BigBear.ai Stock: Time to Buy Before the August 11 Catalyst?

AI stocks are red-hot—but is BigBear.ai a hidden gem or a hype trap?

With August 11 looming, traders are scrambling to position themselves. Here’s what you need to know.

The AI Gold Rush

Every algorithm-flogging startup claims to be 'the next NVIDIA' these days. BigBear.ai’s military contracts and supply-chain optimization tech at least give it real-world use cases—unlike some crypto-pegged 'AI' tokens.

Deadline Dynamics

August 11 isn’t just another date. It’s when institutional players rebalance portfolios, potentially triggering volatility. Retail investors love chasing these events—like moths to a gamma squeeze.

Caveat Emptor

Remember: Wall Street’s 'buy the rumor' game often leaves Main Street holding the bag. If you’re betting on AI stocks, do it because you understand the tech—not because some finfluencer told you to 'get in before the date.'

Image source: Getty Images.

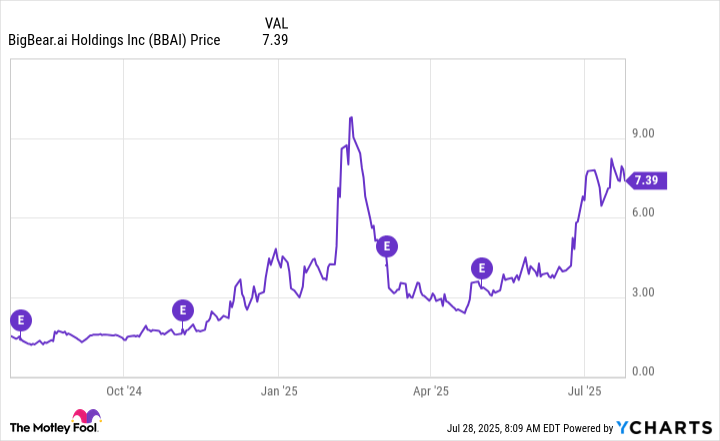

How BigBear.ai stock has done after earnings in the past year

While strong earnings numbers can move the needle for a stock and send it soaring after it releases its latest results, BigBear.ai's stock hasn't gotten much of a boost after earnings in the past year, usually ending up declining after reporting.

BBAI data by YCharts. E = earnings report.

It released its most recent earnings report on May 1, when it reported sales growth of 5% and affirmed its forecast for the year. There wasn't anything too exciting about the company's results, and investors were largely unimpressed; the stock WOULD end up falling in the days following the release.

The good news for investors, however, was that the stock still ended up rallying, and it proved to be a great move to buy the stock before earnings -- it has more than doubled since May, though that's a very short time frame for investors to consider, and past performance can't tell you what will happen in the future. In recent months, the company has announced multiple collaborations and agreements with international airports and the U.S. Army, which have given the stock a far greater boost than earnings.

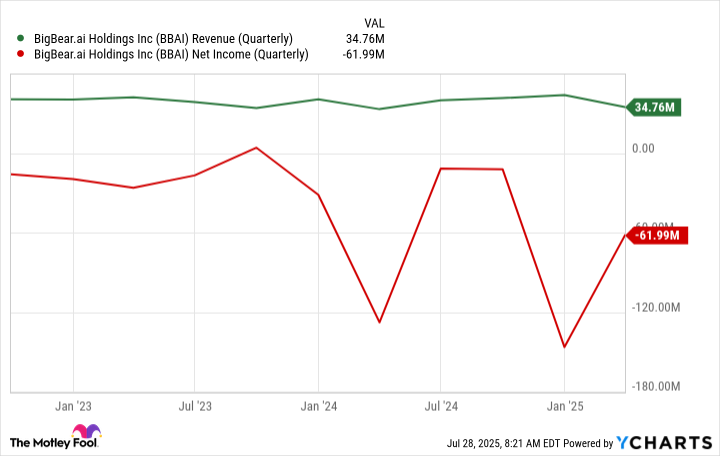

The market may be looking for more signs of progress

Although there is excitement that BigBear.ai can be the next big growth story in AI, investors may be getting a bit nervous with the lack of improvement in the company's financials. Not only has there been just modest growth for a business at a time when demand for AI-related solutions should be strong, but its losses are also large, and it's not clear if there is a path to profitability anytime soon.

BBAI Revenue (Quarterly) data by YCharts

If there isn't much of an improvement on either its top or bottom line in the upcoming quarter, or at least an upgrade in the guidance, that could lead to BigBear.ai stock giving back some of its gains from this year.

Is BigBear.ai stock a buy before its next report?

BigBear.ai isn't a stock I'd buy today, simply because it still has a lot to prove. Its margins are thin, its costs are high, and sales aren't taking off despite the company continually announcing deals and collaborations. In the end, what matters most are the results, and BigBear.ai hasn't delivered and proven that it's on the right track.

Given the stock's run-up in value in recent months, there is plenty of room for it to fall sharply if its upcoming earnings results aren't strong. For that reason, I would invest in BigBear.ai before Aug. 11 as there's little reason to expect a strong and positive earnings surprise that might give the stock a boost, especially given the uncertainty in the economy these days. Many companies may not be eager to commit and spend heavily on AI right now.

While BigBear.ai's stock has potential to rise significantly higher in the future, taking a wait-and-see approach with it appears to make the most sense.