Brookfield Asset Management Stock: Is Now the Time to Buy?

Asset management giant faces crypto disruption—can traditional finance keep pace?

Digital Shift Upends Legacy Models

Brookfield's traditional infrastructure plays look increasingly archaic as blockchain-native alternatives emerge. Tokenized real estate and decentralized asset management protocols now offer what Brookfield does—without the middleman fees.

Yield Hunger Drives Investor Behavior

While Brookfield dividends hover in single digits, DeFi yields consistently outperform traditional asset returns. Smart investors aren't waiting for quarterly distributions—they're farming yields in real-time.

Regulatory Headwinds Mount

SEC scrutiny intensifies just as crypto alternatives gain institutional adoption. Brookfield's compliance overhead keeps growing while crypto platforms operate with algorithmic efficiency.

Final verdict: Brookfield might still pay dividends, but in a world where assets trade 24/7 on global liquidity pools—waiting for quarterly reports feels like reading yesterday's newspaper today. Sometimes tradition is just another word for 'too slow to adapt.'

What does Brookfield Asset Management do?

As an asset manager, Brookfield Asset Management takes money from others and, for a fee, invests it on their behalf. Historically the company has focused on infrastructure projects, but it has been branching out a bit more lately. Today it has offerings in the clean energy, infrastructure, real estate, private equity, and credit markets. Each one is a substantial business, supporting a total fee-bearing capital base of roughly $550 billion across all five.

Image source: Getty Images.

Fee-bearing capital is where the company is focused on growing, with a target of increasing that number to $1.1 trillion by 2030. Management believes it is well positioned to do this because it is homing in on three key global trends: digitization, decarbonization, and deglobalization. As fee-bearing capital increases, so does the company's ability to generate revenue and earnings on its income statement.

Based on management's internal projections, it believes it will be able to increase fee-related earnings 17% a year through 2030. It expects that this growth will support dividend growth of 15% a year. These are big numbers, noting that a 15% dividend growth rate WOULD mean doubling the dividend in about five years.

Brookfield Asset Management's big price advance

Wall Street is clearly well aware of the opportunity here, noting the stock's material share price advance during the past year. However, there are still some interesting numbers to consider. For example, if the dividend were to double, based on the math of dividend yields, the stock price would need to double, too, in order to maintain Brookfield Asset Management's current dividend yield of 2.9%.

The dividend yield here, meanwhile, is above the yields of some of the company's large U.S. peers.(BX 1.14%) yield is 2.5% and(BLK 0.24%) yield is 1.8%. This is notable because it highlights that Brookfield Asset Management's yield isn't out of line with peers. In fact, using yield as a rough gauge of valuation, this comparison actually suggests that the Canadian asset manager may even be cheap relative to competitors.

Looking at a more traditional valuation ratio like the price-to-earnings (P/E) ratio is a bit less favorable. Brookfield Asset Management's P/E is about 42, compared to Blackstone's 46 and BlackRock's 28. But even here, Brookfield Asset Management's valuation doesn't look wildly out of line. That hints that the earnings and dividend growth projected could, indeed, still lead to solid share price advances over the next five years or so.

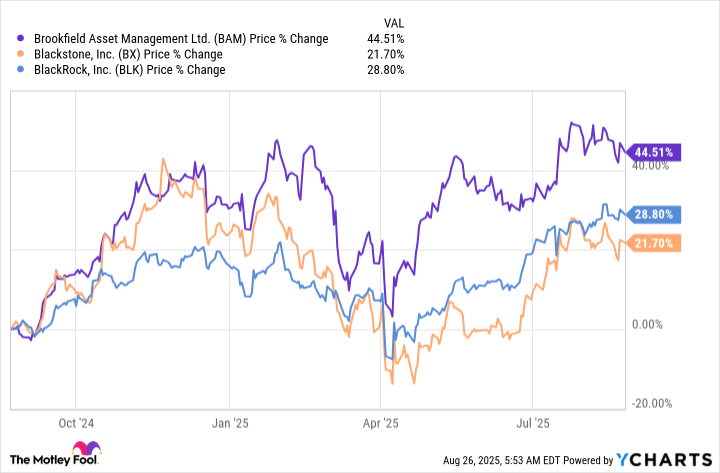

BAM data by YCharts

Nothing goes in a straight line on Wall Street

The complicating factor here is the fast rise in Brookfield Asset Management's stock during the past year. It has not only outperformed the market by a wide margin, but it has also solidly outperformed both Blackstone and BlackRock. It wouldn't be shocking to see the stock pull back some in the NEAR term, particularly if there is a bear market.

Ultimately, the real opportunity is long-term when you look at Brookfield Asset Management today. However, if you have a buy-and-hold approach, it looks like management's growth plan could lead to further dividend hikes and an even higher stock price for patient investors. Just go in prepared to stick around through a market downturn, since five years is actually a fairly long time on Wall Street.