Snap Stock Plunged 91% From Its Peak—Is a 2025 Comeback Even Possible?

Snapchat's parent company left investors ghosted after its brutal 91% collapse from all-time highs. Now, Wall Street wonders if this is a dead cat bounce or the real deal.

The Bleeding Isn't Stopping

User growth stumbles, ad revenue sputters, and TikTok eats its lunch. Snap's playbook looks as outdated as a 2015 disappearing message.

2025 or Bust

With AR glasses still a pipe dream and Meta vacuuming up ad dollars, Snap's path to redemption hinges on... what exactly? Another filter update?

Let's be real—this stock needs more than puppy ears to recover. But hey, at least the board got their bonuses before the crash. Priorities, right?

Image source: Getty Images.

Snap is innovating to attract advertisers

When businesses are deciding where to spend their marketing dollars, they prioritize channels that deliver the best return on their investment. Snap is innovating to make its advertising platform more effective; it's using artificial intelligence (AI) and machine learning to improve ad performance, and it's introducing new tools that give businesses more ways to engage with their target audience.

For example, the company recently launched an AI-powered advertising suite called Smart Campaign Solutions. Its Smart Bidding feature allows businesses to set a target "cost per action," which is the amount they are willing to pay for each LINK click, product sale, or app install. Snapchat's AI algorithm then adjusts bids in real time to meet that target, aiming to deliver the best results for the minimum possible cost -- without any human intervention required.

A leading European sportswear brand doubled its conversions and reduced its cost per action by 50% when it adopted Smart Bidding, so this could be an exciting turning point on Snap's journey to make its ad platform more effective.

Snap also launched a new version of its "Sponsored Snaps" recently, which allows businesses to reach users in their chat inbox -- just like one of their friends. The chat function receives a high level of engagement, and it's an area of the Snapchat platform that wasn't previously being monetized so it opens up a significant amount of new ad inventory for the company.

Snap said businesses that used the new Sponsored Snaps in their campaign mix saw an increase in conversions of up to 22%, so they are likely to become a very popular marketing tool.

Snapchat's user base continues to grow

Snap generated $1.34 billion in revenue during the second quarter, which was a modest increase of 9% from the year-ago period. It will take time for the company's advertising innovations to bear fruit, but some of the positive results businesses are yielding so far could drive significantly more spending in the future, accelerating Snap's revenue growth in the process.

Plus, I think there is one big reason Snapchat will continue to be a desirable destination for advertisers: its growing user base. The platform had a record 469 million daily active users during the second quarter, which was up 9% year over year.

Image source: Snap.

Most businesses want to reach the largest potential audience in a cost-effective manner. Therefore, I think the combination of Snapchat's growing pool of users and its improving advertising platform is a surefire recipe for success over the long term.

Snap stock is trading at a rock-bottom valuation

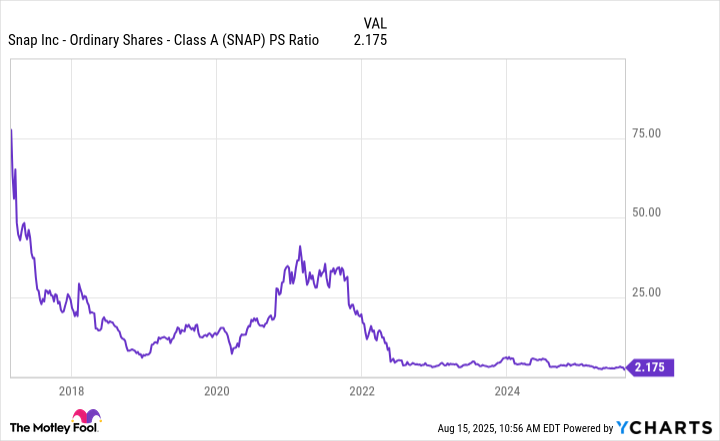

The sharp decline in Snap stock since 2021 has been accompanied by steady revenue growth, which has suppressed its valuation. Snap stock is trading at a price-to-sales (P/S) ratio of just 2.1 as of this writing, which is the cheapest level since it went public.

SNAP PS Ratio data by YCharts

If the improvements to Snap's advertising platform culminate in faster revenue growth in the coming quarters, then this might be a great opportunity for patient, long-term investors to scoop up its stock at rock bottom. However, short-term investors who are seeking quick gains might be left disappointed, because this potential turnaround story probably won't yield results in weeks or months.

With that said, Snap can't afford to waste any time because it's sitting on over $3.5 billion in debt. Fortunately, only $557 million of that liability will mature before the end of 2027, and the company has over $2.8 billion in cash and equivalents on hand so the situation is manageable for now. However, Snap is still losing money on a GAAP (generally accepted accounting principles) basis, so if management can't produce results in the next year or so, concerns will grow about the sustainability of the business.

Snap stock is unlikely to bounce back in 2025, but the company is making all the right moves to fuel a longer-term recovery. Only time will tell whether those moves bear fruit, so this opportunity might only be suitable for investors with a high risk tolerance.