Lululemon Crashes 50% in 2025—Time to Buy Before the Rocket Ride?

Lululemon's stock just got stretched too thin—down 50% this year. Is this the ultimate dip before the rip?

Bargain or value trap?

The athleisure giant's shares are trading at fire-sale prices after a brutal 2025. But here's what the yoga pants crowd isn't telling you: every 50% crash looks like a 'generational opportunity'... until it isn't.

Technical breakdown

No fancy indicators needed—when a blue-chip stock gets halved, it either screams 'oversold' or 'broken business model.' The market's pricing in everything from supply chain nightmares to the death of yoga (unlikely).

Catalyst watch

Keep eyes peeled for: inventory turnover improving, China sales rebounding, or—Wall Street's favorite fantasy—another pandemic sending everyone back to home workouts.

The cynical take

Let's be real—this could just be another overpriced retailer getting pantsed by reality. But if you believe in the cult of Lulu, buying at 50% off beats paying the usual 'brand tax.' Just don't pretend this is some crypto-like parabolic play—unless you think yoga pants are going to the moon.

Slow North America growth

From the third quarter of 2020 to the fourth quarter of 2023, Lululemon's trailing-12-month revenue in North America more than doubled from $3.5 billion to $7.6 billion. Since then, its trailing-12-month revenue has barely budged, hitting $8 billion over the last 12 months. Investors are not liking this revenue growth slowdown in the Core North American market. Last quarter, Americas revenue increased just 4% year-over-year in constant currency.

While a slowdown should never be celebrated, it is important to take everything within a proper context. The entire athleisure category that Lululemon serves has struggled in recent years, especially in the Americas. Competitorsaw revenue drop 11% year over year last quarter, while Athleta slipped 6% (geographical revenue was not disclosed, but the brand is mainly centered in North America). This puts Lululemon's slow 4% revenue growth in a better light.

Despite macroeconomic headwinds for the athleisure category, Lululemon has been able to grow market share and still expand in North America.

Image source: Getty Images.

Room for international expansion

North America is the ugliest part of Lululemon's business, but international is firing on all cylinders. Total international revenue grew 20% year-over-year in constant currency terms last quarter, with China mainland revenue up 22% even with Chinese consumers facing a spending recession for the last few years after the country's housing bubble burst.

Lululemon is just beginning to tap the East Asian market, which is the largest spending region in the world on luxury and premium apparel. Now, it is beginning to expand in Europe. For example, it just opened a flagship 5,700-square-foot store in Milan's shopping district to showcase its products to European shoppers. Other regions outside of China and North America make up just a sliver of Lululemon's revenue, giving it a huge runway to expand in Europe.

Even if growth in North America is sluggish for a few years, other geographies can help Lululemon keep chugging along for investors.

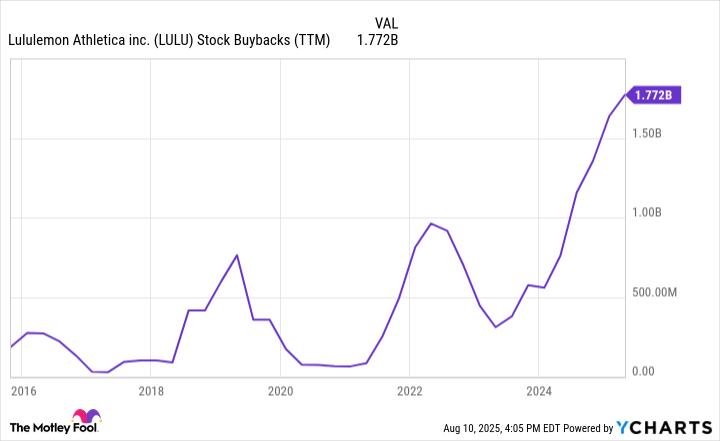

LULU Stock Buybacks (TTM) data by YCharts

Is Lululemon stock about to go parabolic?

After this recent drawdown, Lululemon has a market cap of $22.7 billion. This gives the stock a trailing price-to-earnings ratio (P/E) of under 13, its lowest level in 10 years. If revenue can keep growing and profit margins remain strong (the metric has steadily expanded in the last 10 years), then Lululemon stock looks exceedingly cheap at these levels.

The cherry on top is management's increased spending on stock buybacks, which hit $1.77 billion over the last 12 months. At this rate, Lululemon is close to repurchasing 10% of its outstanding stock per year, which WOULD be a huge boost to earnings per share (EPS) growth.

Apparel is a fickle industry, but Lululemon has shown resilience through thick and thin and now trades at a relatively cheap earnings ratio. Combined with its aggressive buyback program, I think the stock has a chance to zoom parabolic for investors.