Ripple Shatters $3 Barrier: Here’s Why XRP is Surging Against All Odds

XRP rockets past psychological resistance level as institutional demand overwhelms regulatory uncertainty.

Market Momentum Builds

Ripple's native token smashed through the $3 ceiling with violent upward momentum—defying skeptics who've dismissed the project since the SEC lawsuit began. Trading volumes exploded 300% in 24 hours as Asian markets piled in.

Institutional Adoption Accelerates

Major payment corridors between Japan and Southeast Asia now process $8 billion monthly through RippleNet. Banks finally realize faster settlement beats regulatory hand-wringing—even Wall Street's starting to pay attention despite their usual "wait-and-see" posture that typically means "miss-the-boat".

Technical Breakout Confirmed

The breakout above $2.50 triggered algorithmic buying from quant funds—because nothing gets traditional finance moving like machines chasing momentum they never understood in the first place. Resistance now becomes support at $2.80.

XRP's rally exposes how traditional finance still treats crypto like a sideshow—until their clients demand exposure and they're forced to scramble while pretending they'd been bullish all along.

What does Archer Aviation do?

In a nutshell, Archer Aviation is developing flying taxis -- eVTOLs meant to shuttle people across congested cities. Its aircraft run entirely on electricity, which means lower emissions and less noise pollution than traditional small aircraft.

Its flagship bird is the Midnight, a five-seat, 12-rotored short-haul craft that can lift straight into the air and land the same way. Fun fact: Archer recently completed its longest piloted flight of a Midnight craft, flying 55 miles in about 31 minutes at speeds that reached above 126 mph.

Image source: Getty Images.

The flight, of course, was only a test, which is about where Archer Aviation stands today. It's currently in the pre-revenue stage as it awaits Federal Aviation Administration (FAA) approval for the Midnight to begin commercial flights. In the meantime, Archer will continue burning cash on these trials in its effort to demonstrate to regulators that its aircraft can safely carry paying customers.

Strategic partnerships are keeping Archer afloat

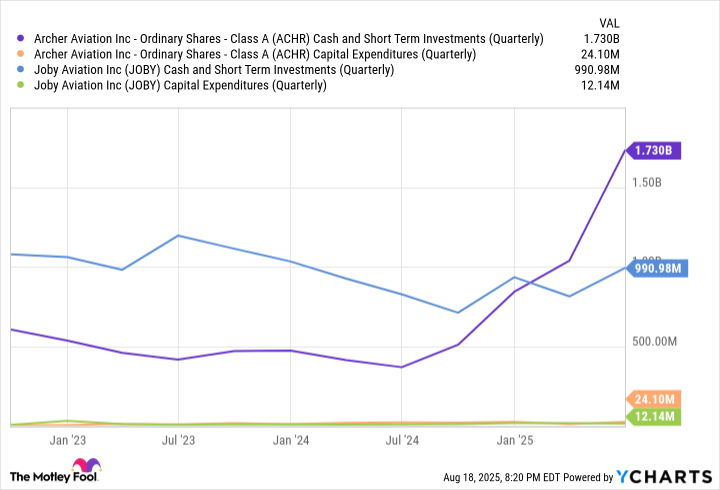

Speaking of "burning cash," what does Archer's balance sheet look like? Not bad from a cash perspective. At the end of June, the company had a cash position of $1.73 billion, up by about $700 million from the end of March and up a whopping $1.3 billion from a year prior. Thanks to continued capital support, Archer has now increased its cash and cash equivalents for at least four consecutive quarters, even as its R&D expenses have stayed relatively steady.

ACHR Cash and Short Term Investments (Quarterly) data by YCharts.

As the chart above shows, Archer's cash position is stronger than that of rival Joby Aviation. Even if one factors in the $250 million thatis expected to contribute to Joby's war chest, Archer is still sitting on about half a billion dollars more.

That's significant, because it could take a while before either company is generating enough revenue to cover its costs. At Archer's current burn rate (about $400 million over the trailing 12 months), the company could keep operating for four to five years at its current spending levels before it WOULD need to raise more money. Meanwhile, Joby's cash burn has been a bit higher (about $448 million over its last four reported quarters), which means it could stay afloat for about three years if it kept its loss rate the same.

Of course, that half-decade or so runway for Archer is purely theoretical. As testing and production of the Midnight ramp up, its cash burn will only accelerate, which means Archer will likely have to keep raising cash by selling fresh equity. It's no stranger to raising capital -- it brought in $850 million that way in June -- but if it has to sell more stock, that would dilute the positions of its shareholders. For now, Archer has a cash cushion. But its lack of revenue is something to watch closely, especially with FAA type certification for the Midnight not expected for a couple more years.

Is Archer Aviation a buy?

To be sure, those regulatory hurdles are just problems for Archer to solve, not reasons to dismiss it as a growth stock investment. Even though its cash FLOW is negative, it has several heavyweight partners, including,, and, that could keep it humming along as it pushes toward commercialization.

While commercializing its aircraft will be the surest sign of its long-term viability, Archer has a few near-term opportunities that could allow it to start generating revenue sooner. Defense contracts, for one, could become a lifeline. Since aircraft made for defense contracts don't have to pass through the usual FAA certification pipeline, Archer could start earning revenue today if it won such a contract. Considering that the WHITE House recently prioritized eVTOL technology as a part of its national defense strategy, such an event may not be far off.

True, Archer's losses are widening (its second-quarter net loss climbed to $206 million from $107 million in the prior-year period), but that's to be expected as it moves from constructing prototypes to full flight testing. The company's strong cash position, plus supporters and potential tailwinds from military deals, make this company's stock a buy right now, especially with shares trading 32% below their recent high.

Investors can expect some turbulence along the way, but they should keep Archer for the long haul, as its story is only just beginning.