Is Oklo Stock the Next Nvidia? Here’s Why Investors Are Betting Big on This Nuclear Disruptor

Nuclear energy meets artificial intelligence—and Wall Street can't look away.

Oklo's micro-reactor technology targets data centers craving 24/7 power without carbon emissions. No permits? No problem. The company's pushing regulatory boundaries while tech giants scramble for energy solutions.

Power Play

AI's energy hunger is real. Data centers drain grids—Oklo's reactors promise off-grid stability. They're compact, scalable, and designed for remote operations. Think less Chernobyl, more cloud-computing partner.

Market Frenzy

Speculators chase the next trillion-dollar story. Nvidia rode AI hardware—Oklo aims to fuel it. Volatility? Extreme. Potential? Massive. One analyst called it 'a lottery ticket wrapped in uranium.'

Reality Check

Nuclear isn't quick or cheap. Regulatory hurdles remain steep, and competitors loom. But if Oklo delivers? They won't just power servers—they'll power portfolios. Just remember: in cleantech, hype often outpaces fission.

Nvidia's early edge

When Nvidia first introduced the graphics processing unit (GPU) in the late 1990s, few understood the transformative potential of the technology. At the time, GPUs were largely embraced by video game players seeking better and faster graphics performance. But Nvidia's visionary CEO, Jensen Huang, recognized something others didn't -- its parallel processing chips could address other latent needs and handle a broader range of computational challenges.

Fast-forward to today, and GPUs have evolved from a niche gaming product into the backbones of generative AI infrastructure -- providing the specific type of processing muscle required for applications ranging from cybersecurity to autonomous vehicles to robotics and beyond.

The key takeaway here is that while Nvidia's GPU business started with limited traction, it ultimately achieved true product-market fit -- laying the foundation for an empire as the use cases for the chips multiplied and the technology became indispensable.

Image source: Getty Images.

Oklo looks promising, but...

Oklo has quickly captured investor attention thanks to its unique positioning at the intersection of energy and AI. One major catalyst for the company is OpenAI CEO Sam Altman, who previously served as chairman of Oklo's Board. Altman's name recognition and influence have undoubtedly elevated Oklo's profile and helped fuel its narrative as a potential multibagger in the AI energy landscape.

Beyond star power, Oklo also benefits from a growing network of high-profile partnerships. Collaborations with the Department of Energy (DOE), the U.S. military, and private sector infrastructure players such asandunderscore the company's credibility. These alliances not only offer some validation to Oklo's technology, but also highlight the strategic importance of its microreactors as potential sources for clean and efficient energy.

...comparing it to Nvidia is a stretch

While Oklo has drawn the attention of government agencies and AI sector power players, the company has yet to deliver a tangible product. Unlike Nvidia's GPU business in the late 1990s, which was already mass-producing chips and gaining early adopters, Oklo has not yet built an operational reactor. No power is being generated at scale, and it has no billable customers in place. In other words, Oklo's value proposition to the AI industry is entirely speculative -- a critical distinction when benchmarked against Nvidia's early position.

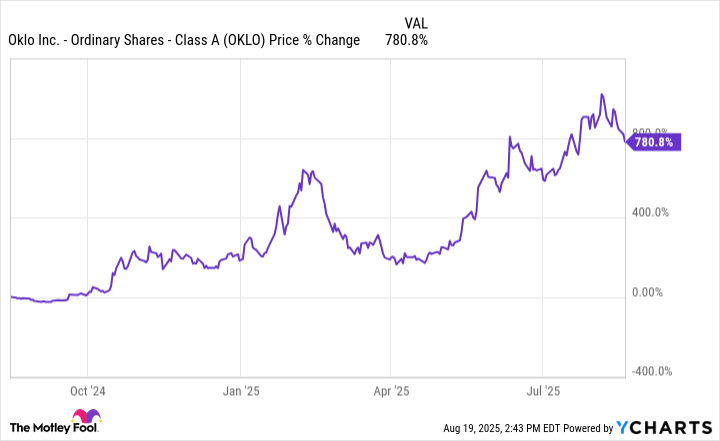

OKLO data by YCharts.

The stock chart above illustrates this disconnect. Oklo's shares have surged by nearly 800% over the past year, pushing its market cap to $9.7 billion -- a figure that equals nearly 26 times Nvidia's combined 1999 and 2000 revenue. That type of premium is difficult to justify for a company with no revenue, a hefty capital expenditure budget, and a path forward that will hinge largely on winning regulatory approvals.

Oklo stock remains a speculative gamble, and its narrative increasingly resembles what one WOULD expect from a meme stock rather than a sustainable growth story. Its rally over the past year has been largely fueled by hype-driven momentum and enthusiasm from unsuspecting retail investors.

In my view, Oklo is far from the next Nvidia. If anything, the stock already appears to have priced in most (if not all) of its potential upside. Chasing the stock's current momentum could leave investors holding the bag when reality kicks in.