Palantir Hits ATH: Time to Buy or Just Another Overhyped Tech Bubble?

Palantir rockets to all-time highs—but is this data darling a must-buy or a ticking reality check?

The Bull Case: AI, Contracts, and Infinite Growth

Defense contracts, AI hype, and government deals keep fueling the fire. Bulls see a runway longer than a Pentagon budget.

The Bear Trap: Valuation vs. Volatility

Trading at nosebleed multiples while insiders quietly trim stakes. Sound familiar? *Cough* 2021 SaaS bubble *cough*.

The Verdict: Ride the Wave or Watch from Shore?

Either way, grab popcorn—this stock’s got more drama than a congressional hearing. Just remember: what goes up… usually comes down harder in tech-land.

Palantir is putting up solid earnings results

Let's start with some positive news, and that's Palantir's recent earnings. Palantir is mostly known for its work with U.S. government agencies like the CIA and the Department of Defense. That's been its bread and butter for a while, but its Artificial Intelligence Platform (AIP) has been a huge boost to its commercial business.

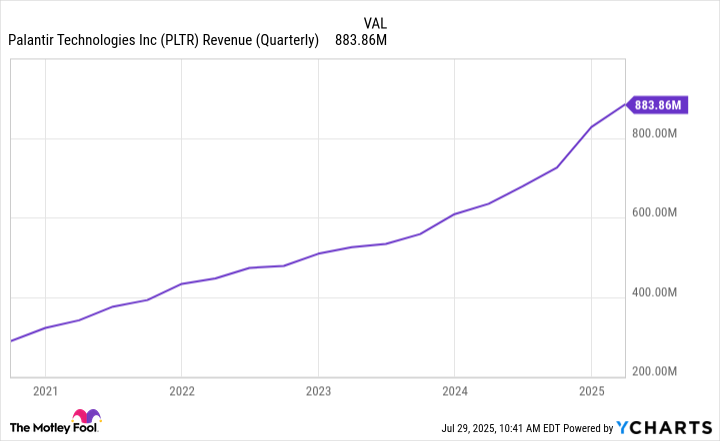

In the first quarter, Palantir's U.S. government revenue grew 45% year over year to $373 million, and its U.S. commercial revenue grew 71% year over year to $255 million. Its $884 million in total revenue (up 39% year over year) continued its impressive growth, which has seen its revenue grow over 200% in the past five years.

PLTR Revenue (Quarterly) data by YCharts

Much of this growth can be attributed to Palantir closing large six-figure-plus deals. It closed 139 deals of at least $1 million, 51 deals of at least $5 million, 31 deals of at least $10 million, and grew its total customers by 39% year over year.

Palantir expects its fiscal year revenue to fall between $3.89 billion and $3.90 billion, which would be around a 36% increase from 2024.

It's hard to ignore Palantir's high valuation

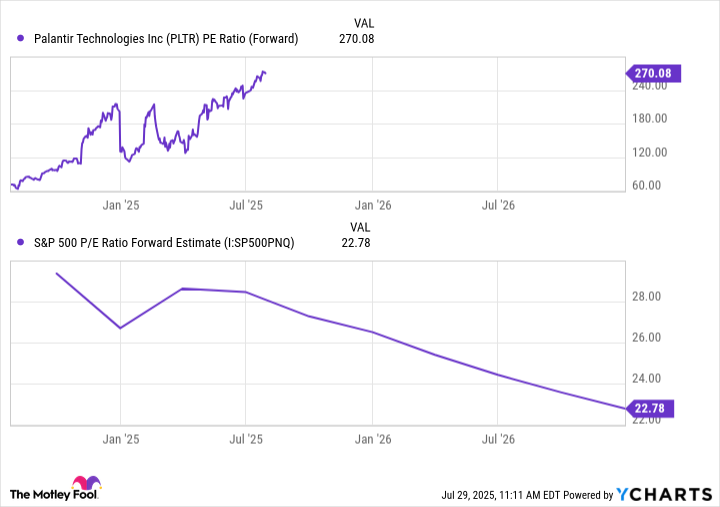

Palantir's recent stock price explosion is great news for investors who've held the stock. However, it's not-so-good news for investors looking to acquire their first shares or add to their existing holdings. To put it lightly, Palantir's stock is extremely expensive.

As of July 29, Palantir's stock is trading at an absurd 270 times its forward earnings. That's hard to justify for any business in any industry, but especially one whose main business (government contracts) isn't known for being high-growth and has yet to show its current growth rates are sustainable long-term.

PLTR PE Ratio (Forward) data by YCharts

Notable past software companies that have reached extremely high valuations -- and still much less than what Palantir currently is -- haven't fared well since that peak.,, andeach traded at triple-digit multiples of their sales at one point, and they're now down 86%, 86%, and 45% from their peaks, respectively.

This doesn't mean Palantir will follow the same fate, but it would need to have a historical and unprecedented run to justify the levels it's currently trading at. And unfortunately, I don't see it happening.

How investors should approach Palantir's stock

If you're a believer in Palantir's long-term potential, I would recommend dollar-cost averaging to begin or continue acquiring shares. When you dollar-cost average, you decide on an amount you're willing to invest in a stock and then put yourself on a set investing schedule, making the investments regardless of prices at that time.

For example, if you have $1,000 you want to invest in Palantir, you could decide to invest $100 every other Monday, $250 on the first of each month, or whatever works best with your situation. The schedule you put yourself on isn't as important as making sure you stick to it and stay consistent through ups and downs.

By dollar-cost averaging, you avoid a situation where you invest a lump sum right before a huge stock price drop happens. Palantir has had instances where its stock price dropped by double-digit percentages in a day, so it's not that far-fetched -- especially with its current stretched valuation.