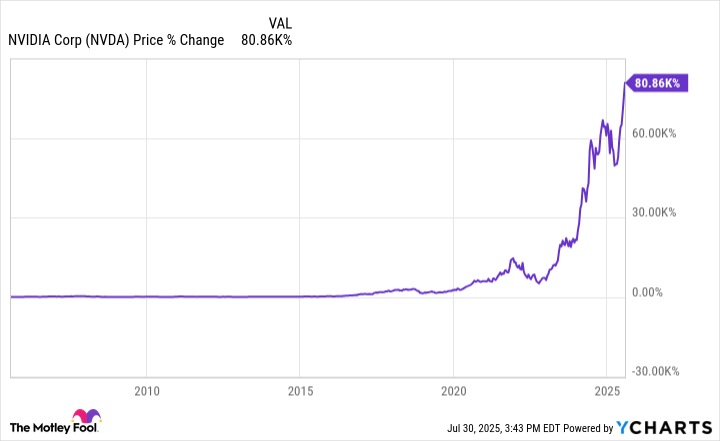

$3,000 in Nvidia (NVDA) 20 Years Ago? Here’s the Life-Changing Sum You’d Be Sitting On Today

Nvidia didn’t just ride the tech wave—it built the damn surfboard. Two decades ago, dropping $3k on NVDA stock would’ve felt like betting on a scrappy underdog. Today? That move looks like stealing the DeLorean from Back to the Future.

The AI Gold Rush’s Silent Partner

While crypto bros were busy dumping money into meme coins, Nvidia quietly became the backbone of artificial intelligence. Their GPUs didn’t just power games—they fueled the entire machine learning revolution. Talk about a pivot.

Wall Street’s Favorite Unicorn (That Actually Exists)

Forget FAANG—NVDA’s returns make those tech darlings look like savings bonds. The stock didn’t just climb; it scaled Everest in flip-flops while analysts kept predicting a ‘correction.’ Joke’s on them.

Your Portfolio’s Biggest ‘What If’

Hindsight’s 20/20, but let’s be real—you probably would’ve sold after the first 200% gain. Human nature loves taking profits…and leaving life-changing money on the table. The real question: What’s today’s Nvidia hiding in plain sight?

Image source: Getty Images.

Don't be too hard on yourself if you missed the monster growth, though. Ask 100 people, and you may not find one who invested in Nvidia back in 2005 and held on.

Holding on to great companies for many years, if not decades, is one of the best ways to build wealth, but it's easier said than done. For one thing, it's not always clear which companies will become long-term winners, and even some extremely promising companies fall on hard times occasionally, with their stock sinking. It can be hard psychologically to not sell shares `at those times.

For a long time, Nvidia was a semiconductor company specializing in chips for gaming. It was very successful at that, but its explosive growth in recent years is largely due to its dominance in chips for data centers, which are in high demand due to artificial intelligence (AI) computing activities.

NVDA data by YCharts

Too late to buy?

While it's too late to buy shares of Nvidia in 2005, it's not too late to buy shares in 2025, and they don't look terribly overvalued at recent levels, either -- despite the stock hitting an all-time high. Nvidia's recent forward price-to-earnings ratio (P/E) of 38 is roughly on par with its five-year average of 39.

In its last quarter, Nvidia's revenue popped by 69%, with double-digit gains expected in the quarters to come. If you expect the use of AI to increase in the NEAR future along with more demand for data centers and the chips on which they run, take a closer look at Nvidia.