AMD Stock in 2025: Could This Be Your Golden Ticket to Financial Freedom?

AMD's stock has been a rollercoaster—but is now the time to bet big?

Silicon underdog or AI powerhouse? AMD's chips are everywhere, from gaming rigs to data centers. The company's relentless innovation keeps it punching above its weight against giants like Intel and Nvidia.

Riding the AI wave. With the AI arms race in full swing, AMD's Instinct accelerators and EPYC processors are carving out a lucrative niche. Demand isn't slowing down—unless the bubble bursts, of course.

Financial alchemy or solid investment? Wall Street's love affair with tech stocks can turn on a dime. AMD's valuation assumes flawless execution—miss one quarter, and the 'story stock' narrative crumbles faster than a crypto exchange.

Bottom line: AMD could mint generational wealth—or become another cautionary tale in the tech casino. Just remember: the house always wins eventually.

Image source: Getty Images.

AMD's diversity may not be as much as some investors believe

One of the reasons why AMD has played second fiddle to Nvidia is the broad reach of its products. Nvidia is focused on building GPUs and other products that support their use. AMD has a much broader product range, including GPUs that directly challenge Nvidia's, but also CPUs for laptops and embedded processors for specific applications in industry.

AMD's lack of focus on GPUs and data centers has caused it to have fewer successful years than Nvidia recently. However, this narrative could flip if the data center GPU market starts to head south. AMD's diversity WOULD shine at that time, likely leading to outperformance compared to Nvidia.

Still, AMD gets a large chunk of its revenue from its data center division, so this weakness would still be quite harmful to AMD. In Q2, AMD's data center segment generated $3.2 billion in revenue. The Client and Gaming division combined was slightly larger, generating $3.6 billion in revenue, and Embedded generated $0.8 billion.

So, if companies suddenly quit building data centers to support the massive AI buildout, AMD would still have nearly half of its revenue base affected, which would turn AMD into a poor performer (alongside Nvidia). As a result, the diversity strength that some investors appreciate with AMD may not be as stable as they think.

But if AMD is priced right, the stock could still be a viable alternative to Nvidia, as there is more than one way to have a winning investment besides growth.

AMD's stock isn't as cheap as you may think

One of the problems with being a highly diversified business is that there is always something popping up in quarterly results that affects the overall picture. For AMD in Q2, it was the loss of its Chinese export license for MI308 chips, which are designed specifically to meet export restrictions. This caused AMD to take a write-off for the quarter, resulting in its normally highly profitable Data Center segment delivering an operating loss for the quarter.

However, news emerged recently that AMD and Nvidia may be allowed to restart exporting chips to China if they pay a 15% export tax. While Nvidia looks primed to benefit from this arrangement (some revenue and profits from China are better than no revenue and profits), AMD may not be in as strong a position. Because AMD isn't the market leader, it doesn't have the strong profit margins that Nvidia has, which could cause this 15% tax to make its chip sales marginally profitable. Once again, some profits are better than no profits, but it won't be as lucrative an arrangement as it formerly was.

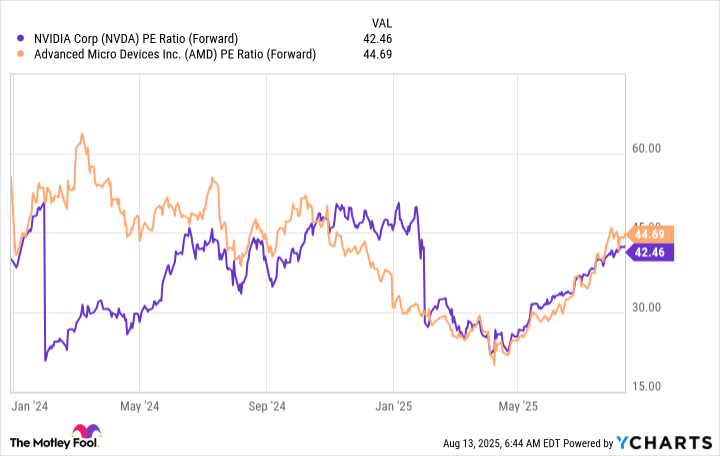

NVDA PE Ratio (Forward) data by YCharts

Time will tell how it affects AMD, but it will likely be more of a boost to Nvidia. Despite all of these drawbacks to AMD versus Nvidia, its stock still trades at a premium to Nvidia's.

With AMD's shares priced at a higher forward price-to-earnings (P/E) ratio than Nvidia's, it puts the nail in the coffin for this analysis. Investing in alternatives to the leaders in some spaces can work out well, but I don't think it's the case with AMD and Nvidia.