If You’d Invested $1,000 in Vanguard Total Stock Market ETF (VTI) 10 Years Ago, Here’s How Much You’d Have Today - The Results Will Shock You!

VTI's Decade-Long Run Leaves Traditional Investors Speechless

The Numbers Don't Lie

While Wall Street fund managers collected their 2% fees regardless of performance, VTI quietly delivered returns that made active management look like expensive guesswork. The ETF's passive approach sliced through market noise and consistently captured broad market growth—no stock-picking genius required.

Ten years of compounding exposed the dirty secret of traditional finance: sometimes the simplest strategy beats the fancy suits and their complex algorithms. Just don't expect your financial advisor to recommend something that actually works—where would the mystery fees come from?

Image source: Getty Images.

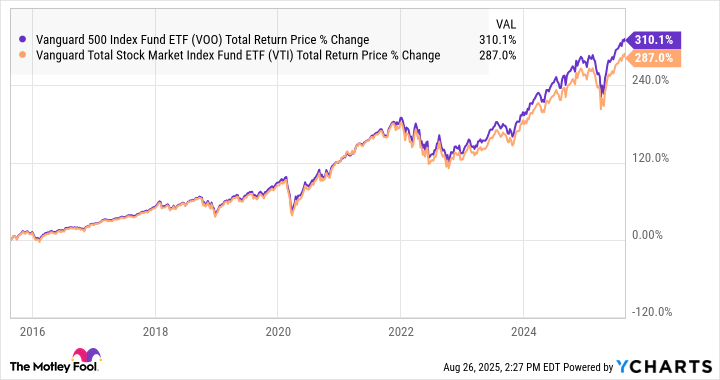

However, it actually underperformed theover the past decade. A $1,000 investment in the(VOO 0.42%) over the same period WOULD have grown to $4,100. This is a 15.1% annualized return.

VOO Total Return Price data by YCharts

Why did the Vanguard Total Stock Market ETF underperform the S&P 500?

The short answer is that over the past decade, large-cap stocks have performed disproportionately well. Megacap technology stocks have driven much of the S&P 500's performance, and this is the primary reason why that benchmark index has done so well.

Now, there's a lot of overlap between the Vanguard Total Stock Market Index and the S&P 500. In fact, the S&P 500 accounts for roughly 80% of the total market capitalization of the U.S. stock market. However, it is the other 20% of the market -- mid-cap and small-cap stocks -- which are included in the Vanguard Total Stock Market ETF but are not in the S&P 500, that has caused the broader index to underperform.

In other words, because it includes smaller companies, it makes some of the best-performing large companies account for a smaller portion of the fund's assets. As an example,(NVDA -0.24%) makes up 8.1% of the S&P 500, but accounts for only 6.8% of the Vanguard Total Stock Market ETF. This is the main reason why, although the Vanguard Total Stock Market ETF has delivered an excellent decade for investors, it wasn't quite as excellent as the returns of the S&P 500.