If You’d Dropped $1,000 in Invesco QQQ Trust a Decade Back, Here’s Your Staggering Total Today

Tech Titans Turbocharge Returns—QQQ's Decade Dominance Rewrites Investing Playbooks

Massive Growth Unleashed

Forget slow-and-steady—this ETF didn’t just climb; it skyrocketed. A grand invested ten years back didn’t just grow—it multiplied, leaving traditional funds eating dust. No ‘enables’ or passive drift here; pure performance drove those digits north.

Why QQQ Crushed It

Heavy on tech giants and innovation, the trust bypassed old-economy laggards. It cut through market noise, betting big on disruptors—exactly where the real gains hid. And hey, while Wall Street hawked complexity, simplicity won. Classic finance irony, right?

Future-Proof or Fool’s Gold?

Past glory doesn’t guarantee tomorrow’s wins—but ignoring a track record like this? That’s just cynical. Or smart. You pick.

Image source: Getty Images.

One tech ETF to rule them all

The Nasdaq-100 is a basket of 100 of the largest nonfinancial companies listed on the Nasdaq Stock Market. But these aren't just any companies.

The top 10 holdings in QQQ are:

|

1. |

Nvidia |

10.09% |

|

2. |

Microsoft |

8.59% |

|

3. |

Apple |

7.84% |

|

4. |

Amazon |

5.54% |

|

5. |

Broadcom |

5.31% |

|

6. |

Meta Platforms |

3.69% |

|

7. |

Netflix |

2.92% |

|

8. |

Tesla |

2.9% |

|

9. |

Alphabet (Class A) |

2.75% |

|

10. |

Alphabet (Class C) |

2.59% |

|

Total |

52.2% |

Source: Invesco (as of Aug. 26)

With nine of the world's most disruptive tech companies comprising half of QQQ's holdings, it's not surprising that this ETF has been such a beast. Overall, 61% of QQQ is weighted toward technology companies, which is why QQQ is a popular choice for investors seeking exposure to the best of the best in the tech sector.

In case you were wondering,is a prominent component of QQQ, sitting just outside the top 10 holdings with a 2% allocation.

By the way, QQQ is more diversified than you might think. Consumer discretionary stocks represent 19% of QQQ's holdings by weight. QQQ also includes healthcare companies, industrials, utilities, consumer staples, energy firms, and even a few railroads.

High growth, low costs

QQQ is considered a passively managed ETF. That's because the goal of QQQ is to closely match the returns of the Nasdaq-100 by mirroring the index's holdings. By contrast, an actively managed ETF aims to outperform a particular index through active stock selection and/or market timing.

An ETF's expense ratio tells you how much of your investment will be deducted annually as management fees. Because QQQ is a passively managed ETF, its expense ratio is lower than you'd find in an actively managed ETF or mutual fund. A passively managed fund doesn't require the constant oversight involved in an active management strategy -- hence the lower fees.

QQQ's expense ratio is 0.20%, which means you'll pay $2 annually for every $1,000 invested. That's a competitive fee -- even for passively managed funds -- considering that the category average is nearly five times higher at 0.92%. At the end of the day, that means less of your investment is going into the pockets of the fund managers.

The power of passive indexing

Investing in passively managed index funds and ETFs -- also known as passive indexing -- is a time-tested wealth-building strategy. Over time, passive index funds often match or even outperform actively managed funds, with lower fees. They also provide instant diversification, helping you avoid single-stock risk.

QQQ is a great way to get exposure to the most disruptive megatrends in tech, including artificial intelligence, electrification, cloud computing, e-commerce, mobile, streaming, and big data. Like the tech innovators that dominate its portfolio, the ETF has a history of massive returns. Since its inception in 1999, QQQ has delivered total returns of 1,200%.

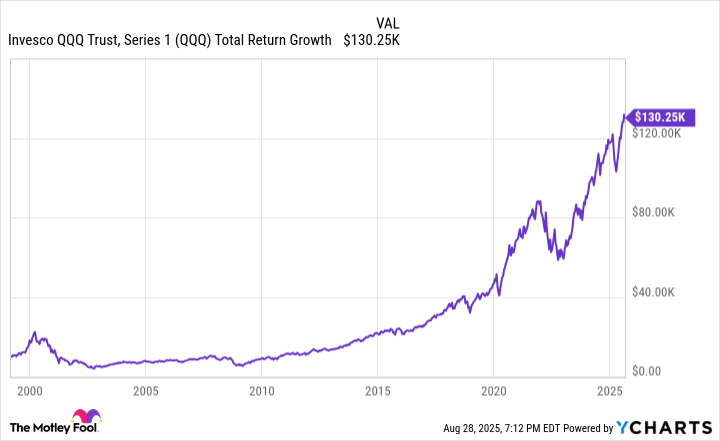

QQQ Total Return Level data by YCharts

If you'd invested $10,000 in QQQ in 1999, you'd be sitting on a cool $130,000 today. Keep in mind that tech stocks can be more volatile than other types of stocks, so the ride would've been a bit bumpy at times. But a long-term, buy-and-hold approach tends to smooth out short-term peaks and valleys. That's a lesson QQQ has been teaching patient investors for over two decades.