HSBC’s Quantum Leap: IBM Tech Boosts Bond Trading Accuracy by 34%

Quantum computing just proved its Wall Street worth—and traditional traders should be sweating.

HSBC's quantum experiment with IBM tools delivered what human analysts couldn't: a 34% precision jump in bond trading predictions. The bank's quantum algorithms sliced through market noise that typically gums up conventional models.

Why This Shakes Finance

Quantum systems don't just calculate faster—they spot patterns invisible to classical computers. HSBC's test run handled complex bond pricing variables simultaneously, bypassing the sequential analysis that slows traditional systems.

The bank's quantum advantage emerged in volatility forecasting, where minute price movements make or break trades. While competitors rely on historical data, HSBC's quantum approach modeled real-time probability landscapes.

Wall Street's Quantum Race Heats Up

Financial giants now face a tech arms race—upgrade or get outpriced. Quantum's 34% edge isn't incremental; it's disruptive enough to rewrite trading desk playbooks overnight.

Of course, the real test comes when quantum traders collide with bankers still using spreadsheets—because nothing says 'efficient markets' like a 34% advantage hidden behind billion-dollar hardware. The future of finance is here, and it doesn't care about your Ivy League degree.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Meanwhile, HSBC shares have dropped 0.44% in yesterday’s trading, closing at $69.89.

The trial analyzed more than one million requests for quotes on over five thousand European corporate bonds between September 2023 and October 2024. HSBC used a hybrid system that combined quantum and classical computing, which gave the model an advantage over common techniques. However, the study also cautioned that the results are tied to this specific dataset and may not extend to other markets.

Philip Intallura, HSBC Group Head of Quantum Technologies, called the project the most tangible example yet of near-term value from quantum hardware in finance. He added that the bank views this as a sign that a new era of computing is close at hand, rather than something distant.

Why It Matters

For financial firms, even small gains in prediction accuracy can translate into significant advantages across billions of trades. HSBC’s 34% boost indicates that quantum tools could enhance how banks manage risk and improve efficiency in bond markets. Although the study was based on historic data rather than live trades, the outcome points to early steps toward practical use.

Meanwhile, IBM is competing with Alphabet (GOOG) (GOOGL) to build large-scale quantum machines by the end of the decade. At the same time, experts warn that more powerful quantum systems could threaten current encryption methods, which are central to banking security.

Jay Gambetta, Vice President of IBM Quantum, explained that quantum machines can process information in ways that classical systems cannot. For HSBC, the trial provides an early view of how quantum computing may deliver practical benefits and offer banks a competitive edge once the technology matures.

Is HSBC a Good Stock to Buy?

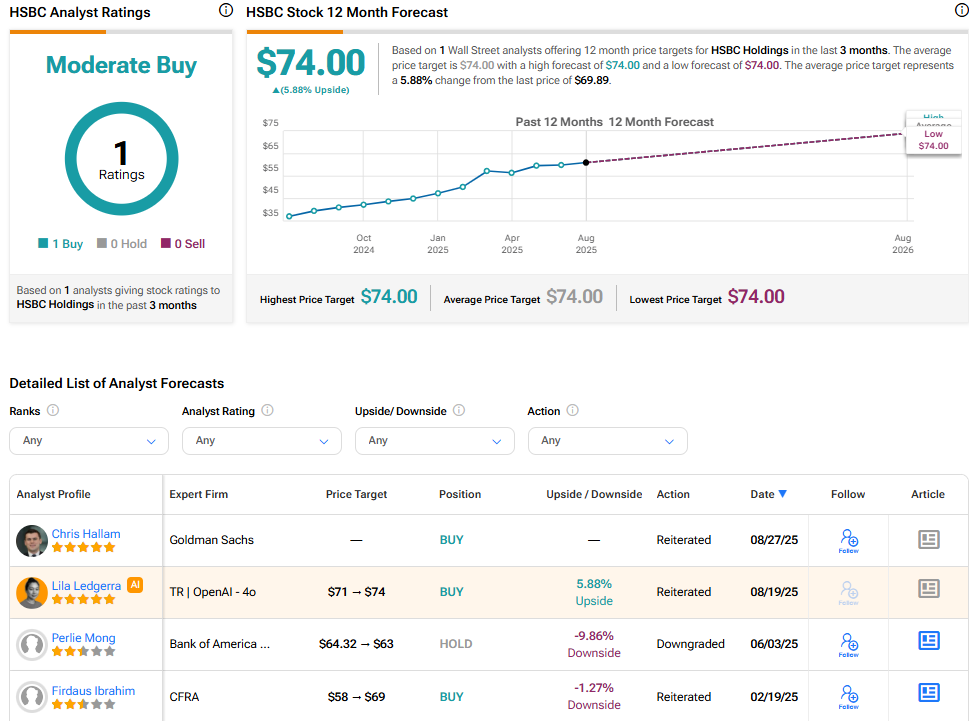

On Wall Street, HSBC receives limited coverage and currently holds a Moderate Buy rating from a single analyst. The average HSBC stock price target is $74, implying a 5.88% upside from the current price.