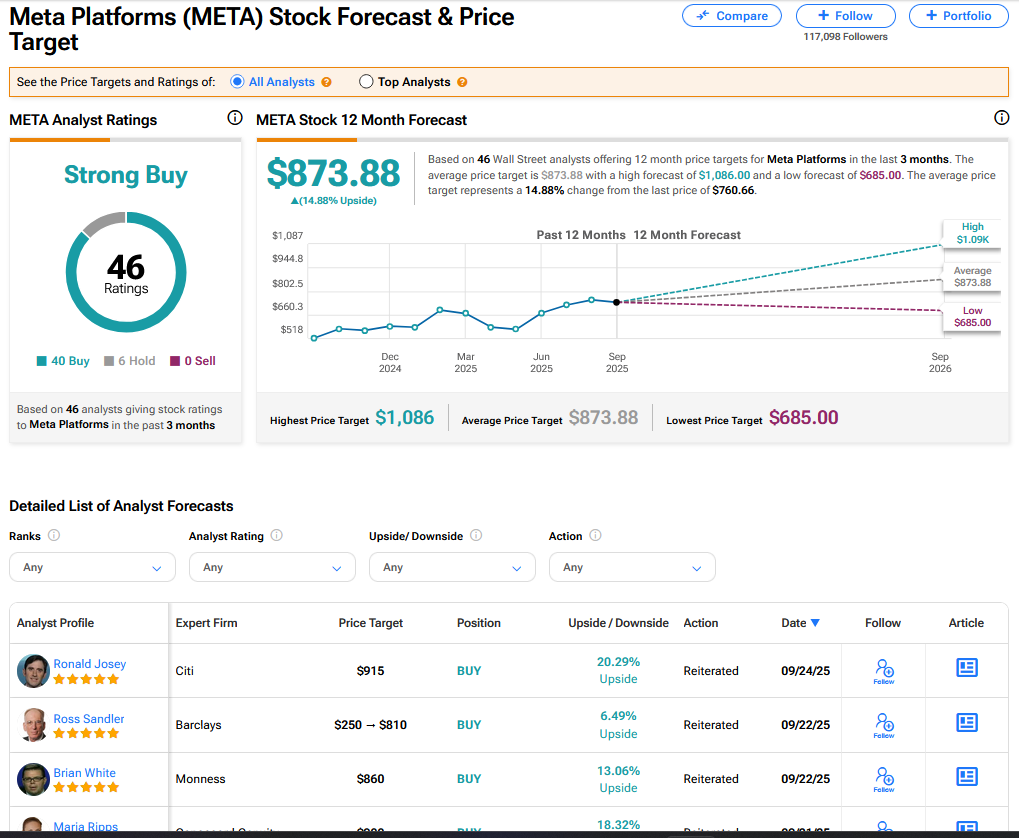

Is META a Good Stock to Buy Now?

On TipRanks, META has a Strong Buy consensus based on 40 Buy and 6 Hold ratings. Its highest price target is $1,086. META stock’s consensus price target is $873.88, implying a 14.88% upside.