Take-Two Interactive Stock Crushes Market in 2025—Will a Blockbuster Game Release Send It to the Moon?

Take-Two Interactive's stock is on a tear—outpacing the broader market with bullish momentum. But the real question on investors' minds? Whether an upcoming game release could send shares into the stratosphere.

Fueling the Rally

With GTA VI rumors swirling and a pipeline packed with AAA titles, Take-Two's 2025 surge isn't just luck. The company's strategic bets—from immersive open worlds to live-service monetization—are paying off.

The Catalyst Ahead

A major 2026 release could be the rocket fuel this stock needs. Analysts whisper about 'Project Nero'—a rumored sci-fi IP with blockchain-integrated assets. Because why let gamers just play when they can speculate on digital swords?

Wall Street's Love-Hate Dance

Short interest remains high—because nothing unites hedge funds like simultaneously betting on and against the same hype train. Either way, Take-Two's volatility promises entertainment beyond its games.

Image source: Getty Images.

Take-Two's profitable growth strategy

While new releases in video games have inherent risks with player reception, this risk is relatively low for Take-Two. GTA has an established player base that is very passionate about the series. The last one significantly expanded the player base, selling 215 million copies over the last 12 years since its initial release.

Take-Two is also investing to grow the business more broadly beyond reliance on GTA. It has significantly increased research and development (R&D) spending and headcount to prepare for several new releases in the coming years.

Another factor that lowers the risk for Take-Two is that most of its revenue doesn't come from single-game sales but from ongoing spending by players throughout the year. In the most recent quarter, 77% of its bookings, which is non-GAAP (adjusted) revenue, came from recurrent consumer spending, which includes sales of VIRTUAL currency and subscription services that provide access to other content. Overall, last quarter's sales were driven by the usual suspects -- NBA 2K25, Grand Theft Auto V, Civilization VII, several mobile titles including Toon Blast, Red Dead Redemption 2, and WWE 2K25.

While spending on R&D and integration of its acquisition of mobile game Maker Zynga have weighed on margins and free cash flow the past few years, Take-Two's growth in recurrent consumer spending has dramatically improved its profitability over the last decade, pushing its stock price to new highs. The release of GTA VI and other titles in its pipeline is designed to scale the company's costs over more games, and, therefore, continue to grow margins and free cash flow over the long term.

The stock can outperform the market

I believe Take-Two is one of the best video game stocks to invest in right now because of these catalysts. The stock's valuation relative to growth expectations could support market-beating returns over the next few years.

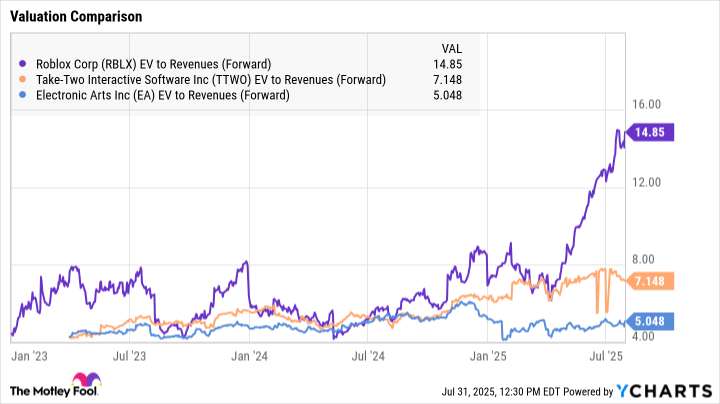

On a forward enterprise value (EV)-to-revenue basis, the stock trades at a 7.15x multiple -- lower than's 14.8x, and higher than' 5.0x multiple.paid a 7.44x EV-to-revenue multiple for Activision Blizzard a few years ago. Take-Two sits in the middle of the pack, which means it is fairly valued.

Data by YCharts

These companies generate higher free cash FLOW than Take-Two, so investors are expecting Take-Two to improve its margins following the release of GTA VI. Long term, investors should expect leading game makers to adopt artificial intelligence (AI) to improve efficiency and automate more coding to lower costs. AI can reduce the time it takes to enter code and build games, which is a catalyst to watch for Take-Two's profitability over the next 10 years.

Overall, the stock seems reasonably priced. With analysts expecting earnings to grow at an annualized rate of 39% through 2029, and free cash Flow expected to reach $2.9 billion, the stock is likely to follow that growth. This sets up the likelihood that the stock can outperform the market from here.