This AI Infrastructure Play Could Dominate Like Amazon—Here’s Why

Move over, cloud giants—the next trillion-dollar infrastructure war is being fought in AI's trenches. And one company's stacking chips like Bezos in 1999.

The AI Arms Race's Unsung Enabler

While Nvidia hogs headlines, the real money might flow to whoever builds the picks-and-shovels for generative AI's gold rush. Think data pipelines, not just GPUs.

Wall Street's Blind Spot

Analysts still value this firm like it's selling widgets—not the digital scaffolding for AGI. Reminds us of when they called AWS 'just a website hosting side hustle.' (Spoiler: it now prints $90B/year.)

The Cynic's Corner

Sure, the CEO talks 'democratizing AI'—but let's be real. This is about locking in ecosystem moats before regulators wake up. Infrastructure always wins... until the antitrust lawsuits land.

Nebius and the neocloud

Nebius is emerging as a major player in the neocloud market. Similar toand, Nebius offers AI infrastructure as a service. Essentially, the company outfits data centers with Nvidia GPU architectures and subsequently rents access to this infrastructure to other businesses.

In some ways, this is not dissimilar to the objective of Amazon's cloud computing platform, Amazon Web Services (AWS). AWS allows developers to build and scale applications on Amazon's infrastructure, stored in data centers spread across the globe. Today, Nebius' AI infrastructure reach includes data centers in New Jersey, Kansas City, Iceland, Finland, France, the United Kingdom, and Israel.

According to the company's financials, Nebius' Core infrastructure platform boasted a $249 million annual recurring revenue (ARR) run rate at the end of the first quarter. While this might seem small compared to the multibillion-dollar deals of its rivals, Nebius guided that its ARR run rate should be in the range of $750 million to $1 billion by the end of the year.

Considering Nebius has only been operating as a standalone entity for less than a year, I see the company's growth as quite impressive and am optimistic that it can continue to scale as Nvidia releases subsequent GPU architectures in the coming years.

Image source: Getty Images.

Nebius has much more than data centers going for it

Beyond the CORE infrastructure business, Nebius operates across three subsidiaries: Avride, Toloka, and TripleTen.

Avride develops autonomous vehicles and delivery robots. The company currently has a fleet of delivery robots operating in Tokyo thanks to a partnership with(which some call the "Amazon of Japan").

In addition, Avride is working closely withandto help develop a fleet of robotaxis, which are expected to launch later this year in Dallas. I see some similarities in Nebius' foray into the autonomous vehicle and the delivery opportunities to Amazon's investments in robotaxi company, Zoox.

Toloka is a data-labeling platform similar to Scale AI. Companies such as Anthropic, Amazon,, andare customers of Toloka and use the company's software across various generative AI applications.

TripleTen is an online education platform that offers boot camps across a variety of in-demand services such as cybersecurity, data science, and software engineering.

While Toloka and TripleTen do not directly compete with Amazon per se, AWS does offer some overlapping features through products such as Amazon Mechanical Turk and Amazon SageMaker.

Is Nebius stock a buy right now?

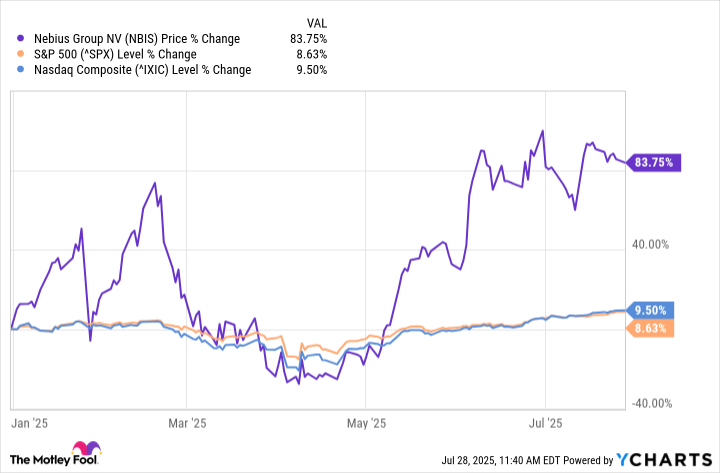

As of July 28, shares of Nebius have soared by 84% so far this year -- absolutely trouncing the returns seen in the and Nasdaq Composite.

NBIS data by YCharts

If you take these returns at face value, you might think that Nebius stock has too much momentum behind it right now. In my view, there is more than meets the eye with Nebius' share price action, though.

As the chart above illustrates, Nebius stock plummeted earlier this year as the broader technology industry experienced a hefty drawdown on the heels of tariff-driven uncertainty.

However, following the CoreWeave initial public offering (IPO) in late March combined with renewed investor enthusiasm following some positive first-quarter earnings back in May, Nebius stock started to witness a sharp rebound.

My main point here is that both the extreme selling and buying of Nebius stock this year appears to be rooted more in broader macro elements than anything specifically tied to the company. I don't think these dynamics will last much longer, though.recently initiated a buy rating on Nebius, placing a $68 price target on the stock, which implies 33% upside from current trading levels.

To me, Nebius could be seen in a similar light as Amazon. While both companies operate critical cloud-based applications, each is also seeking to disrupt AI across various other infrastructure platforms. I see Amazon and Nebius as ubiquitous businesses building uniquely positioned ecosystems across different pockets of the AI infrastructure landscape.

Given Nebius' various businesses are still in the early stages of scaling, I think the company has much more room to run in the long term. For this reason, I see Nebius stock as a no-brainer right now.