The One Alarming Stat Super Micro Computer Investors Are Overlooking—At Their Peril

Wake-up call: Super Micro's hidden risk factor just flashed red.

The metric that keeps CFOs up at night

While Wall Street obsesses over AI server hype, a critical number got buried in the last earnings report. Not growth projections—not even margins. This one's about cash flow velocity, and it's moving in the wrong direction.

Supply chain math doesn't lie

Inventory turnover ratios don't trend on X, but they dictate whether those shiny new servers ship on time—or get stuck waiting for $3 capacitors like last quarter's logistics nightmare. Meanwhile, competitors are locking down contracts with prepayment clauses that'd make a Swiss banker blush.

The cynical take

Nothing boosts a stock like AI buzzwords and selective disclosure—until someone asks why working capital efficiency dropped 22% year-over-year. But hey, as long as retail investors keep conflating 'hyperscale demand' with 'flawless execution,' who needs balance sheet optics?

Image source: Getty Images.

Gross profit declined last quarter

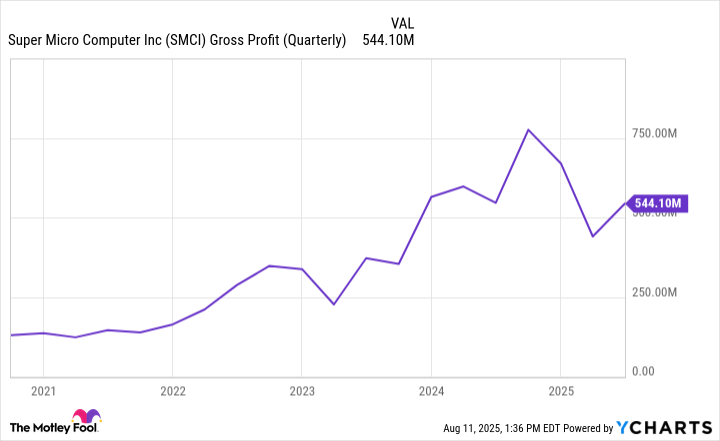

On Aug. 5, Supermicro reported its fiscal fourth-quarter numbers for the period ended June 30, and sales ROSE by 8% to $5.8 billion. The company's slowing growth is a problem, but a bigger one is that its gross profit declined, from $546 million to $544 million.

Gross profit is what a company has left from revenue after accounting for cost of sales. Although it wasn't a huge drop in gross profit this past quarter, this is not the type of trend you expect from a growth stock.

SMCI Gross Profit (Quarterly) data by YCharts.

A decline in gross profit is concerning because it can mean a company is relying heavily on discounted prices to MOVE products, perhaps due to intense competition or limited demand. Either way, it's not a great situation to be in.

And in Supermicro's case, its narrowing gross margin negated the revenue growth the company achieved in the latest quarter. If that trend continues, that means even if its sales take off, that may not necessarily lead to a big increase in the bottom line.

Supermicro is forecasting more growth in the year ahead

For the full fiscal year, net sales totaled $22 billion, up 47% year over year. For the current fiscal year, it is projecting net sales of $33 billion, implying a faster growth rate, at 50%.

That appears to be optimistic, given the uncertainty in the markets these days due to tariffs and rapidly changing macroeconomic conditions.

But even if that growth materializes, it may not necessarily result in positive earnings growth. Consider that while sales rose at a high rate in the past fiscal year, net income fell by 9%.

It all comes back to those thin gross profit margins. If the company's margins were wider than the 11% it has been averaging, there WOULD have been more in gross profit to help cover its rising operating expenses. And that's why until its margins improve, the business may face an uphill battle in growing its earnings.

Investors should tread carefully with Supermicro

Supermicro does have a lot of long-term potential due to AI, but the tech stock is by no means a slam-dunk buy, even though it appears cheap, trading at a forward price-to-earnings multiple of only 16 (based on analyst estimates). Unless you have a high risk tolerance, I think you may be better off taking a wait-and-see approach with Supermicro.