Prediction: This Unstoppable Stock Will Join Nvidia, Microsoft, and Apple in the $3 Trillion Club Before 2029

The next tech titan is charging toward the exclusive $3 trillion valuation club—and Wall Street hasn't even priced it in yet.

Forget playing catch-up. This isn't about following trends; it's about setting them. While analysts debate P/E ratios and macroeconomic headwinds, this company's executing a growth playbook that leaves traditional valuation models in the dust.

Scaling at a pace that makes even cloud giants blink, its infrastructure's becoming the backbone of next-gen tech—AI, decentralized networks, you name it. Revenue's not just climbing; it's accelerating. And adoption? Let's just say user growth curves look more like vertical lines.

By 2029, joining Nvidia, Microsoft, and Apple in the $3 trillion club isn't a hopeful target—it's a trajectory. Sure, skeptics will call it hype. But then again, they said the same about Bitcoin at $100.

Sometimes the market doesn't need another spreadsheet—it needs vision. And this stock's got it in spades.

The artificial intelligence (AI) race

Of the three publicly traded companies currently worth $3 trillion or more, two are among the leaders in the rapidly growing artificial intelligence (AI) industry. Meta Platforms could also ride that wave over the next few years to join their ranks. The company has been investing heavily in AI, spending substantial amounts on data center infrastructure and offering the most sought-after AI workers compensation packages that WOULD make some professional athletes envious.

Image source: Getty Images.

AI has already improved Meta Platforms' business. The company still makes almost all of its revenue through ad sales, but thanks to AI-powered algorithms, it is deepening user engagement with its websites and apps, including Facebook and Instagram. According to CEO Mark Zuckerberg, the company's improved algorithms drove a 5% increase in time spent on Facebook and 6% on Instagram during the second quarter alone.

Although it may not keep boosting engagement at similar paces every quarter, these meaningful improvements make Meta Platforms -- which already boasts over 3 billion daily active users -- an even more attractive ecosystem for advertisers. Meanwhile, the company is also making it easier for businesses to maximize the effectiveness of their advertising campaigns. From defining a target audience to generating text and more, the company's efforts in this area are already yielding success.

In the second quarter, AI-based improvements in ads resulted in a 5% increase in ad conversions on Instagram and a 3% increase on Facebook.

Meta Platforms' AI efforts are likely to continue yielding results and drive consistently growing ad revenue for the company. In the second quarter, the tech leader's sales grew by 22% year over year to $47.5 billion, while its net earnings per share ROSE by 38% to $7.14. And Meta could soon have another major source of revenue. The company is betting that AI glasses will become common, and Zuckerberg believes they will be the main device by which we integrate AI into our day-to-day lives.

More than a billion people already wear glasses, so it's not hard to see the potential here -- provided, of course, that the company's vision for the future is correct. Even if Meta's outlook for AI-connected augmented reality glasses turns out to be overly optimistic, the company's Core advertising business should continue performing well over the next five years.

Beware of these risks

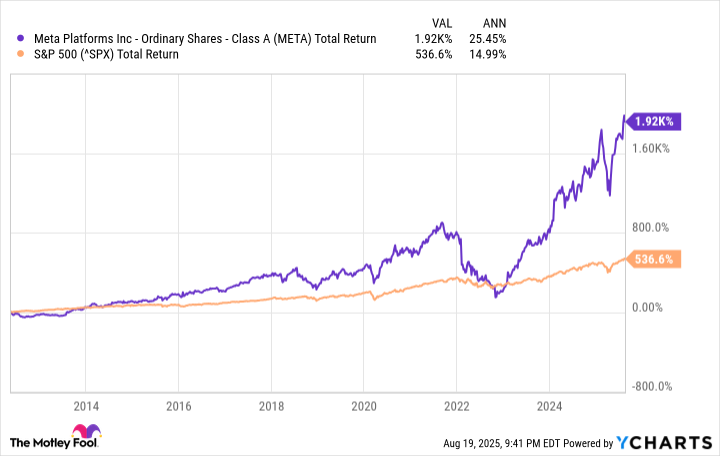

Meta Platforms' current market cap is $1.9 trillion. To achieve a market capitalization of $3 trillion in the next four years would require it to achieve a compound annual growth rate of 12.1%. That's well within the company's reach, in my view, and well slower than its overall performance since its 2012 IPO.

META Total Return Level data by YCharts.

Of course, past performance doesn't guarantee future results, and it's worth keeping some risks in mind. First, there is stiff competition in the AI space, which is why the company feels the need to aggressively recruit talent and invest billions in data center infrastructure. Although the company is making significant strides, it's possible that its multibillion-dollar investments may not justify themselves, and instead could significantly reduce its bottom line.

Second, Meta Platforms' business is somewhat susceptible to shifts in macroeconomic conditions. Companies tend to decrease their ad spending when the economy slows, or even when they think it may. If that happens over the next few years, it could slow Meta Platforms' progress. However, even with these caveats -- and whether the stock achieves a $3 trillion valuation by 2029 -- Meta Platforms is an excellent pick for long-term investors.

Economic downturns don't last forever, and this company can survive them while still producing decent results. And once they pass, Meta Platforms will bounce back. Furthermore, the company has already been through a period of mounting expenses and slowing revenue growth. It faced those conditions a few years ago and rebounded, partly due to its cost-cutting measures. Meta Platforms' unparalleled base of over 3 billion daily users, the competitive moat it enjoys based on network effects, and its significant growth opportunities in advertising, AI, paid messaging, and the metaverse all make the stock worth owning beyond 2029, even if it doesn't reach a $3 trillion market cap by then.