UnitedHealth’s Dividend Yield Hits Record High – Time to Buy or Just Another Wall Street Mirage?

Dividend hunters are circling UnitedHealth after its yield skyrocketed to unprecedented levels. But before you jump on this apparent cash cow, let's dissect whether this is a golden opportunity or a value trap in disguise.

The yield is flashing – but what's the signal?

When a healthcare behemoth's dividend payout starts looking like a high-yield bond, it either means the stock got crushed or management's feeling generous (hint: it's usually the former).

Healthcare's hedge against crypto volatility

While your Bitcoin portfolio does backflips, UnitedHealth offers something rare in 2025 – actual cash flow. The stock's become the anti-crypto for institutional investors craving stability (and able to ignore the irony of betting on America's broken healthcare system).

The verdict: Yield or yield not?

At these levels, the dividend might cushion further drops – or become the next victim of 'adjustments' when earnings inevitably disappoint. Because nothing on Wall Street stays generous forever... except maybe the fees.

Image source: Getty Images.

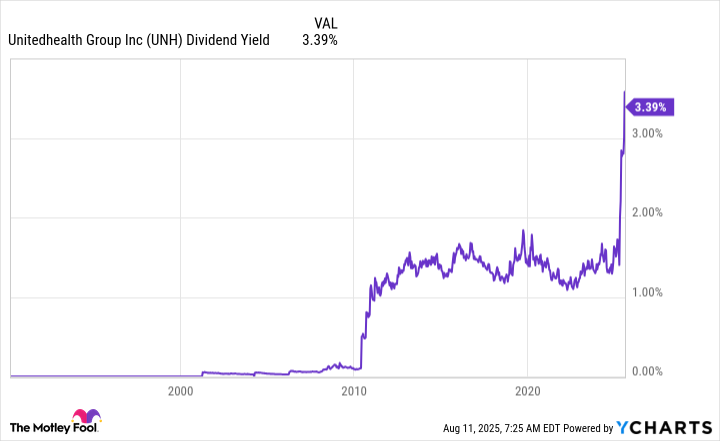

UnitedHealth's yield has generally been less than 2%

The big reason for investing in UnitedHealth stock in the past has been its sheer growth and the key role it plays in the healthcare industry. Its dividend, while it has been growing, was a nice bonus but didn't offer a huge incentive to buy the stock, given that UnitedHealth's yield was generally not that high.

Data by YCharts.

UnitedHealth stock has lost half of its value this year as investors became worried about its prospects for growth amid healthcare reform and rising costs. That drastic decline in value has had the opposite effect on its yield.

This happens because, with all things being equal, a drop in share price means investors are collecting the same dividend for a cheaper price, resulting in a higher yield. While a rising yield might raise alarm bells, the dividend still looks completely safe, as UnitedHealth's payout ratio is less than 40% of earnings.

However, the stock's tailspin may not be over just yet.

UnitedHealth continues to battle high costs and uncertainty

Although UnitedHealth continued to grow its business this year and sales increased, the problem has been rising utilization rates and costs. During its most recent quarter, which ended on June 30, the company's sales rose by 13% year over year to $111.6 billion, which came in slightly higher than analyst expectations of $111.5 billion. But adjusted earnings per share of $4.08 were nowhere NEAR Wall Street projections of $4.48.

The company also saw a change in CEO this year. (Andrew Witty resigned, and previous CEO, Stephen Hemsley, took over.)

Some investors may see it as a positive change given all the turmoil involving the business, including the Department of Justice investigating its billing practices. But it's yet another factor to consider when deciding whether to invest in the stock. A change in management may help alter the direction of a falling stock, but it also may point to significant challenges ahead, which may be difficult to navigate.

Is UnitedHealth Group stock a good buy right now?

UnitedHealth stock trades at a steep discount -- less than 11 times its trailing earnings. By comparison, the average S&P 500 stock trades at a price-to-earnings multiple of around 25. There's clearly a great deal of hesitance in buying the stock right now, as investors are fearful that this may be a long and difficult path ahead for the business -- and perhaps the worst may still be to come.

There's no guarantee that this is the bottom, and UnitedHealth's stock can't go even lower. But its current price might make it worth buying, as it's already heavily discounted and expectations are incredibly low.

UnitedHealth may be experiencing a surge in utilization rates and higher costs, but I believe the market has overreacted to a lot of bad press in recent months. The company is a potentially good stock to buy if you're patient and willing to hang on for the long haul, especially given its high yield.