Cathie Wood Dumps AMD Stock, Doubles Down on Alibaba and Baidu in Bold China Bet

Cathie Wood's ARK makes a dramatic pivot—slashing AMD positions while loading up on Chinese tech giants.

The Great Rotation

Wood executes a classic sector rotation play, moving chips for e-commerce dominance. The AMD sell-off signals shifting priorities as China's tech landscape shows renewed momentum.

Wall Street's Whiplash

Traders scramble to decode the sudden move—because nothing says 'conviction' like following last year's trends. The timing raises eyebrows as regulatory clouds linger over Chinese ADRs.

Another day, another portfolio shuffle that'll either look brilliant or join the graveyard of celebrity investor missteps.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Wood Sells AMD Stock

The most notable transaction on Wednesday was the sale of 138,432 AMD shares, worth about $22.3 million, by the ARK Innovation ETF (ARKK).

The sale of AMD stock by Wood’s ARKK ETF comes at a time when there are concerns about rising competition in the chip space, especially after Nvidia (NVDA) announced a $5 billion investment in troubled chipmaker Intel (INTC) and a $100 billion investment in Open AI, as well as rival Broadcom (AVGO) announced a $10 billion order from a new customer, reflecting robust demand for its AI custom chips.

Is AMD Stock a Buy or Sell?

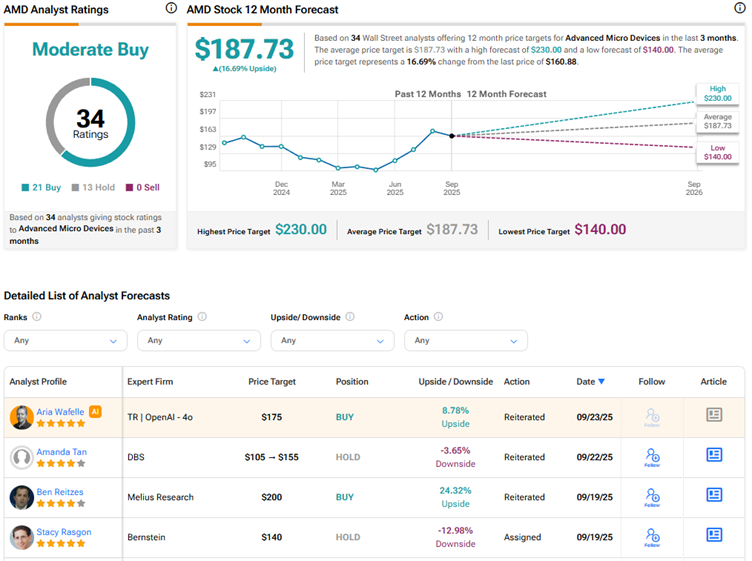

Currently, Wall Street is cautiously optimistic on AMD stock, with a Moderate Buy consensus rating based on 21 Buys and 13 Holds. The average AMD stock price target of $187.73 indicates about 17% upside potential. AMD stock has declined 4% over the past month, but is up more than 33% year-to-date.

Additionally, ARRK ETF continued to trim its stake in AI-powered healthcare technology company Tempus AI (TEM). Yesterday, ARKK sold 45,299 TEM shares, worth $3.81 million. There have been concerns about Tempus AI stock’s valuation following a 135% rally so far this year.

Wood Builds Positions in Chinese Stocks

Wood continues to build its position in Chinese technology companies. AI-led growth potential appears to be driving renewed interest in Chinese stocks. It is worth noting that ARK ETFs sold almost all its holdings in Chinese stocks in 2021 amid a regulatory crackdown on the tech sector.

On Wednesday, the ARKK ETF purchased 63,231 shares of Chinese e-commerce and cloud computing giant Alibaba, valued at $10.3 million. Additionally, the ARKK ETF bought 82,913 internet company Baidu shares, worth about $10.4 million. These transactions follow significant purchases of Chinese stocks made on Monday.

Wall Street’s Take on BABA and BIDU Stocks

Currently, Wall Street has a Strong Buy consensus rating on Alibaba stock, with the average price target of $171.04 indicating a 3.1% downside risk. Meanwhile, Baidu stock scores a Moderate Buy consensus rating, with the average price target suggesting a 11% possible downside from current levels.

BABA stock has rallied 108% year-to-date, while BIDU stock is up 58% over the same period.