Palantir Stock: Last-Minute Buy Before August 4 Earnings Bomb Drops?

Palantir’s Q2 earnings land August 4—and the data-mining giant’s stock is either a stealth play or a ticking time bomb. Here’s the breakdown.

Bull Case: AI Contracts Could Spark a Rally

Defense and enterprise deals inked this quarter might finally justify the company’s premium valuation. If Palantir’s Gotham platform shows revenue growth above 20%, bulls will claim vindication.

Bear Trap: Another ‘Guidance Adjustment’ Ahead?

Three of the last four quarters featured post-earnings stock drops. Another vague ‘long-term growth’ narrative without hard numbers could trigger sell-offs. Watch commercial segment growth—anything under 15% spells trouble.

Bottom Line: This isn’t investing. It’s betting on whether institutional traders still believe in magic beans. Place your bets before Thursday’s closing bell.

Image source: Getty Images.

Palantir delivered a strong Q1 and expects another impressive Q2

Palantir's artificial intelligence (AI)-powered data analytics platform has become quite popular. While the mechanics behind the technology are complex, the function of the software can simply be described as data in, insights out. This simple concept has provided its users with unprecedented value and has transformed how many companies operate.

One of Palantir's most exciting products is its AIP (Artificial Intelligence Platform). AIP enables users to integrate large language models and can automate several processes using AI agents. AIP has become an incredibly popular add-on to Palantir's base software package and is the source of a lot of its growth.

Palantir has delivered strong growth rates over recent quarters, with revenue rising 39% in Q1 and expected to rise 38% in Q2. While that appears to be a slowdown, don't read too much into management's guidance. Palantir has a long track record of setting the bar low and exceeding guidance, so the true growth figure will likely be a few percentage points above that, as long as AI demand was strong in Q2.

There haven't been any signs of weakening AI demand from any other company involved in that space, so I'd expect Palantir to report another solid quarter for Q2. But will that be enough?

Palantir's valuation is unjustifiable

Palantir's stock has already been on a huge run, but its stock performance far outpaces its business results. While Palantir's projected 38% revenue growth is impressive, its stock has risen much more than that. Palantir's stock ROSE 438% between June 30, 2024, and June 30, 2025, the same time frame that year-over-year Q2 results will compare. That indicates that the stock far outpaces business results, which can be concerning for investors.

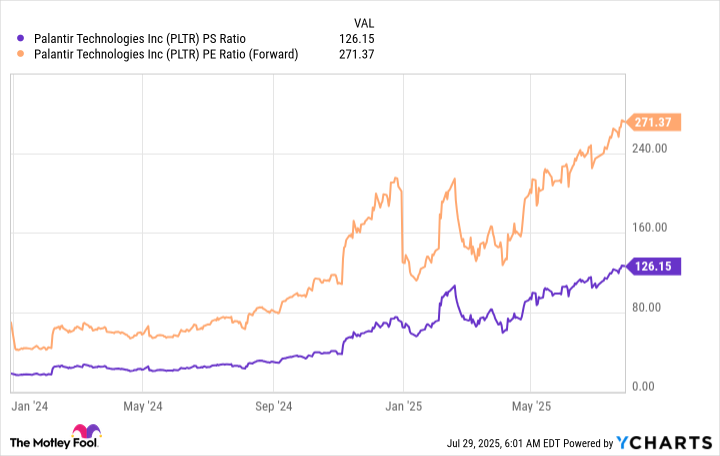

This mismatch has led to a severely inflated stock valuation for Palantir, as it trades for 126 times sales and 271 times forward earnings.

PLTR PS Ratio data by YCharts

Neither of those valuations is remotely reasonable, and they assume a massive amount of future growth.

Take(NVDA -2.46%), for example. While it's the largest company in the world by market cap, it has a forward P/E of 41 and delivered revenue growth of 69% in its last quarter.

If we assume that Palantir can achieve a 30% profit margin, ignore the effects of stock-based compensation (which Palantir has a fair amount of), and assign it the same forward P/E that Nvidia receives now (41 times forward earnings), Palantir's projected revenue over the next 12 months would need to be $30.3 billion to produce profits of $9.1 billion to achieve that valuation at today's stock price. Right now, Palantir generates $3.1 billion in revenue and $571 million in profits.

At Palantir's current 39% growth rate, it WOULD take about seven years' worth of growth to reach $30.3 billion in revenue. As a result, I don't feel confident buying Palantir's stock at these levels, as the stock is driven by hype rather than realistic performance. If Palantir starts doubling or tripling its revenue year over year, I may change my stance, but we're nowhere near that level.

Palantir's stock could rise after earnings, but if you zoom out to a three-to-five-year view, it already has all the growth it will likely deliver and then some baked into the stock price. As a result, investors should find a different AI stock to pick as the earnings season ramps up.