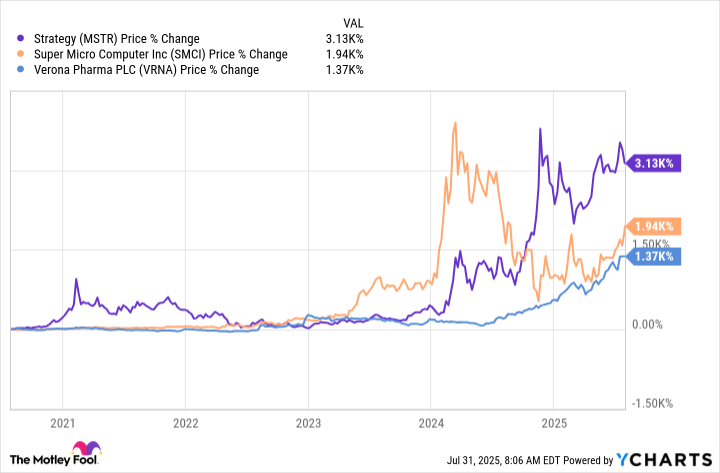

How $6,000 in These 3 Stocks 5 Years Ago Ballooned to $135,000 Today

Forget Wall Street's crystal balls—sometimes blind luck beats hedge fund algorithms. Here's how a modest $2,000 bet on each of these stocks became a life-changing windfall.

The Unlikely Trio That Outperformed Bitcoin

While crypto bros were shilling meme coins, these under-the-radar picks quietly printed generational wealth. No NFTs, no metaverse hype—just old-school compounding.

When 'Set It and Forget It' Actually Works

The numbers don't lie: $6,000 transformed into $135,000 in half a decade. Meanwhile, actively managed funds charged 2% fees to underperform inflation.

The Punchline? You Probably Sold Too Early

Let's be real—most investors would've panic-sold during the 2022 bear market. Hindsight's 20/20, but today's gains belong to the stubborn few who ignored CNBC.

MSTR data by YCharts

Here's a look at what a $2,000 investment from five years ago WOULD now be worth in each one of these stocks, and why they have been such exceptional performers.

Image source: Getty Images.

MicroStrategy: $65,000

Business intelligence company Strategy (formerly referred to as MicroStrategy) has been bullish on, and that has paid off in droves for its shareholders. Its Core business isn't much to get excited about, with sales declining in recent years. Instead, investors have been loading up on the business as it continues to add to its stockpile of Bitcoins, which totaled 607,770 as of July 21.

With Bitcoin reaching record levels this year, Strategy's stock has benefited from the growing popularity of the top cryptocurrency in the world. In five years, Strategy has risen by an astounding 3,100%, and it would have turned a $2,000 investment from July 2020 into more than $65,000 today.

Whether Strategy remains a good investment comes down to how Bitcoin does. If the digital currency continues to rise in value, then investing in Strategy, which is the largest corporate holder of Bitcoin, can be an excellent move. But because Bitcoin can be volatile, investing in Strategy does come with considerable risks, and it may not be suitable for all types of investors. The company is scheduled to report earnings after the market closes today, so investors will be able to get fresh news.

Super Micro Computer: $41,000

Tech company Super Micro Computer (commonly referred to as Supermicro) has benefited from a surge in spending on all things related to artificial intelligence (AI). The company provides businesses with servers and infrastructure they need to build AI models and related products.

In its most recent fiscal year, which ended on June 30, 2024, Supermicro reported nearly $15 billion in sales -- more than four times the $3.6 billion it generated three years earlier. (The company is scheduled to next report on Aug. 5.) Taking a chance on the stock five years ago, before the AI boom, would have paid off significantly, with a $2,000 investment in the company now being worth more than $41,000.

But it hasn't all been smooth sailing. Supermicro faced controversy last year that included its auditor leaving and calling into question the reliability of the company's financial statements. Supermicro has seemingly recovered from that situation, but its valuation still looks modest. It trades at less than 18 times its estimated future profits, making it one of the cheaper AI stocks out there.

There's still some risk here as the company's margins are fairly thin, but with a lot of growth potential still on the horizon due to AI, Supermicro could make for a good buy given its modest valuation.

Verona Pharma: $29,000

If you invested $2,000 into pharma stock Verona back in 2020, your investment would now be worth over $29,000. And when you combine that with the other stocks on this list, the total value of all these investments would be $135,000 (assuming you invested $2,000 into each of them in July 2020).

It wasn't until last year that Verona had an approved drug in its portfolio. Ohtuvayre was approved in 2024 for chronic obstructive pulmonary disease, as a maintenance treatment. The drug has blockbuster potential and it's a compelling enough asset that healthcare giantrecently announced plans to acquire Verona for about $10 billion. The deal is expected to close later this year.

There's a lot of growth potential for Verona, but with a pending acquisition in place, there may be limited room for the stock to rally as it's trading around the price that Merck is going to pay for it ($107). But you can still potentially benefit from its growth by investing in Merck.