CrowdStrike (CRWD) Q2 Earnings Drop Today: Here’s What Wall Street Is Really Watching

All eyes lock on CrowdStrike as the cybersecurity giant prepares to unveil its Q2 numbers—will they hack it or get hacked by expectations?

The Setup

Wall Street's betting big on continued cloud security demand driving growth. Analysts want to see if CrowdStrike's customer expansion beats forecasts—again.

The Skeptic's Corner

Because nothing says 'healthy market' like a security stock's performance depending on how many systems get breached each quarter. Talk about perverse incentives.

Bottom Line

This isn't just about numbers—it's about whether CrowdStrike can keep outrunning the competition while the world keeps getting more paranoid. Place your bets.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

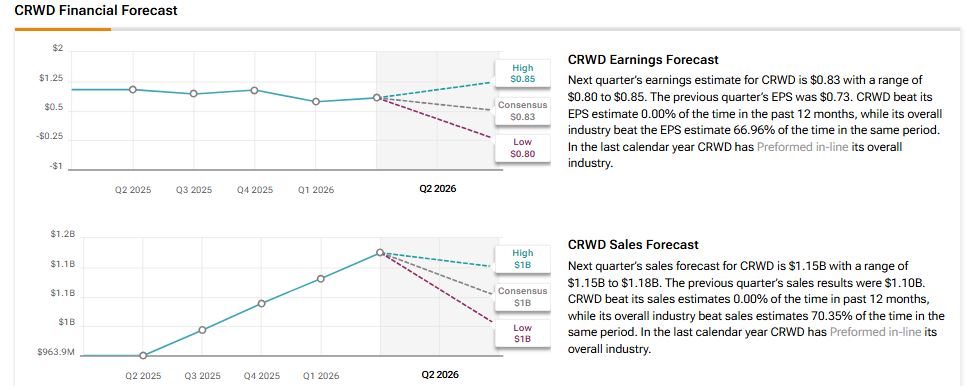

Wall Street analysts expect CrowdStrike to report earnings of $0.83 per share for the second quarter of Fiscal 2026, down 20% from the year-ago quarter. However, analysts expect Q2 revenues to increase 19% year-over-year to $1.15 billion, according to the TipRanks Analyst Forecasts Page. It’s important to note that CrowdStrike has an impressive track record with earnings, having exceeded EPS estimates in each of the past nine consecutive quarters.

Analysts’ Views on CRWD Ahead of Q2 Results

Heading into the Q2 results, BMO Capital analyst Keith Bachman lowered his price target on the stock to $460 from $500, but kept an Outperform rating. He noted good partner feedback in the July quarter and steady demand for the company’s security tools. However, he is cautious about the stock’s performance in the second half of FY26. Bachman also said CrowdStrike WOULD need to grow its annual recurring revenue (ARR) and sales by more than 22% in FY27 to push the stock higher.

Meanwhile, Guggenheim analyst John DiFucci kept a Neutral rating on the stock. The 5-star analyst expects the company to meet revenue and annual recurring revenue (ARR) targets in the second quarter. He pointed out that in Q1, CrowdStrike closed two very large deals—each over $23 million—showing that customers are committing to big contracts. He also sees plenty of room for long-term growth in the U.S. federal government market, which could lift revenue over time.

However, he believes there is limited upside from current levels. With the stock still trading at a high valuation, he prefers to remain on the sidelines for now.

Options Traders Anticipate a Large Move

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings MOVE is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting an 8.54% move in either direction.

Is CRWD Stock a Good Buy?

With 26 Buys and 13 Hold recommendations, CrowdStrike scores a Moderate Buy consensus rating on TipRanks. The average CRWD stock price target of $496.00 implies an upside potential of about 18.43% from current levels.