Billionaires Are Flooding Into This AI Index Fund—Turn $500/Month Into $500K+

Wall Street's elite are piling into an AI-focused index fund—and the math is staggering. Just $500 monthly could morph into half a million dollars. Here's why the smart money won't shut up about it.

The Billionaire Backstop

When the 0.001% start betting big on a 'democratized' investment, grab your popcorn. This fund bundles bleeding-edge AI players—think chipmakers, cloud giants, and algo-wielding disruptors.

Compound This, Not That

The fund's 5-year tear proves even index investing gets spicy when you hitch it to AI's rocket fuel. Though let's be real—if you're reading this, you're probably late to the private jet party.

The Fine Print Flex

Past performance? Check. Volatility? Like a crypto meme coin. But hey, at least the management fees are lower than a hedge fund's third yacht.

Image source: Getty Images.

Why go with the Invesco QQQ Trust?

This ETF mirrors the, an index tracking the largest 100 nonfinancial companies listed on the Nasdaq stock exchange. You can think of it as a subset of the larger (^IXIC -1.46%), which essentially contains all stocks listed on the exchange.

If you're looking for a well-diversified ETF, this likely isn't your cup of tea; it's very tech-heavy, with the sector making up over 60% of the fund. The consumer discretionary (19.44% of the ETF), healthcare (4.82%), industrial (4.35%), and telecommunications (4.30%) sectors round out the top five represented sectors.

Part of the reason it's so tech-heavy is that it's weighted by market cap, and mega-cap tech stocks have exploded in valuations in recent years. Below are the ETF's top 10 holdings (as of Aug. 13):

How the Invesco QQQ Trust could turn $500 monthly into over $500,000

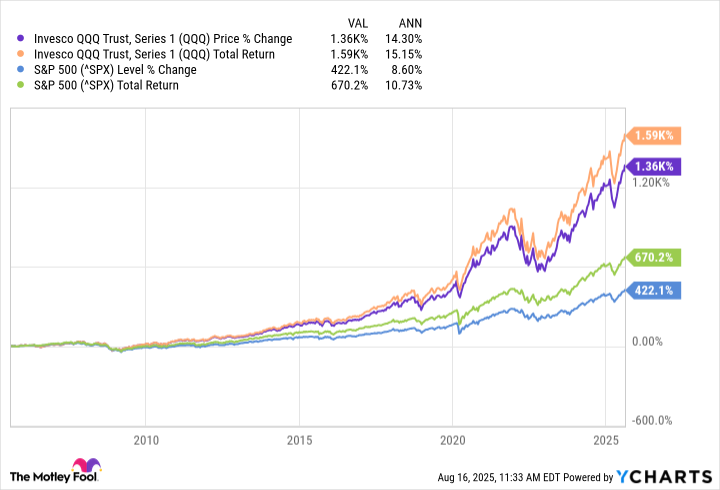

This ETF has routinely been a market-beater and has produced some impressive returns over the past 20 years. In that span, the ETF is up over 1,360% (1,590% when including dividends). These average out to over 14% and 15% average annual returns, respectively.

QQQ data by YCharts.

These past gains don't guarantee that it will continue to happen, but for the sake of illustration, let's see how monthly $500 investments could play out over time with slightly more modest average annual returns:

| 15 | $187,600 | $220,100 | $258,800 |

| 20 | $335,900 | $422,400 | $533,400 |

| 25 | $572,600 | $775,700 | $1.057 million |

Returns calculated using Investor.gov compound interest calculator. Total rounded down to the nearest hundred. Table by author.

Even taking into account the ETF's 0.20% expense ratio, which these totals do, it has the ability to be a lucrative investment. All you need is time to let compound earnings work its magic.

Why I think the Invesco QQQ could continue its impressive returns

This ETF's top 10 holdings make up over 52% of the fund, so their performance will greatly impact the fund's performance. And except for Costco, these are all major tech stocks. This could work out in the ETF's favor because these companies are operating in industries that are poised for high growth for the foreseeable future.

The most obvious driver WOULD be the current artificial intelligence (AI) boom we're experiencing. Aside from the efficiency boost the companies stand to gain from AI developments, these are companies that operate in all phases of the ecosystem.

Nvidia and Broadcom provide chips and other hardware powering data centers; Amazon, Microsoft, and Alphabet provide the cloud infrastructure that makes deploying AI possible; Meta will be the blueprint for using AI in advertising; and Apple is in the process of investing billions and further integrating AI into its hardware products.

Of course, nobody can predict how a stock or ETF's performance will go. However, this ETF has all the ingredients to be a lucrative investment for some time. And it's not just about AI, either. Its holdings cover many booming industries.