The One Compelling Reason UPS Stock Just Became Unignorable

Logistics giant quietly positions itself for the blockchain revolution—while Wall Street sleeps.

UPS isn't just moving packages anymore. It's moving toward becoming a critical infrastructure player in the tokenized economy. Recent supply-chain integrations with enterprise blockchain platforms signal a pivot that traditional analysts are completely missing.

Forget delivery trucks—think digital asset corridors. The company's existing global logistics network provides a physical backbone that crypto-native firms can only dream of building. That infrastructure advantage translates directly into real-world adoption leverage.

While legacy finance still debates Bitcoin's viability, UPS executes. The company's gradual embrace of blockchain-tracked shipments and crypto payment pilots demonstrates actual utility—not speculative hype. Real revenue streams beat theoretical use cases every time.

Here's the cynical truth: most institutional 'experts' won't recognize this shift until UPS stock has already pumped 200%. They're too busy over-analyzing quarterly earnings calls to notice the fundamental reinvention happening right under their noses.

Smart money watches the infrastructure players quietly building the rails—not the flashy tokens racing down them. UPS might just be laying the tracks for the next generation of global value transfer.

UPS' 7.4% dividend yield is eye-catching

Addressing the elephant in the room, passive income investors will delight in CEO Carol Tome's assertion on the recent earnings call that "The UPS dividend is backed by solid free cash FLOW and a strong investment-grade balance sheet. We know how important the dividend is to our investors, and you have our commitment to a stable and growing dividend."

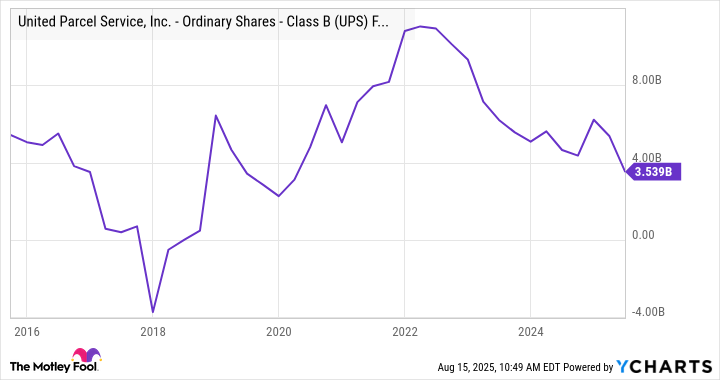

UPS' dividend is usually backed by solid free cash Flow (FCF), but that's not the case right now. The dividend will use up $5.5 billion in cash this year, and as the chart demonstrates, UPS' rolling-12-month FCF is significantly below that right now.

UPS Free Cash Flow data by YCharts

Moreover, management typically does not guide toward FCF when discussing dividends. Instead, the stated aim is to target 50% of earnings in dividends.

The table demonstrates that UPS is nowhere NEAR that ratio right now, and it will need to get earnings per share to $13.12 before its target of 50% of earnings in dividends is reached.

|

Analyst estimates for earnings per share |

$6.59 |

$7.33 |

|

UPS dividend per share |

$6.56 |

$6.56* |

|

Dividend/earnings |

99.5% |

89.5% |

|

Theoretical dividend at 50% of earnings |

$3.30 |

$3.67 |

Data source: Yahoo Finance, UPS presentations, *assumes no dividend increase.

Where Tome is on firmer ground is the claim that UPS has a rock-solid balance sheet. She's right. The following Wall Street analyst estimates for net debt and earnings before interest, taxation, depreciation, and amortization (EBITDA) imply that UPS can easily pay off its debt in a couple of years.

|

Net debt |

$14,966 million |

$19,829 million |

$20,433 million |

$20,753 million |

|

EBITDA |

$12,503 million |

$11,586 million |

$12,417 million |

$13,271 million |

|

Net debt/EBITDA |

1.20 times |

1.71 times |

1.65 times |

1.56 times |

Data source: marketscreener.com, author's analysis.

Management's capital allocation policy

However, there's a deeper question here: Why use up cash in paying dividends when it can be better applied to growing earnings through investing in the business? After all, the point of investing in stocks is to place money in the hands of people who can generate better returns on it than the investor can. Returning capital is an important aspect of investing, but it may be more beneficial to allocate that cash toward generating even greater long-term returns for investors.

Having spent $1 billion on share buybacks already in 2025, in a market filled with such uncertainty that management was unwilling to give full-year guidance in the second-quarter earnings presentations, investors have a right to question management's capital allocation. It's unfortunate because management is pursuing an aggressive earnings growth strategy at the same time.

UPS is a battleground stock

As such, UPS investors are a broad church of investors whose interests may well be at odds. On one side of the pew are income-seeking investors buying into the stock for the dividend. They will be happy with current events.

Image source: Getty Images.

On the other side of the pew, or even the aisle, are those investors who believe management is correct to focus on investing in growing, targeted, and higher-margin markets like healthcare and small and medium-sized businesses (SMBs), while at the same time reducing low-margindeliveries.

While acknowledging the SMB market's current challenges due to tariff uncertainty, management's 2024 investor day presentation outlined ambitious targets for increasing SMB and healthcare revenue, while also investing in technology (automation and smart facilities, etc.) to create the "network of the future." Management also said it WOULD "use excess cash to repurchase shares."

These investors would prefer that management focus on its growth initiatives, or even elect to accelerate them, rather than making buybacks to boost EPS or use cash to pay dividends.

Image source: Getty Images.

Where next for UPS?

Optimists will argue that UPS can ride out this difficult period while maintaining its dividend and growing the business. In contrast, pessimists say that UPS's capital allocation policy isn't being adjusted to address the reality of its end markets in 2025. In addition, the company is unnecessarily spending cash on buybacks and dividends that could be used to invest in line with its growth strategy.

Right now, the pessimists are winning the debate. Still, if management adjusts the capital allocation policy and resets expectations, then UPS stock could soar as the market will focus on its significant long-term growth potential.