Bold Forecast: This AI Stock Could Hit $5 Trillion by 2030—Here’s Why

The AI gold rush just got a seismic upgrade. One stock—already a heavyweight—is now projected to join the $5 trillion club within five years. No, this isn’t another crypto hype cycle. It’s cold, hard algorithmic confidence.

### The $5 Trillion Bet: AI’s Next Juggernaut

Forget FAANG. The next trillion-dollar wave is all about artificial intelligence, and this stock is riding it like a surfer on a tsunami. Analysts are whispering about data dominance, vertical integration, and a moat wider than Wall Street’s self-regard.

### Why Traditional Investors Are Playing Catch-Up

Legacy finance keeps treating AI like a side hustle. Meanwhile, this company’s tech stack is eating entire industries—automating, optimizing, and occasionally terrifying regulators. Growth? Try exponential. Margins? Let’s just say they’re not funding this with meme coins.

### The Fine Print (Because Someone Has to Read It)

Sure, $5 trillion sounds like monopoly money. But with AI adoption accelerating faster than a DeFi rug pull, the math checks out—assuming the company doesn’t accidentally create Skynet first. Either way, shareholders win.

Image source: Getty Images.

Most investors overestimate Google's challenges

It's no secret that generative artificial intelligence (AI) is challenging the Google search engine. Some people have already replaced their search habits with a generative AI browser, but this is far from the majority.

Still, that hasn't stopped people from stating that Google search will eventually go extinct. I think this is far too bold a prediction, as it assumes that an entire generation of users will suddenly change how they primarily use the internet.

Most people don't need the search horsepower that a generative AI experience offers but are already getting a bit of Google's evolved process. At the top of each search, Google now displays an AI overview, which summarizes the search results using generative AI.

This combination of traditional search and generative AI is likely to be enough for the vast majority of the population. Additionally, management has stated that generative AI overviews can be monetized at the same rate as traditional searches, which ensures Google's revenue stream will remain intact.

Alphabet is also investing heavily in various parts of AI, such as an in-house generative AI model (Gemini), computing servers to host AI (Google Cloud), and self-driving vehicles (Waymo). All of this can help secure the company's position as a top artificial intelligence investment pick.

However, can that help transform the company into a $5 trillion business by 2030?

Alphabet's cheap valuation makes it a less risky pick

Thanks to the market's bearish outlook on the Google search engine, the company's primary revenue driver, Alphabet currently has a very cheap valuation (at least compared to the broader market).

GOOGL Price-to-Earnings E Ratio (Forward) data by YCharts.

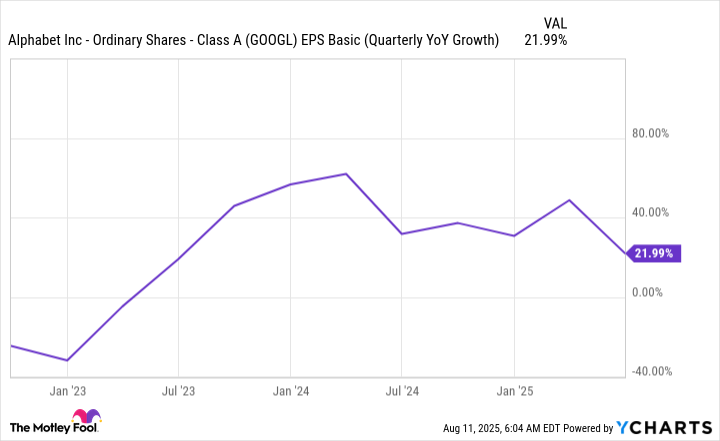

At 20.3 times forward earnings, the company's stock is far cheaper than the broader market's 23.7 times forward earnings, as measured by the. The long-term average return for the market is about 10% annually, so if Alphabet is growing its earnings at a 10% or greater pace, it should receive a premium valuation, compared to the market. Alphabet has steadily delivered 20% or greater earnings-per-share (EPS) growth over the past few years, so it has earned it.

GOOGL EPS Basic (Quarterly YoY Growth) data by YCharts.

To bake some conservatism into this assessment, let's say that Alphabet's valuation could increase to 25 times forward earnings (which is still far cheaper than its big-tech peers), and can grow EPS by 15% over the next five years. If it did that, it WOULD have EPS of $19.06 in five years. With a forward P/E of 25, that would price Alphabet's stock at more than $476 per share.

At today's share count, that would value the company at around $5.75 trillion. That's a massive rise from today's $2.4 trillion market cap. If that happens, it will be a massive market outperformer.

Alphabet is a strong candidate to outperform the market over the next few years and can easily reach a $5 trillion valuation over the next five years. It's one of my best stocks to buy now, and its cheap stock price plays a big role in that opinion.