Who Is TipRanks’ All-Star Analyst on Broadcom Stock (AVGO)?

Meet the analyst calling the shots on Broadcom's explosive trajectory.

Decoding the AVGO Oracle

TipRanks' top-performing analyst has been nailing Broadcom's moves with uncanny precision. This semiconductor giant keeps defying market expectations while Wall Street scrambles to keep up.

The Pattern Recognition Edge

Their track record shows consistent outperformance where others falter. While most analysts chase yesterday's news, this all-star spots trends before they hit mainstream radar.

Why Broadcom Keeps Winning

AVGO's strategic acquisitions and diversified tech portfolio create a fortress balance sheet that traditional chip companies envy. The stock's resilience during market volatility speaks volumes about its underlying strength.

Wall Street's Favorite Blind Spot

Meanwhile, traditional finance still underestimates how semiconductor dominance translates to long-term value creation—classic short-term thinking from an industry that still uses fax machines.

One thing's clear: when this analyst talks Broadcom, smart money listens.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Broadcom designs, develops, and supplies a broad range of semiconductor, enterprise software, and security solutions. For a thorough assessment of the stock, go to TipRanks’ Stock Analysis page.

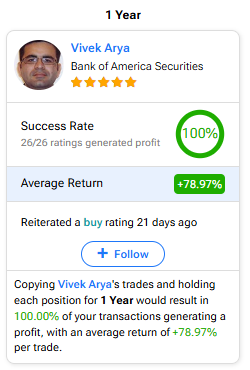

Most Profitable and Accurate Analyst on AVGO Stock

When we look at Thill’s recommendation for Broadcom stock, we see that he has achieved an impressive 100% success rate by holding the stock for one year. Plus, he has earned an average return of 78.97% during that period.

On an overall basis, copying Thill’s trades and holding them for a year WOULD give you an average return of 19.30%, with 60% of your trades generating a profit.

Thill primarily focuses on covering the Technology sector in the U.S. and Canadian markets. Importantly, his most profitable rating to date is a Buy on Credo Technology stock (CRDO). The analyst has achieved a massive 349.5% return on the call between April 16, 2025, and today.

Following phenomenally successful analysts’ ratings can add profit to your portfolio. Find the best analyst to follow for any stock by scrolling down to the “” feature on its page.

To follow the best Wall Street analysts, take a look at the list of Top Analysts on TipRanks.