Can AMD Actually Hit $1 Trillion Valuation by 2030? Here’s the Reality Check

AMD's trillion-dollar dream faces brutal semiconductor math—and Wall Street's notorious short-term memory.

The chipmaker's AI-driven surge has analysts buzzing, but reaching twelve zeros requires near-perfect execution across every market segment. Data center dominance? Check. GPU relevance? Holding. Consumer segment stability? Questionable.

Competition isn't sleeping either. Nvidia's ecosystem moat deepens while Intel finally remembers how to manufacture chips. Meanwhile, cyclical demand swings could gut quarterly projections faster than traders can say 'risk-off'.

Then there's the innovation treadmill—AMD must out-innovate rivals while maintaining margin discipline, a balancing act that crushed previous challengers. One misstep in next-gen architecture or supply chain management resets the entire growth narrative.

Wall Street's price targets assume flawless execution for five consecutive years—because nothing says 'reasonable projection' like betting against semiconductor cycles and human error. Maybe they've forgotten that most trillion-dollar club members got there by creating markets, not just competing in them.

So will AMD join the elite? Possibly. Probably not. But the real question is whether anyone will remember these predictions when 2030 actually arrives—finance's attention span rarely outlasts a quarterly earnings cycle.

Image source: Getty Images.

AMD's diversification is helpful and harmful, depending on the quarter

AMD offers a broad lineup of computing hardware. It offers graphics processing units (GPUs) that compete directly against Nvidia in both data center and gaming, as well as other applications where GPUs are commonly used. Right now, the biggest use case for GPUs in data centers is AI training and inference.

While Nvidia is solely focused on GPUs, AMD's product lineup expands beyond that. It also has CPUs that can be placed in consumer laptops and computers in both aftermarket and original equipment manufacturing (OEM) settings. It also has an embedded processors division, thanks to its acquisition of Xylinx. These purpose-built processors span a wide variety of industries and are a promising area for continuous growth for AMD.

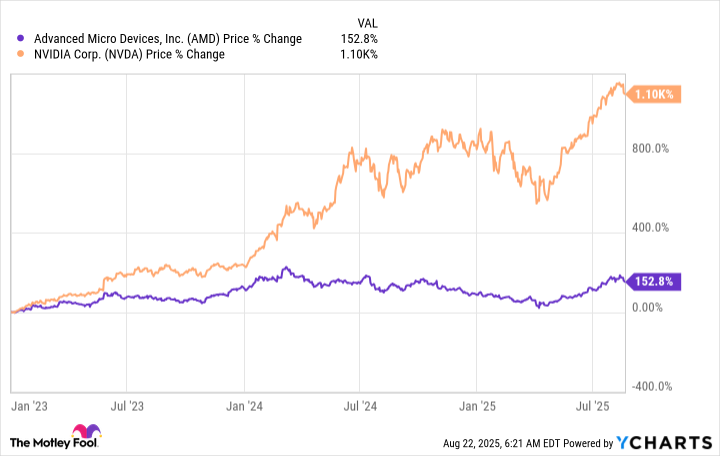

AMD's downfall versus Nvidia has been its lack of focus, as AMD is spreading its resources across multiple technologies instead of focusing on a single technology. Some may consider this a strength, because if the data center GPU market falls apart, AMD will be hurt much less than Nvidia. On the flip side, with data center spending booming, AMD doesn't experience the same strength as Nvidia. That has been the case over the past few years, and is a primary reason why Nvidia's stock left AMD in the dust.

AMD data by YCharts

However, AMD could still be a solid stock to own, even if it hasn't delivered the performance Nvidia has.

AMD needs business to return to China if it hopes to be a $1 trillion company

AMD's second quarter was a mixed bag. Its data center division was harmed by the TRUMP administration's decision to revoke its export license to China, an action that also hurt Nvidia. However, AMD has reapplied for an export license with the assurance from the government that it will be approved. The catch is that these two will have to pay a 15% export tax, which would eat into both companies' margins.

However, the sales would be a welcome return for AMD, as its data center division only grew at a 14% pace in the second quarter. That's far slower than the 57% growth AMD delivered in Q1, showcasing how important these sales are to AMD. If AMD can recover these sales, its growth should return to much faster levels.

AMD's client and gaming segment had an impressive Q2, rising 69% year over year, while embedded fell 4%. This amounted to 32% growth for AMD, which is above the 27% CAGR needed for AMD to become a $1 trillion company.

Next year's outlook looks a little slower. Management expects 21% revenue growth, which would put AMD below the growth threshold. However, that figure could easily tick up if the Chinese export business returns at a stronger level.

Still, for AMD to maintain that 27% CAGR over the next five and a half years is a tall task, and I think the stock will fall short of those expectations. Yet with AMD projected to grow revenue at a 20% pace, it will still outgrow the market and potentially lead to a market-beating stock through 2030. That's a good enough reason to own AMD, and although I prefer Nvidia, I can see the merits of owning AMD as well.