XRP (Ripple) at $10 by 2027: Pipe Dream or Inevitable Surge?

Ripple's XRP has been the crypto world's perennial 'almost'—teasing rallies, dodging regulators, and dividing investors. Now, whispers of a $10 price target before 2027 are gaining volume. Here’s why the hype might not be hollow.

The Bull Case: Liquidity on Steroids

Institutional adoption could turn XRP into the SWIFT-killer it’s always promised to be. Banks love cheap, fast settlements—and Ripple’s been courting them like a Wall Street lobbyist at a congressional buffet.

The Bear Trap: Regulatory Hangover

The SEC lawsuit scar tissue runs deep. Even with partial wins, trust moves slower than a Bitcoin block in 2010. One misstep, and $10 becomes a meme alongside 'XRP Army' Twitter avatars.

The Wildcard: Crypto’s Irrational Exuberance

Remember when Dogecoin hit $0.70? Markets reward narratives over fundamentals—and XRP’s 'banking revolution' story could go parabolic if BTC drags the altcoin market up again. Just don’t bet your mortgage on it (unless you’re into performance art).

There's some real momentum with this coin

Let's start evaluating XRP's prospects for reaching $10 before 2027 by assessing the key factors in its favor.

First, developer energy on the XRP Ledger (XRPL) is getting harder to dismiss.

There's already a developer grant program aimed at creating cross-chain tooling and real-world asset (RWA) pilot programs, a MOVE designed to fatten the project pipeline and keep talent on-chain rather than defecting to another chain's ecosystem. Meanwhile, June's latest upgrade release added token escrows, permissioned decentralized exchanges (DEXs), and batch transactions, all of which is plumbing that enterprise users have demanded for years. Taken together, those upgrades reduce friction for builders and set the stage for more on-chain volume.

Image source: Getty Images.

Second, the infrastructure for handling institutional money on the XRPL is forming in real time, and already quite impressive.

A wave of new stablecoins went live on XRPL this summer, giving treasurers familiar settlement assets and keeping transaction fees payable in XRP. That's sure to make the chain a cozier home for institutional investors, too.

Finally, the drumbeat signaling the arrival of exchange-traded funds (ETFs) holding XRP is growing louder. Three spot XRP ETFs launched in Toronto in June, and U.S. filings face a regulatory decision deadline of Oct. 17.

Many crypto industry experts now put the ETF approval odds as better than even, citing a friendlier policy tilt from the Securities and Exchange Commission (SEC). If the SEC says that the ETFs can go ahead, asset issuers WOULD need to source (buy) millions of XRP to create new shares, taking public float off the market when supply is already finite.

The obstacles are formidable, too

All the above Optimism about XRP's odds of rising dramatically in value needs to be taken into the context of the arithmetic of the coin actually reaching $10.

XRP has a market cap of about $180 billion today. With 59 billion coins in circulation, the market cap would swell to $590 billion if each coin were worth $10. That is a tall order to accomplish before 2027, even in euphoric markets -- not to suggest that the markets are anywhere NEAR euphoric right now.

Timing is also tricky.

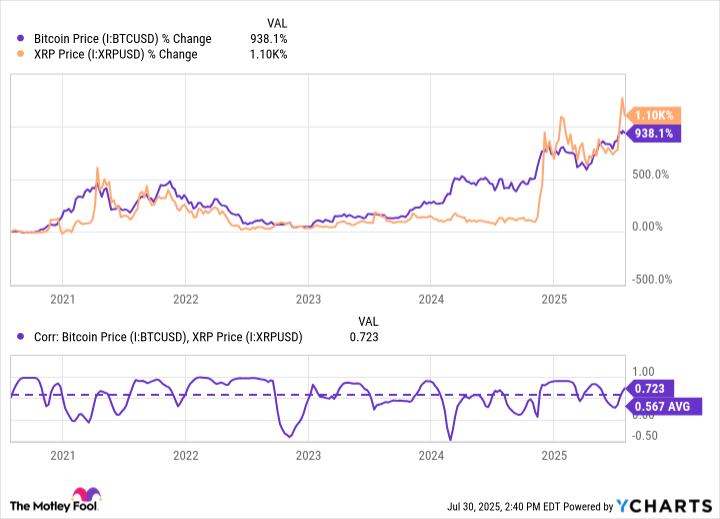

Crypto tends to run in four-year bursts surrounding thehalving cycles, and thus changes in the prices of XRP and Bitcoin tend to be highly correlated. Just look at this chart:

Bitcoin Price data by YCharts

With this in mind, it's reasonable to suspect that the 2024-2025 bitcoin boom may extend into early 2026, but history shows that froth often cools thereafter. If liquidity tightens just as XRP still needs its final leg, the climb could stall until the cycle resets.

Macro clouds may also be gathering, which could then rain on the parade toward $10. The Federal Reserve's interest rate policy remains a tug-of-war, with hawkish governors warning about sticky inflation while others, including the president, push for rapid cuts. Markets now price in two trims before 2026, but the path is in doubt, and political pressure from the WHITE House is muddying the outlook. If liquidity growth hiccups, the speculative bid for crypto could wane right when XRP needs it most.

Therefore, it is very plausible, but not highly probable, that XRP will vault to $10 before 2027. A smoother glide path that reaches the milestone closer to the decade's end looks more realistic, giving time for ETFs to mature, for its stablecoin ecosystem to deepen, and for a fresh liquidity cycle to set the next stage.