Could This Small-Cap Artificial Intelligence (AI) Stock Become the Next Nvidia?

Forget chasing yesterday's winners—the real money's being made by investors spotting tomorrow's AI giants before Wall Street catches on.

Hidden Gem Hunting

While Nvidia's riding high, savvy traders are scanning the small-cap landscape for AI plays that could deliver 10x returns. The metrics don't lie: companies with proprietary AI tech and scalable solutions are quietly building moats that could challenge established players.

Execution Over Hype

What separates potential winners from vaporware? Real revenue streams and patent-protected technology. The AI sector's littered with companies that promised revolution but delivered empty PowerPoint presentations—yet the ones solving actual business problems are printing money.

Market Timing Play

Getting in before institutional money floods the space requires nerves of steel and deep technical due diligence. The regulatory landscape remains uncertain, but early movers in compliant AI infrastructure could reap rewards that make current crypto gains look pedestrian.

Because let's be honest—if traditional finance understood disruption, they wouldn't still be charging 2% management fees for underperforming index funds.

Is quantum computing the next GPU?

Just as there were initially few mainstream commercial applications for GPUs, there aren't many so far for quantum computers. The technology remains largely experimental. The machines are complex, costly to build and operate, and have not yet addressed real-world utility at scale. Still, the potential of quantum computing AI is enormous.

Unlike classical computers -- which store and manipulate data in binary FORM -- quantum computers use qubits, which can also hold values that are probability amplitudes, thanks to a property known as superposition. The result of this is that in some cases, quantum computers can solve problems exponentially faster than even a classical supercomputer.

Experts expect that quantum computing's strengths will be applicable across a host of use cases, from drug discovery and financial risk modeling to cryptography and predicting energy patterns. As such, quantum computing has the potential to unlock trillions of dollars in economic value at scale. Yet, as with GPUs in the 1990s, the gap between the ambitious visions of the pioneers and widespread commercial adoption of the technology remains wide.

Image source: Getty Images.

Analyzing Quantum Computing Inc.

Over the past year, Quantum Computing Inc., or QCi, has surged into the spotlight. Given that its name mirrors one of the tech sector's hottest themes, it's not too surprising that shares of this emerging company have skyrocketed by more than 3,200% in just 12 months. While momentum like that might be tempting to follow, smart investors will want to look beneath the surface first.

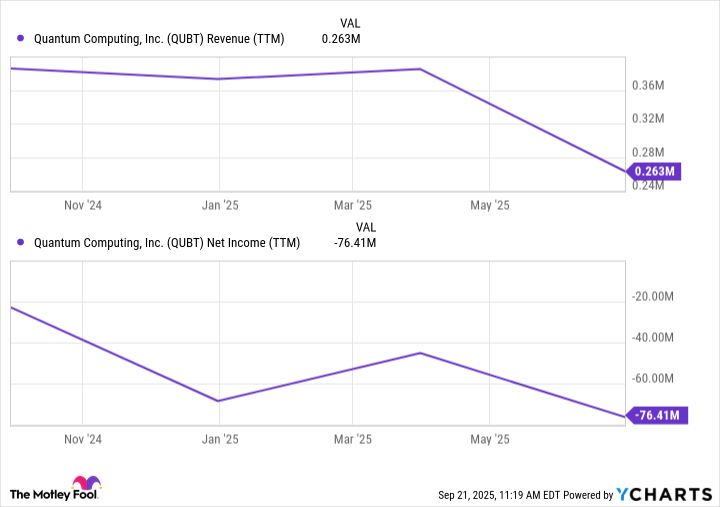

QUBT Revenue (TTM) data by YCharts.

So far, QCi is generating minimal revenue, and it continues to burn significant cash, which raises serious doubts about its path to profitability.

In my view, Quantum Computing Inc. shares are benefiting less from the company being in a position of operational strength and more from retail investors' enthusiasm. The company is in the right place at the right time and riding a wave of hype-driven narratives. And the mismatch between QCi's headline-grabbing name and its underlying business fundamentals is quite concerning.

Is Quantum Computing Inc. the next Nvidia?

Nvidia's rise to dominance was never fueled by branding alone. The company brought cutting-edge technology to bear, steadily improved it over the years, and was led by a visionary who recognized how GPUs' uses could extend far beyond gaming and into data centers and AI.

Just as important, the company built a formidable moat by promoting its software architecture, CUDA, to developers. The more widely used CUDA became, the more effectively Nvidia locked developers into its ecosystem.

Quantum Computing Inc. lacks these types of competitive advantages. Its business is showing limited traction, and it's lagging its peers across both hardware and software. Meanwhile, giants like, Alphabet,, andare already investing heavily in quantum computing applications, and they are well-positioned to integrate them into their sprawling ecosystems.

Against this backdrop, Quantum Computing Inc. has essentially become a speculative meme stock favored by day traders chasing quick profits rather than a holding of long-term investors building durable positions.

For those looking to gain exposure to the quantum computing landscape, a more prudent approach WOULD be to invest in established AI leaders with profitable, diversified businesses that are also exploring this rising new technology.