UnitedHealth (UNH) Soars with 34% Price Target Boost – ’Compelling Upside’ Ahead

Wall Street wakes up to healthcare giant's explosive potential.

The Numbers Don't Lie

Analysts just slapped a whopping 34% premium on UnitedHealth's valuation targets – because sometimes even traditional finance recognizes actual value when it sees it. The healthcare behemoth's stock suddenly looks like one of the few sane bets in a market obsessed with speculative nonsense.

Execution Over Hype

While crypto tokens pump on vaporware promises, UNH delivers something radical: actual revenue. The company's diversified portfolio – from insurance to pharmacy benefits – creates a fortress balance sheet that would make any DeFi protocol blush. They're scaling real-world solutions while blockchain projects struggle to onboard their first 10,000 users.

The Institutional Stamp

When mainstream analysts use phrases like 'compelling upside,' they're essentially admitting this is the closest thing to a sure bet in traditional markets. It's almost adorable watching them discover what crypto natives understood years ago – exponential growth potential exists beyond their precious S&P 500.

Healthcare Meets Alpha

UnitedHealth's trajectory proves something revolutionary: you don't need magical internet money to generate serious returns. Sometimes the most disruptive plays hide in plain sight – even if they lack the sexy buzzwords of Web3. The stock's performance might actually convince some hedge funds to diversify beyond their usual suspects.

Let's be real – if traditional analysts are this excited about 34% upside, they'd probably faint at typical crypto ROI. But hey, baby steps toward financial literacy.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Mayo believes UNH is well poised for a “more compelling upside” despite the stock already climbing over 15% in the past month. Earlier this month, the healthcare insurer announced that nearly 78% of its Medicare Advantage members will be enrolled in plans with four stars or higher for 2026. The Centers for Medicare & Medicaid Services (CMS) uses a star rating system to measure plan quality and customer experience. High ratings are vital for insurers since they increase enrollment and government bonus payments, strengthening their bottom line.

Mayo Expects UNH Stock to Trade Higher

Mayo is particularly encouraged by the potential for a rapid recovery in Optum by 2027. UnitedHealth has been struggling with the Optum crisis in the aftermath of the 2024 ransomware attack on Change Healthcare. The breach has cost the company billions of dollars and triggered lawsuits, investigations, and increased regulatory scrutiny.

If this recovery occurs as Mayo expects, he projects earnings per share (EPS) of $25 for fiscal 2025, notably higher than the current consensus estimate of $21. He also noted that risks related to the Medicare Advantage Star ratings have “diminished,” setting a solid EPS floor of $16 for this year.

Mayo raised his earnings estimates for UNH stock based on three factors: a recovery at Optum, improving Medicare Advantage star ratings, and a multi-year path for margin growth. In short, Mayo sees UnitedHealth poised for compelling upside thanks to improving fundamentals and favorable policy trends.

Is UNH a Good Stock to Buy?

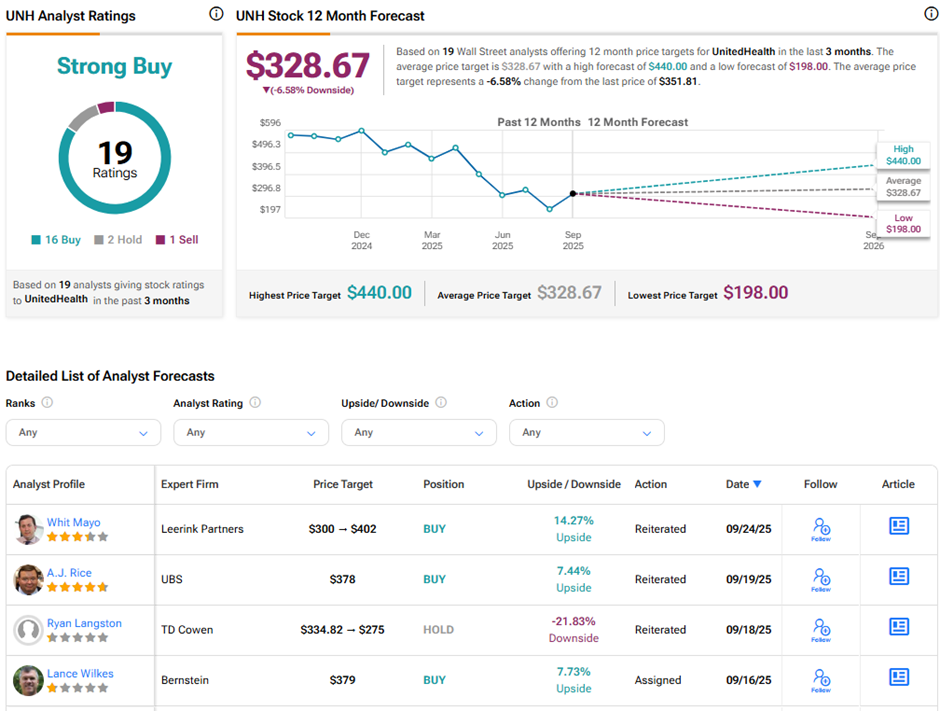

Despite the headwinds, analysts remain highly optimistic about UnitedHealth’s long-term outlook. On TipRanks, UNH stock has a Strong Buy consensus rating based on 16 Buys, two Holds, and one Sell rating. The average UnitedHealth price target of $328.67 implies 6.6% downside potential from current levels.