2030 Showdown: This Under-the-Radar AI Stock Is Primed to Crush Nvidia

Forget the hype train—this dark horse AI play is building a faster engine.

Nvidia's GPUs dominate today's AI infrastructure, but the next wave of computing demands a different architecture. One unsung chip designer is quietly positioning itself to eat Nvidia's lunch by solving the bottlenecks Nvidia can't.

The secret sauce? Specialized processors that cut through AI workloads like a plasma torch through butter—no brute-force CUDA required. While Wall Street obsesses over quarterly GPU shipments, this company's patent filings tell the real story.

Here's the kicker: Their tech bypasses the entire 'more transistors' arms race. We're talking orders-of-magnitude efficiency gains that'll make current AI hardware look like steam engines.

(Of course, hedge funds will still find a way to overcomplicate this and charge 2-and-20 for the privilege.)

The AI infrastructure wave is just starting

I like to think of the AI narrative as a story. For the last few years, the biggest chapter revolved around advanced chipsets called graphics processing units (GPUs), which are used across a variety of generative AI applications. These include building large language models (LLMs), machine learning, robotics, self-driving cars, and more.

These various applications are only now beginning to come into focus. The next big chapter in the AI storyline is how infrastructure is going to play a role in actually developing and scaling up these more advanced technologies.

Global management consulting firm McKinsey & Company estimates that investments in AI infrastructure could reach $6.7 trillion over the next five years, with a good portion of that allocated toward hardware for data centers.

Piggybacking off of this idea, consider that cloud hyperscalers,, and, along with their "Magnificent Seven" peer, are expected to devote north of $330 billion on capital expenditures (capex) just this year. Much of this is going toward additional servers, chips, and networking equipment for accelerated AI data center expansion.

To me, the aggressive spending on capex from the world's largest businesses is a strong signal that the infrastructure wave in AI is beginning to take shape.

Image Source: Getty Images.

This is great for Nvidia and even better for TSMC

Rising AI infrastructure investment is a great tailwind for Nvidia but also a source of growth for,, and many others.

Unlike AMD or Nvidia, though, growth for Taiwan Semiconductor (TSMC for short) doesn't really hinge on the success of a particular product line. In other words, Nvidia and AMD are competing fiercely against one another to win AI workloads, which boils down to which of them can design the most powerful, energy efficient chips at an affordable price.

The investment case around TSMC is that it could be seen as more of an agnostic player in the AI chip market because its foundry and fabrication services stand to benefit from broader, more secular tailwinds fueling AI infrastructure -- regardless of whose chips create the most demand.

Think of TSMC as the company actually making the picks and shovels that Nvidia, AMD, and other chip companies need to go out and sell while competing among one another.

TSMC's "Nvidia moment" may be here

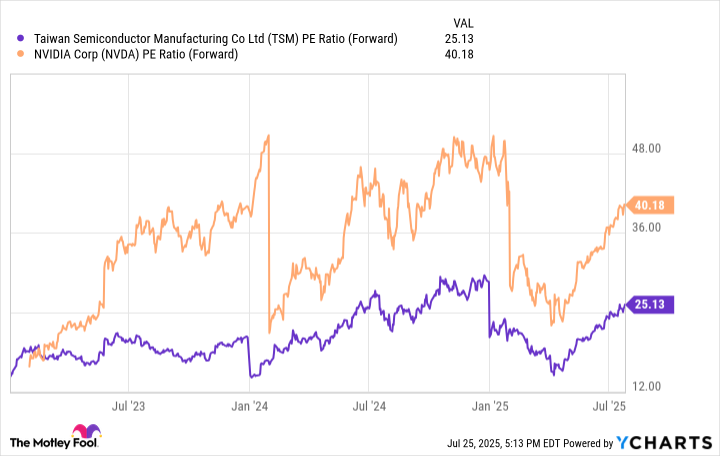

The valuation disparity between Nvidia and TSMC says a couple of things about how the latter is viewed in the broader chip landscape.

TSM PE Ratio (Forward) data by YCharts; PE = price to earnings.

Companies such as Nvidia and AMD rely heavily on TSMC's foundry and fabrication services, which are essentially the backbone of the chip industry. While some on Wall Street WOULD argue that Nvidia has a technological moat thanks to its one-two punch of chips and software, I think that TSMC has an underappreciated moat that provides the company with broader exposure to the chip industry compared to its peers.

Over the next five years, I think use cases of AI development increase as businesses seek to expand beyond their current markets in cloud computing, cybersecurity, enterprise software, among others.

Emerging applications such as autonomous driving and quantum computing will drive demand for GPUs and data center capacity even further. For this reason, TSMC may be on the verge of an "Nvidia moment" featuring prolonged, explosive growth.

TSMC's modest forward price-to-earnings multiple (P/E) of 25 puts it in a unique position compared to Nvidia (with its forward P/E of 40) for considerable expansion as the infrastructure chapter of AI continues to be written.

I think Taiwan Semiconductor Manufacturing's valuation will increasingly become more congruent with the company's growth over the next several years, and so I predict that the stock will outperform Nvidia by 2030.